Question

For tax purposes, gross income is all the money a person receives in a given year from any source. But income taxes are levied on

For tax purposes, gross income is all the money a person receives in a given year from any source. But income taxes are levied on taxable income rather than gross income. The difference between the two is the result of many exemptions and deductions. To see how they work, suppose you made $70,000 last year in wages, $10,000 from investments, and were given $5,000 as a gift by your grandmother. Also assume that you are a single parent with one small child living with you.

Instructions: Enter your answers as whole numbers.

a. What is your gross income? $.

b. Gifts of up to $12,000 per year from any person are not counted as taxable income. Also, the personal exemption allows you to reduce your taxable income by $3,650 for each member of your household.

Given these exemptions, what is your taxable income? $.

c. Next, assume you paid $700 in interest on your student loans last year, put $2,000 into a health savings account (HSA), and deposited $4,000 into an individual retirement account (IRA). These expenditures are all tax exempt, meaning that any money spent on them reduces taxable income dollar-for-dollar.

Knowing that fact, what is now your taxable income? $.

d. Next, you can either take the so-called standard deduction or apply for itemized deductions (which involve a lot of tedious paperwork). You opt for the standard deduction that allows you as head of your household to exempt another $8,500 from your taxable income.

Taking that into account, what is your taxable income? $.

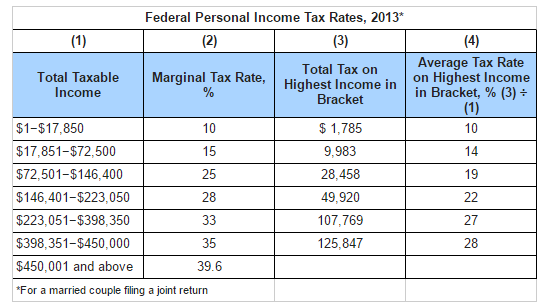

e. Apply the tax rates shown in the table below to your taxable income.

Instructions: For the following parts, round your answers to 1 decimal place.

How much Federal income tax will you owe? $.

What is the marginal tax rate that applies to your last dollar of taxable income? percent.

f. As the parent of a dependent child, you qualify for the governments $1,000 per-child tax credit. Like all tax credits, this $1,000 credit pays for $1,000 of whatever amount of tax you owe. Given this credit, how much money will you actually have to pay in taxes?

$.

Using that actual amount, what is your average tax rate relative to your taxable income? percent.

What about your average tax rate relative to your gross income? percent.

Federal Personal Income Tax Rates, 2013* Average Tax Rate Total Taxable Marginal Total Tax on in on Highest Income Income Tax Rate, Highest Income (3)+ Bracket 10 10 $1-$17,850 1,785 14 $17,851-$72,500 9,983 15 25 28,458 19 $72,501-$146,400 $146,401-$223,050 49,920 28 $223,051-$398,350 33 107,769 27 35 125,847 $398,351-$450,000 28 39.6 $450,001 and above *For a married couple filing a joint returnStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started