Answered step by step

Verified Expert Solution

Question

1 Approved Answer

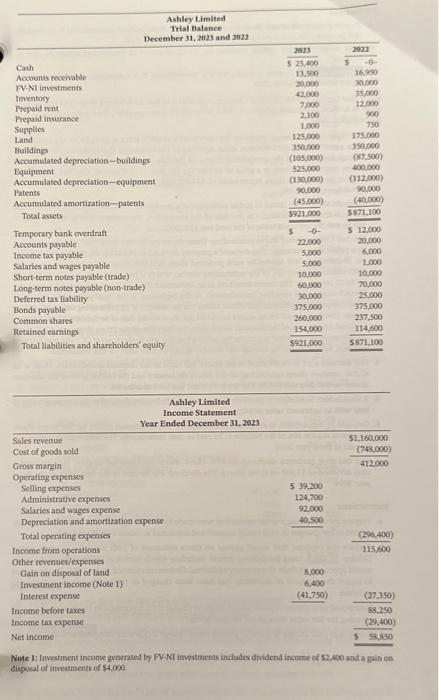

Cash Accounts receivable FV-NI investments Inventory Prepaid rent Prepaid insurance Supplies Land Buildings Accumulated depreciation-buildings Equipment Accumulated depreciation-equipment Patents Accumulated amortization-patents Total assets Temporary bank

Cash Accounts receivable FV-NI investments Inventory Prepaid rent Prepaid insurance Supplies Land Buildings Accumulated depreciation-buildings Equipment Accumulated depreciation-equipment Patents Accumulated amortization-patents Total assets Temporary bank overdraft Accounts payable Income tax payable Salaries and wages payable Ashley Limited Trial Balance December 31, 2023 and 2022 Short-term notes payable (trade) Long-term notes payable (non-trade) Deferred tax liability Bonds payable Common shares Retained earnings Total liabilities and shareholders' equity Sales revenue Cost of goods sold Gross margin Operating expenses Selling expenses Administrative expenses Salaries and wages expense Depreciation and amortization expenseshem now bornionas bar Income before taxes Income tax expense Net income Ashley Limited Income Statement Year Ended December 31, 2023 Total operating expenses Income from operations Other revenues/expenses Gain on disposal of land 1991 wib Investment income (Note 1) bogato cond Interest expense boiskeb inomaista on my dotdw gnibulon busto 2023 $ 25,400 13,500 20,000 42,000 7,000 2,100 1,000 125,000 350,000 (105,000) 525,000 (130,000) 90,000 (45,000) $921,000 STRE -0- 22,000 5,000 5,000 10,000 60,000 30,000 375,000 260,000 154,000 $921,000 $ $ 39,200 124,700 92,000 40,500 8,000 6,400 (41,750) 2022 -0- 16,950 30,000 35,000 12,000 900 750 175,000 350,000 (87,500) 400,000 (112,000) 90,000 (40,000) $871,100 12,000 20,000 6,000 1,000 10,000 70,000 25,000 375,000 237,500 114,600 $871,100 $1,160,000 (748,000) 412,000 (296,400) 115,600 (27,350) 88,250 (29,400) $ 58,850 Note 1: Investment income generated by FV-NI investments includes dividend income of $2,400 and a gain on disposal of investments of $4,000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started