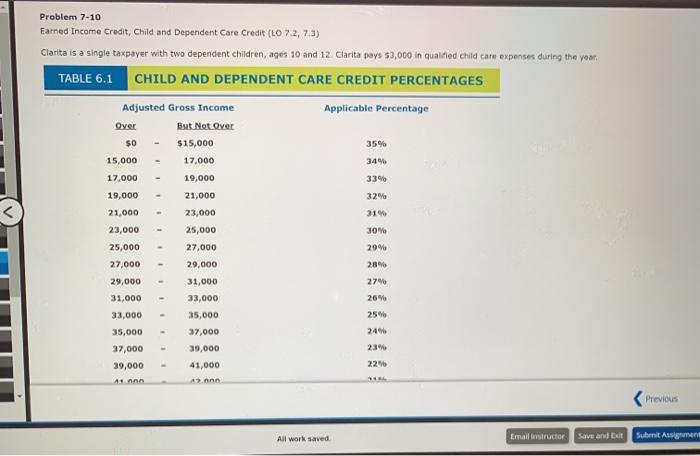

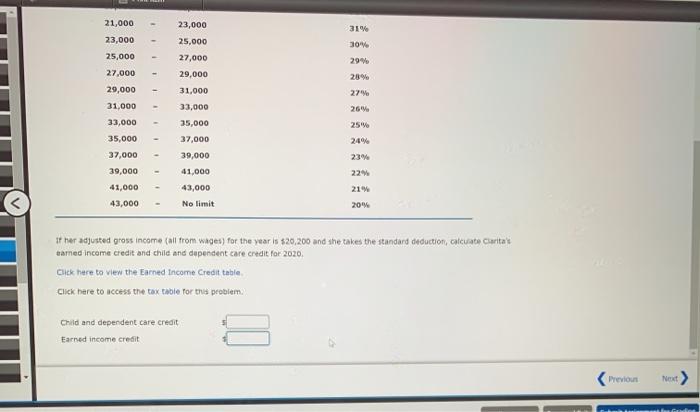

Problem 7-10 Earned Income Credit, Child and Dependent Care Credit (LO 7.2 7.3) Clarita is a single taxpayer with two dependent children, ages 10 and 12. Clarita pays $3,000 in qualified child care expenses during the you. TABLE 6.1 CHILD AND DEPENDENT CARE CREDIT PERCENTAGES Adjusted Gross Income Applicable Percentage Over But Not Over $0 $15,000 35% 15,000 17,000 34% 17,000 19,000 33% 19,000 21,000 32% 21,000 23,000 31% 23,000 25,000 JO 25,000 27,000 29% 27,000 29,000 28 29,000 31,000 27 31,000 33,000 26% 33,000 35,000 25% 35,000 37,000 24 37,000 39,000 23 39,000 41,000 22 Ann Previous All work saved Email instructor Save and Exit Submit Assignment 21,000 23,000 25,000 30% 29% 28% 27,000 29,000 27% 26% 31,000 33,000 23,000 25,000 27,000 29,000 31,000 33,000 35,000 37,000 39,000 41,000 43,000 No limit 25% 35,000 23% 229 37,000 39,000 41,000 43,000 21% 20% If her adjusted gross income call from wages) for the year is $20,200 and she takes the standard deduction, calcuate Carita's tamned income credit and child and dependent care credit for 2020. Click here to view the Earned Income Credit table Click here to access the tax table for this problem Child and dependent care credit Earned income credit Previous Problem 7-10 Earned Income Credit, Child and Dependent Care Credit (LO 7.2 7.3) Clarita is a single taxpayer with two dependent children, ages 10 and 12. Clarita pays $3,000 in qualified child care expenses during the you. TABLE 6.1 CHILD AND DEPENDENT CARE CREDIT PERCENTAGES Adjusted Gross Income Applicable Percentage Over But Not Over $0 $15,000 35% 15,000 17,000 34% 17,000 19,000 33% 19,000 21,000 32% 21,000 23,000 31% 23,000 25,000 JO 25,000 27,000 29% 27,000 29,000 28 29,000 31,000 27 31,000 33,000 26% 33,000 35,000 25% 35,000 37,000 24 37,000 39,000 23 39,000 41,000 22 Ann Previous All work saved Email instructor Save and Exit Submit Assignment 21,000 23,000 25,000 30% 29% 28% 27,000 29,000 27% 26% 31,000 33,000 23,000 25,000 27,000 29,000 31,000 33,000 35,000 37,000 39,000 41,000 43,000 No limit 25% 35,000 23% 229 37,000 39,000 41,000 43,000 21% 20% If her adjusted gross income call from wages) for the year is $20,200 and she takes the standard deduction, calcuate Carita's tamned income credit and child and dependent care credit for 2020. Click here to view the Earned Income Credit table Click here to access the tax table for this problem Child and dependent care credit Earned income credit Previous