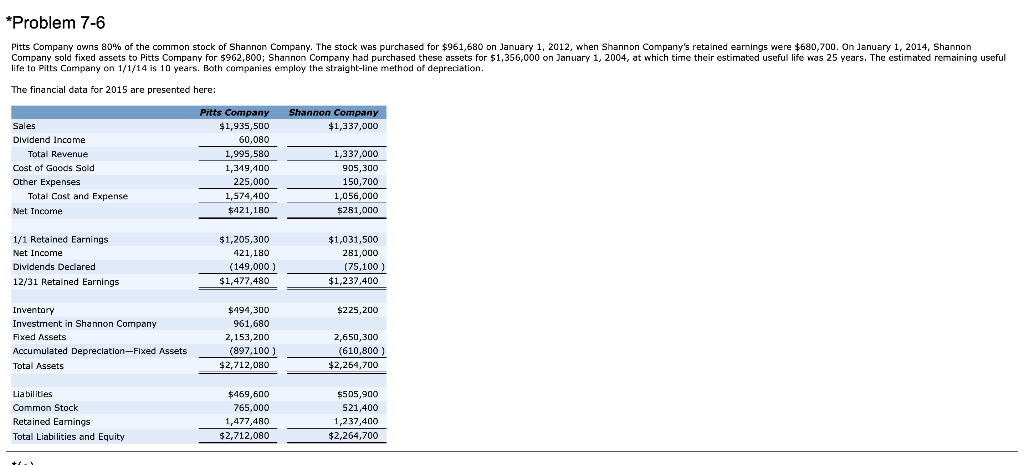

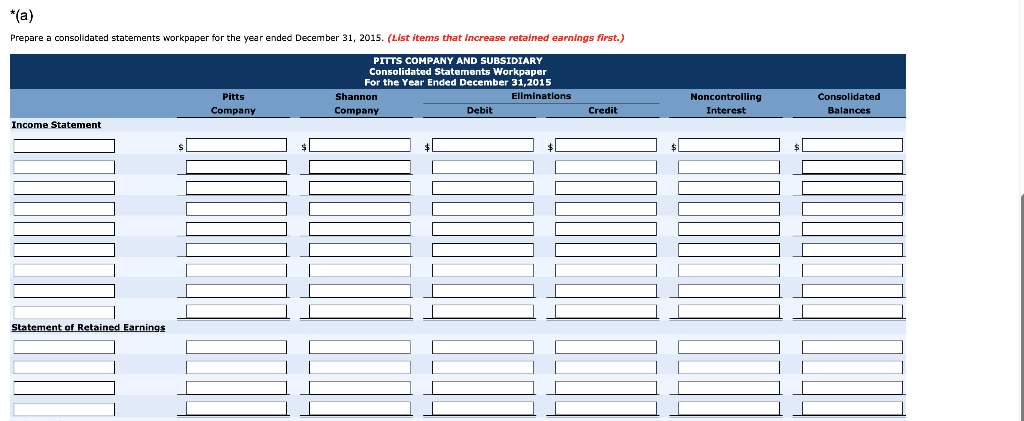

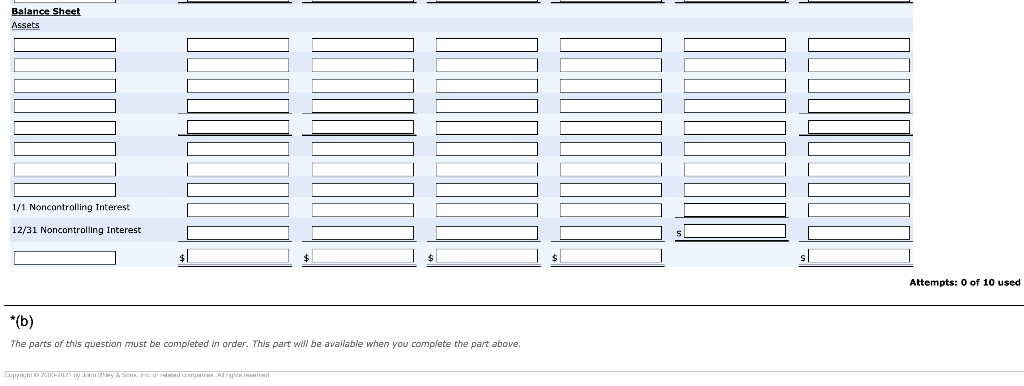

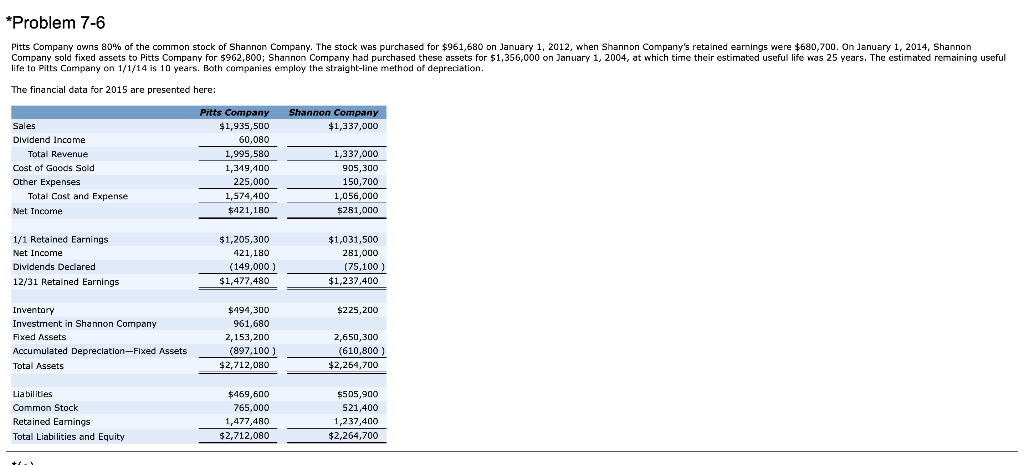

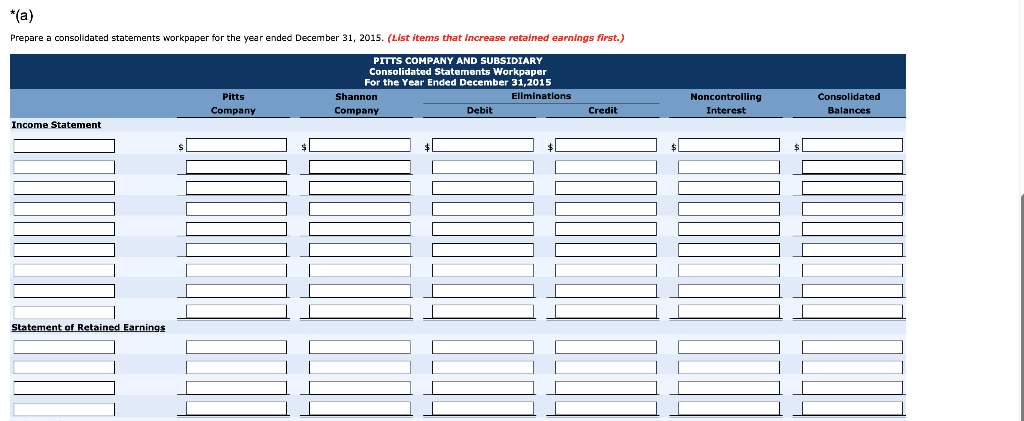

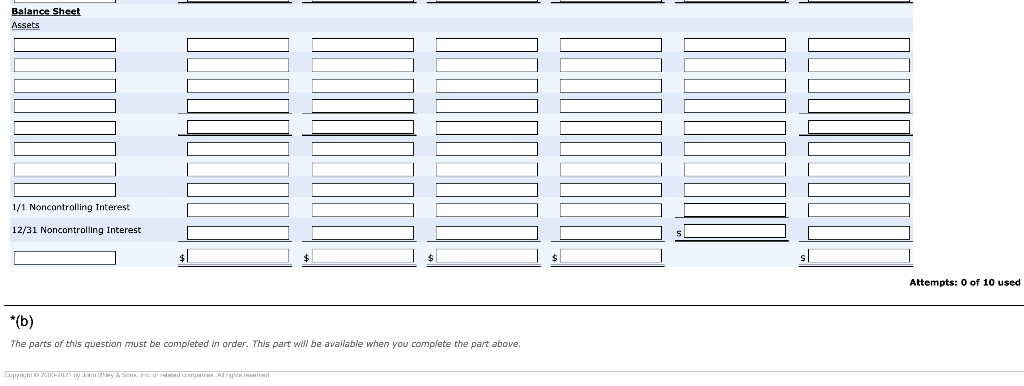

*Problem 7-6 Pitts Company owns 80% of the common stock of Shannon Company. The stock was purchased for $961,680 on January 1, 2012, when Shannon Company's retained earnings were $680,700. On January 1, 2014, Shannon Company sold fixed assets to Pitts Company for $962,800; Shannon Company had purchased these assets for $1,356,000 on January 1, 2004, at which time their estimated useful life was 25 years. The estimated remaining useful life to Pitts Company on 1/1/14 is 10 years. Both companies employ the straight-line method of depreciation. The financial data for 2015 are presented here: : Shannon Company $1,337,000 Sales Dividend Income Total Revenue Cost of Goods Sold Other Expenses Total Cost and Expense Net Income Pitts Company $1,935,500 60,080 1,995,580 1,319,400 225,000 1,574,400 $421,180 1,337,000 905,300 150,700 1,056,000 $281,000 1/1 Retained Earnings Net Income Dividends Declared 12/31 Retained Earnings $1,205,300 421,180 (149,000) $1,477,480 $1,031,500 281,000 (75,100) $1,237,400 $225,200 Inventory Investment in Shannon Company Fixed Assets Accumulated Depreciation-Fixed Assets Total Assets $494,300 961,680 2,153,200 (897,100 ) $2,712,080 2,650,300 (610,800 ) $2,254,700 Liabilities Common Stock Retained Earnings Total Liabilities and Equity $469,600 765,000 1,477,480 $2,712,080 $505,900 521,400 1,237,400 $2,264,700 *(a) Prepare a consolidated statements workpaper for the year ended December 31, 2015. (List items that increase retained earnings first.) PITTS COMPANY AND SUBSIDIARY Consolidated Statements Workpaper For the Year Ended December 31, 2015 Pitts Shannon Eliminations Company Company Debit Credit Income Statement Noncontrolling Interest Consolidated Balances Statement of Retained Earnings Balance Sheet Assets 1/1 Noncontrolling Interest 12/31 Noncontrolling Interest $ Attempts: 0 of 10 used *(b) The parts of this question must be completed in order. This part will be available when you complete the part above. synchi 2010-2012 try. Why, retro. Al *Problem 7-6 Pitts Company owns 80% of the common stock of Shannon Company. The stock was purchased for $961,680 on January 1, 2012, when Shannon Company's retained earnings were $680,700. On January 1, 2014, Shannon Company sold fixed assets to Pitts Company for $962,800; Shannon Company had purchased these assets for $1,356,000 on January 1, 2004, at which time their estimated useful life was 25 years. The estimated remaining useful life to Pitts Company on 1/1/14 is 10 years. Both companies employ the straight-line method of depreciation. The financial data for 2015 are presented here: : Shannon Company $1,337,000 Sales Dividend Income Total Revenue Cost of Goods Sold Other Expenses Total Cost and Expense Net Income Pitts Company $1,935,500 60,080 1,995,580 1,319,400 225,000 1,574,400 $421,180 1,337,000 905,300 150,700 1,056,000 $281,000 1/1 Retained Earnings Net Income Dividends Declared 12/31 Retained Earnings $1,205,300 421,180 (149,000) $1,477,480 $1,031,500 281,000 (75,100) $1,237,400 $225,200 Inventory Investment in Shannon Company Fixed Assets Accumulated Depreciation-Fixed Assets Total Assets $494,300 961,680 2,153,200 (897,100 ) $2,712,080 2,650,300 (610,800 ) $2,254,700 Liabilities Common Stock Retained Earnings Total Liabilities and Equity $469,600 765,000 1,477,480 $2,712,080 $505,900 521,400 1,237,400 $2,264,700 *(a) Prepare a consolidated statements workpaper for the year ended December 31, 2015. (List items that increase retained earnings first.) PITTS COMPANY AND SUBSIDIARY Consolidated Statements Workpaper For the Year Ended December 31, 2015 Pitts Shannon Eliminations Company Company Debit Credit Income Statement Noncontrolling Interest Consolidated Balances Statement of Retained Earnings Balance Sheet Assets 1/1 Noncontrolling Interest 12/31 Noncontrolling Interest $ Attempts: 0 of 10 used *(b) The parts of this question must be completed in order. This part will be available when you complete the part above. synchi 2010-2012 try. Why, retro. Al