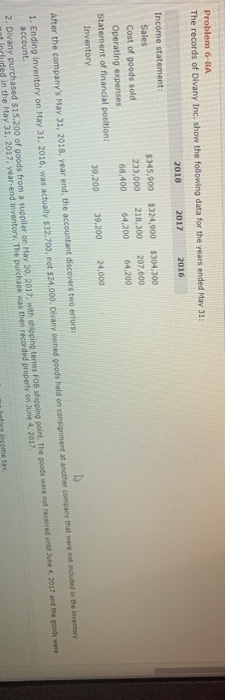

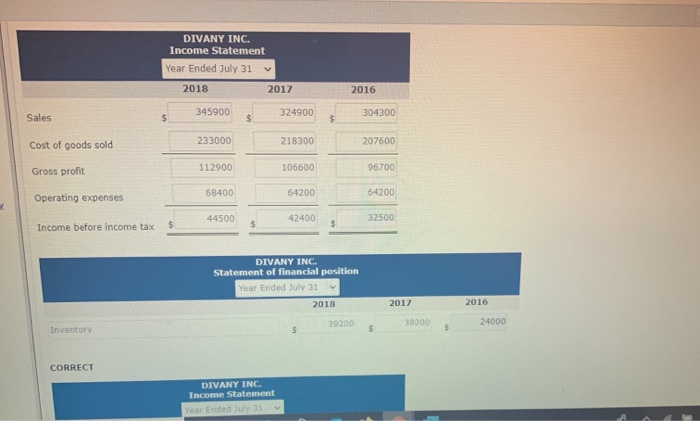

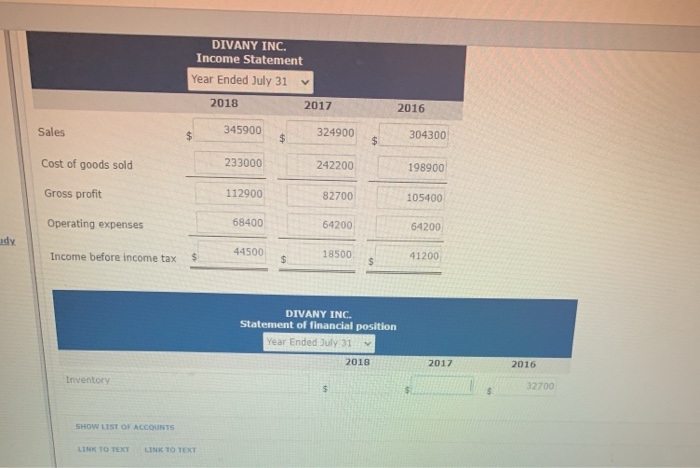

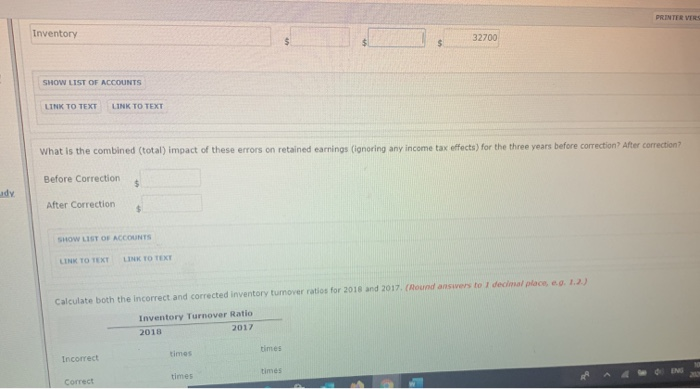

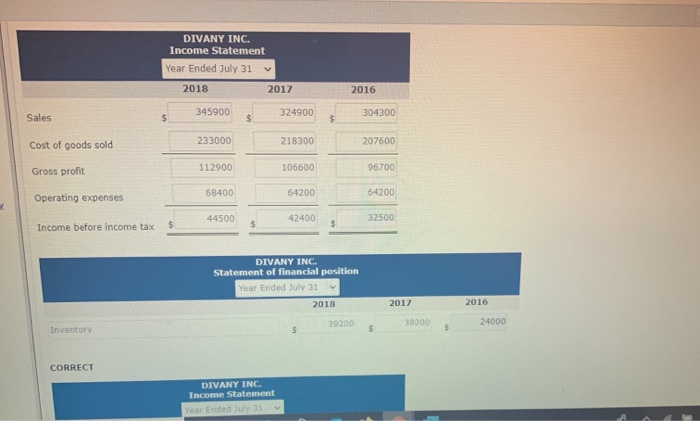

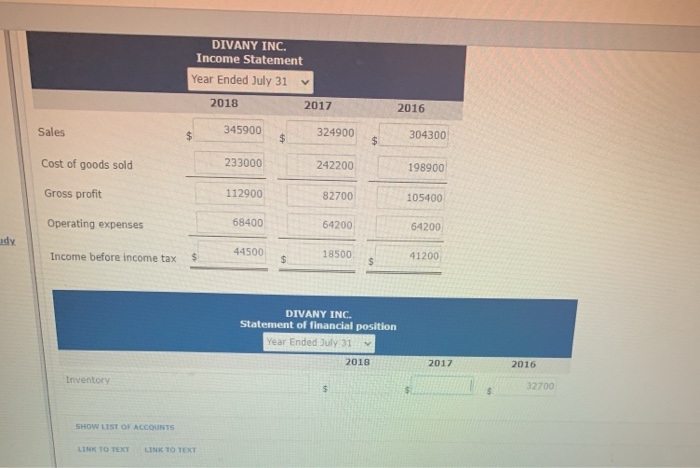

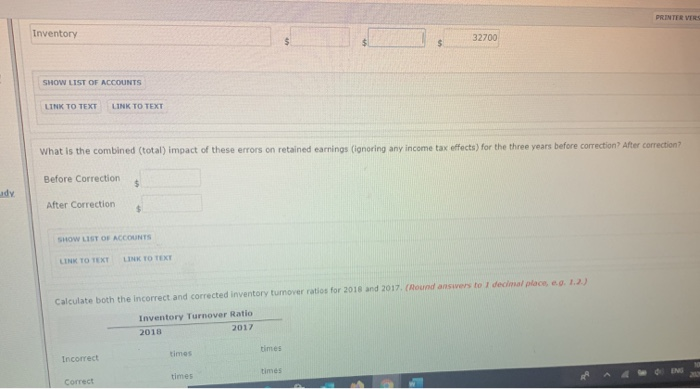

Problem 6-BA The records of Divany Inc. show the following data for the years ended May 31: 2018 2017 2016 Income statement: Sales $345,900 $324,900 $304,300 Cost of goods sold 233,000 218,300 207,600 Operating expenses 68.400 64.200 64,200 Statement of financial position: Inventory 39.200 39,200 24,000 After the company's May 31, 2018, year end, the accountant discovers two errors: 1. Ending inventory on May 31, 2016, was actually $32,700, not $24,000. Divany owned goods held on consignment at another company that were not included in the inventory account 2. Divany purchased $15.200 of goods from a supplier on May 30, 2017, with shipping terms FOB shipping point. The goods were not received until June 4, 2017 and the goods were in the May 31, 2017, year end inventory. The purchase was then recorded properly on June 2017 Income tax DIVANY INC. Income Statement Year Ended July 31 v 2018 2017 2016 345900 324900 304300 Sales $ $ $ 233000 218300 Cost of goods sold 207600 Gross profit 112900 106600 96700 68400 64200 64200 Operating expenses 44500 42400 32500 Income before income tax $ DIVANY INC. Statement of financial position Year Ended July 31 2018 2017 2016 29200 39200 24000 Inventory $ $ $ CORRECT DIVANY INC. Income Statement Year Ended July 31 DIVANY INC. Income Statement Year Ended July 31 2018 2017 2016 Sales 345900 $ 324900 304300 $ $ Cost of goods sold 233000 242200 198900 Gross profit 112900 82700 105400 Operating expenses 68400 64200 64200 ody Income before income tax 44500 $ 18500 $ 41200 DIVANY INC. Statement of financial position Year Ended July 31 2018 2017 2016 Inventory 5 32700 SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT PRINTER VERS Inventory 32700 $ SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT What is the combined (total) impact of these errors on retained earnings (ignoring any income tax effects) for the three years before correction? After correction? Before Correction $ udy After Correction $ SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT Calculate both the incorrect and corrected inventory tumover ratios for 2018 and 2017. (Round answers to decimal place ....) Inventory Turnover Ratio 2018 2017 times Incorrect times times times Correct