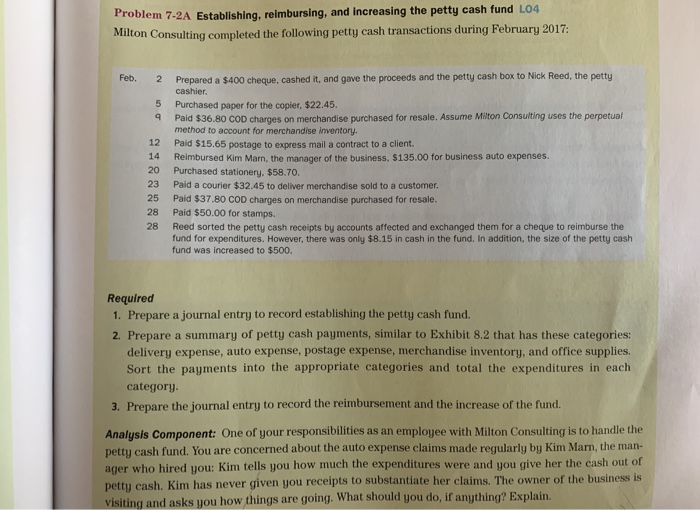

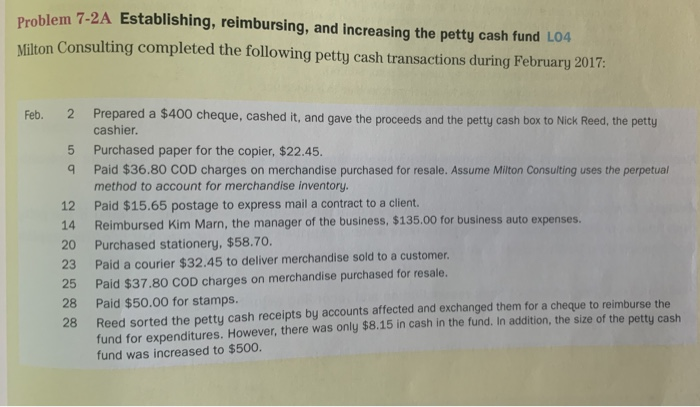

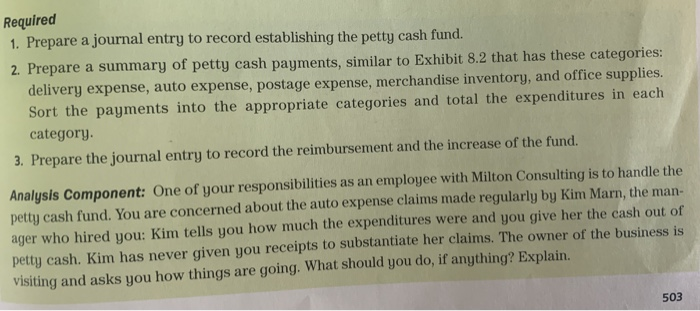

Problem 7-2A Establishing, reimbursing, and increasing the petty cash fund L04 Milton Consulting completed the following petty cash transactions during February 2017: Feb. 2 5 Prepared a $400 cheque, cashed it, and gave the proceeds and the petty cash box to Nick Roed, the petty cashier. Purchased paper for the copier, $22.45. Paid $36.80 COD charges on merchandise purchased for resale. Assume Milton Consulting uses the perpetual method to account for merchandise inventory. Paid $15.65 postage to express mail a contract to a client. Reimbursed Kim Mar, the manager of the business. $135.00 for business auto expenses. Purchased stationery, $58.70. Paid a courier $32.45 to deliver merchandise sold to a customer. Paid $37.80 COD charges on merchandise purchased for resale. Paid $50.00 for stamps. Reed sorted the petty cash receipts by accounts affected and exchanged them for a cheque to reimburse the fund for expenditures. However, there was only $8.15 in cash in the fund. In addition, the size of the petty cash fund was increased to $500. 20 23 25 28 28 Required 1. Prepare a journal entry to record establishing the petty cash fund. 2. Prepare a summary of petty cash payments, similar to Exhibit 8.2 that has these categories: delivery expense, auto expense, postage expense, merchandise inventory, and office supplies Sort the payments into the appropriate categories and total the expenditures in each category 3. Prepare the journal entry to record the reimbursement and the increase of the Analusis Component: One of your responsibilities as an employee with Milton Consulting is to handle the pettu cash fund. You are concerned about the auto expense claims made regularly by Kim Marn, the man ager who hired uou: Kim tells you how much the expenditures were and you give her the cash out of petty cash. Kim has never given you receipts to substantiate her claims. The owner of the business is visiting and asks you how things are going. What should you do, if anything? Explain. problem 7-2A Establishing, reimbursing, and increasing the petty cash fund L04 Milton Consulting completed the following petty cash transactions during February 2017: Feb. 2 5 9 12 14 20 23 25 28 28 Prepared a $400 cheque, cashed it, and gave the proceeds and the petty cash box to Nick Reed, the petty cashier. Purchased paper for the copier, $22.45. Paid $36.80 COD charges on merchandise purchased for resale. Assume Milton Consulting uses the perpetual method to account for merchandise inventory. Paid $15.65 postage to express mail a contract to a client. Reimbursed Kim Marn, the manager of the business, $135.00 for business auto expenses. Purchased stationery, $58.70. Paid a courier $32.45 to deliver merchandise sold to a customer. Paid $37.80 COD charges on merchandise purchased for resale. Paid $50.00 for stamps. Reed sorted the pettu cash receipts by accounts affected and exchanged them for a cheque to reimburse the fund for expenditures. However, there was only $8.15 in cash in the fund. In addition, the size of the pottu cash fund was increased to $500. Required 1. Prepare a journal entry to record establishing the petty cash fund. 2. Prepare a summary of petty cash payments, similar to Exhibit 8.2 that has these categories: delivery expense, auto expense, postage expense, merchandise inventory, and office supplies. Sort the payments into the appropriate categories and total the expenditures in each category 3. Prepare the journal entry to record the reimbursement and the increase of the fund. Analysis Component: One of your responsibilities as an employee with Milton Consulting is to handle the petty cash fund. You are concerned about the auto expense claims made regularly by Kim Marn, the man- ager who hired you: Kim tells you how much the expenditures were and you give her the cash out of petty cash. Kim has never given you receipts to substantiate her claims. The owner of the business is visiting and asks you how things are going. What should you do, if anything? Explain. 503