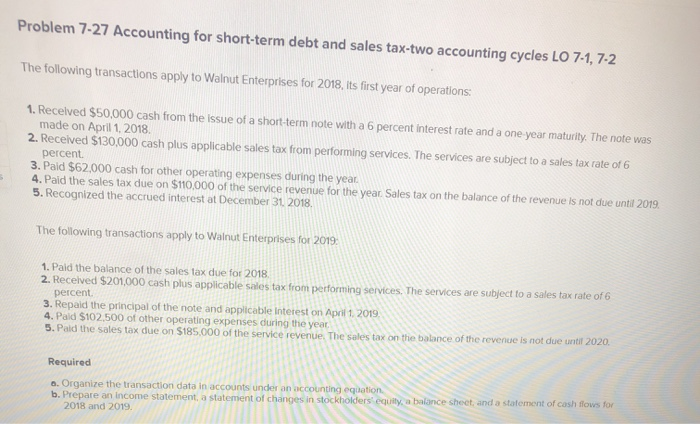

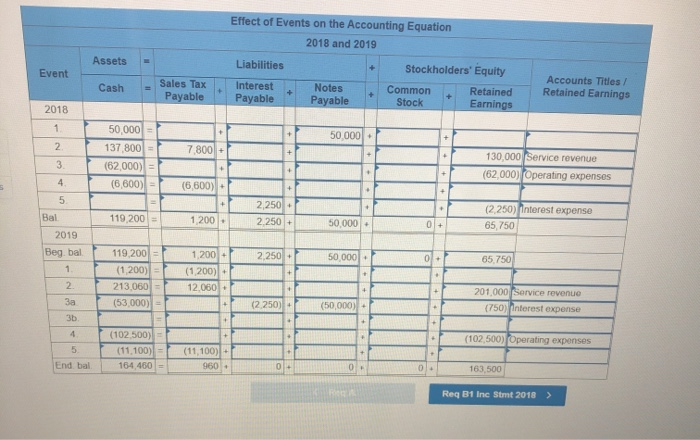

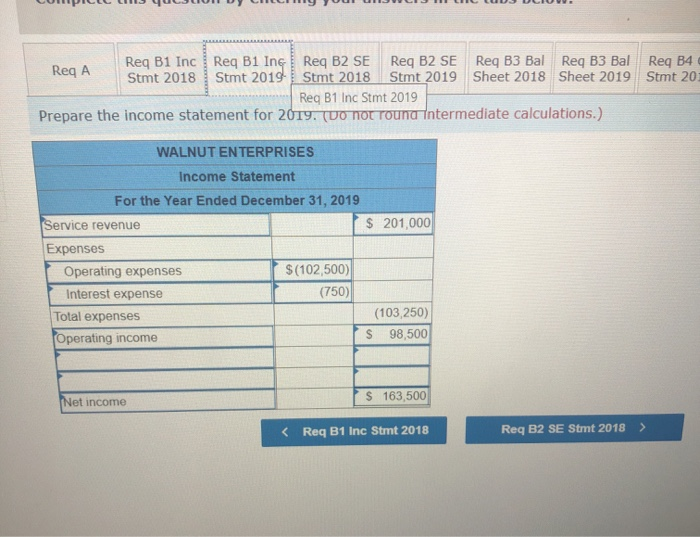

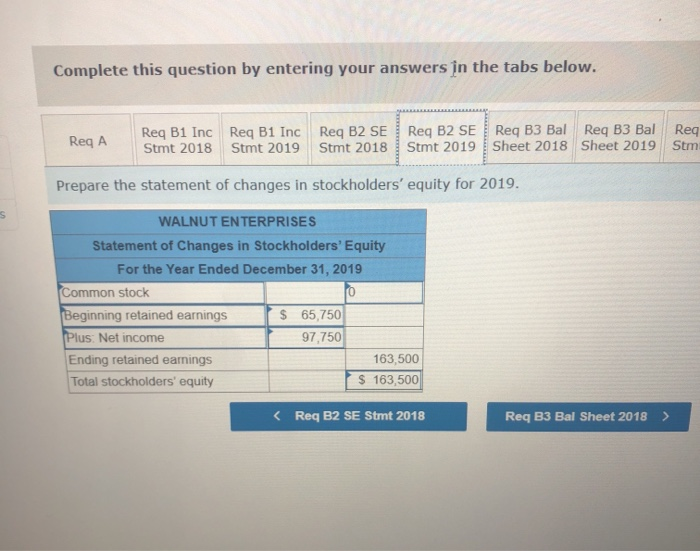

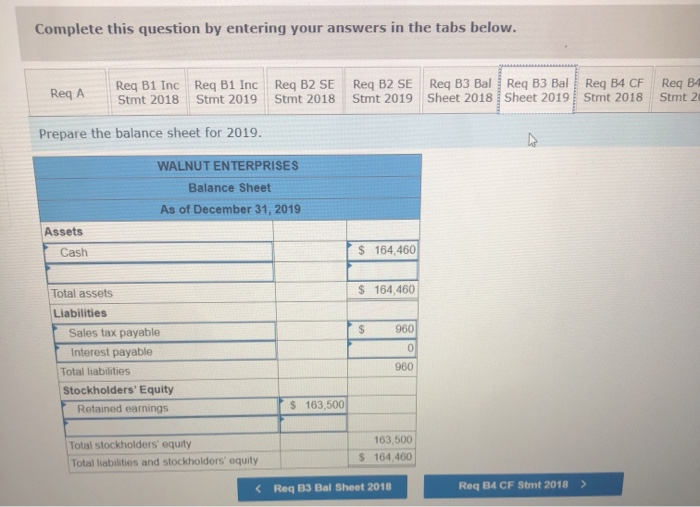

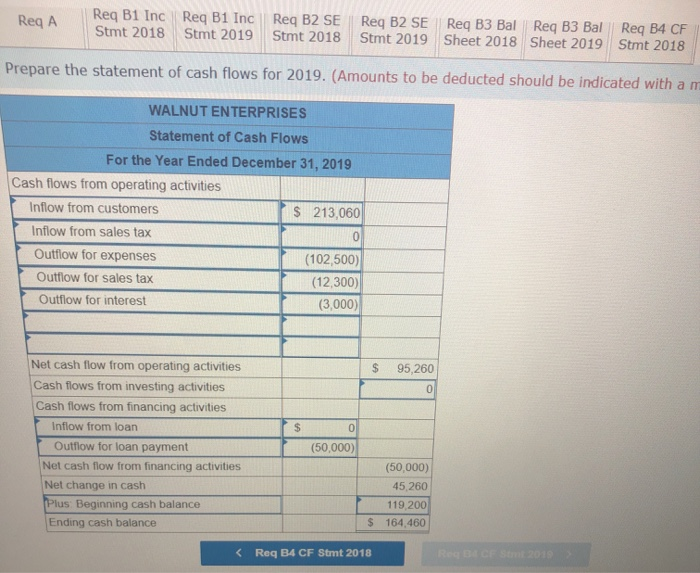

Problem 7-27 Accounting for short-term debt and sales tax-two accounting cycles LO 7-1, 7-2 The following transactions apply to Walnut Enterprises for 2018, its first year of operations: 1. Received $50,000 cash from the issue of a short-term note with a 6 percent interest rate and a one year maturity. The note was made on April 1, 2018 2. Received $130,000 cash plus applicable sales tax from performing services. The services are subject to a sales tax rate of 6 percent 3. Paid $62,000 cash for other operating expenses during the year 4. Paid the sales tax due on $110,000 of the service revenue for the year Sales tax on the balance of the revenue is not due until 2019. 5. Recognized the accrued interest at December 31, 2018 The following transactions apply to Walnut Enterprises for 2019. 1. Paid the balance of the sales tax due for 2018 2. Received $201.000 cash plus applicable sales tax from performing services. The services are subject to a sales tax rate of 6 percent 3. Repaid the principal of the note and applicable Interest on April 1, 2019. 4. Paid $102,500 of other operating expenses during the year 5. Paid the sales tax due on $185,000 of the service revenue. The sales tax on the balance of the revenue is not due until 2020, Required a. Organize the transaction data in accounts under an accounting equation b. Prepare an income statement, a statement of changes in stockholders' equity, a balance sheet and a statement of cash flows for 2018 and 2019. Effect of Events on the Accounting Equation 2018 and 2019 Assets Liabilities Event Cash Sales Tax Payable Interest Payable Notes Payable Stockholders' Equity Common Retained Stock Earnings Accounts Titles / Retained Earnings + 2018 1 + 50.000 2 7 8001 - + 50,000 137 800 = (62000) = (6,600) 3 130,000 Service revenue (62,000) Operating expenses 4 (6 600) + 5 Bal 119.200 = 1,200 2.250 2.250 + (2.250) Interest expense 65,750 50.000 0+ 2.250 50,000 0 + 65.750 2019 Beg bal 1 2 3b 4 5 End bal 119.2001 (1 200) 213,060 - (53000) 1.200 + (1 200) 12.060 (2.250) (50,000) 201,000 Service revenue (750) Interest expense (102 500) Operating expenses (102.500) (11.100) 164 460 (11.100) 960 - 0 0 163,500 Req B1 Inc Stmt 2018 > Req A Req B1 Inc Req B1 IngReq B2 SE Req B2 SE Reg B3 Bal Req B3 Bal Req B4 Stmt 2018 Stmt 2019 Stmt 2018 Stmt 2019 Sheet 2018 Sheet 2019 Stmt 20 Req B1 Inc Stmt 2019 Prepare the income statement for 2019. (Do not rouna intermediate calculations.) $ 201,000 WALNUT ENTERPRISES Income Statement For the Year Ended December 31, 2019 Service revenue Expenses Operating expenses $(102,500) Interest expense (750) Total expenses Operating income (103,250) 98,500 Net income $ 163,500 Complete this question by entering your answers in the tabs below. Req A Req B1 Inc Req B1 Inc Req B2 SE Req B2 SE Req B3 Bal Req B3 Bal Stmt 2018 Stmt 2019 Stmt 2018 Stmt 2019 Sheet 2018 Sheet 2019 Req Stm Prepare the statement of changes in stockholders' equity for 2019. WALNUT ENTERPRISES Statement of Changes in Stockholders' Equity For the Year Ended December 31, 2019 Common stock 0 $ 65,750 97,750 Beginning retained earnings Plus: Net income Ending retained earnings Total stockholders' equity 163,500 $ 163,500 Req A Req B1 Inc Req B1 Inc Req B2 SE Req B2 SE Req B3 Bal Req B3 Bal Req B4 CF Stmt 2018 Stmt 2019 Stmt 2018 Stmt 2019 Sheet 2018 Sheet 2019 Stmt 2018 Prepare the statement of cash flows for 2019. (Amounts to be deducted should be indicated with a m WALNUT ENTERPRISES Statement of Cash Flows For the Year Ended December 31, 2019 Cash flows from operating activities Inflow from customers $ 213,060 Inflow from sales tax 0 Outflow for expenses (102,500) Outflow for sales tax (12,300) Outflow for interest (3.000) $ 95,260 0 $ 0 Net cash flow from operating activities Cash flows from investing activities Cash flows from financing activities Inflow from loan Outflow for loan payment Net cash flow from financing activities Net change in cash Plus Beginning cash balance Ending cash balance (50,000) (50,000) 45,260 119 200 $ 164,460