//

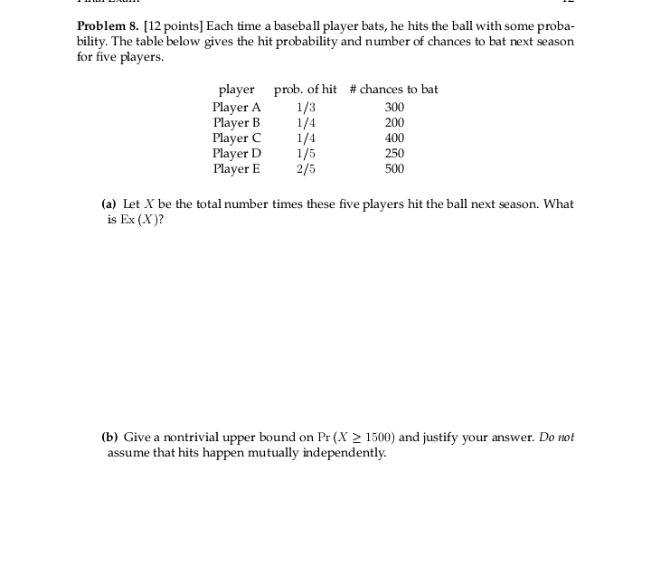

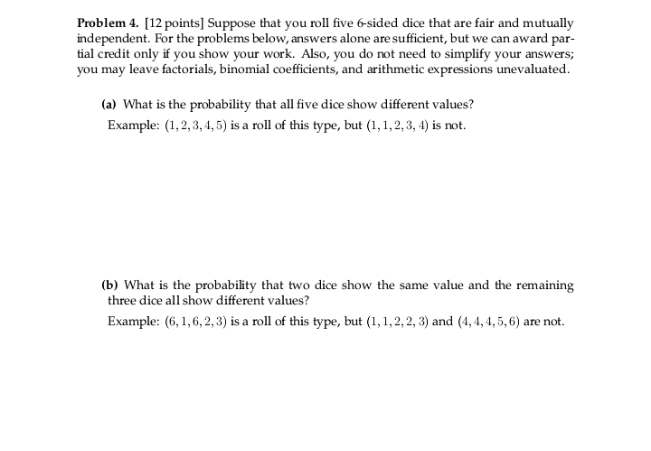

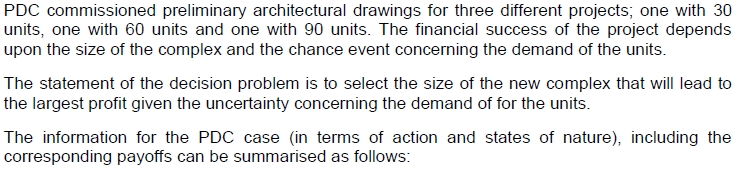

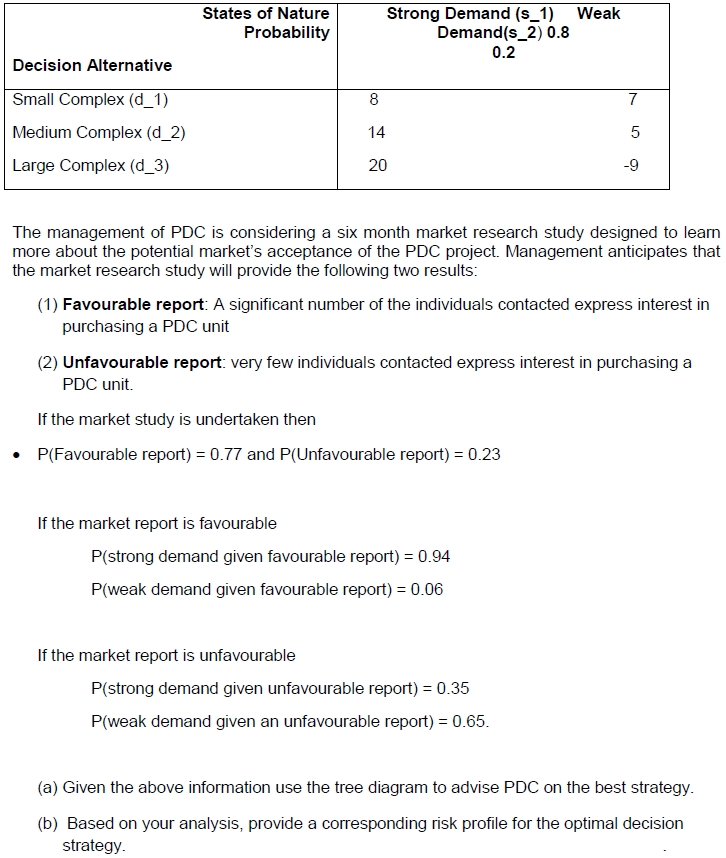

Problem 8. [12 points] Each time a baseball player bats, he hits the ball with some proba- bility. The table below gives the hit probability and number of chances to bat next season for five players. player prob. of hit # chances to bat Player A 1/3 300 Player B 1/4 200 Player C 1/4 400 Player D 1/5 250 Player E 2/5 500 (a) Let X be the total number times these five players hit the ball next season. What is Ex (X )? (b) Give a nontrivial upper bound on Pr (X 2 1500) and justify your answer. Do not assume that hits happen mutually independently.Problem 4. [12 points] Suppose that you roll five 6-sided dice that are fair and mutually independent. For the problems below, answers alone are sufficient, but we can award par- tial credit only if you show your work. Also, you do not need to simplify your answers; you may leave factorials, binomial coefficients, and arithmetic expressions unevaluated. (a) What is the probability that all five dice show different values? Example: (1, 2, 3, 4, 5) is a roll of this type, but (1, 1, 2, 3, 4) is not. (b) What is the probability that two dice show the same value and the remaining three dice all show different values? Example: (6, 1,6, 2,3) is a roll of this type, but (1, 1, 2, 2, 3) and (4, 4, 4,5, 6) are not.PDC commissioned preliminary architectural drawings for three different projects; one with 30 units, one with 60 units and one with 90 units. The financial success of the project depends upon the size of the complex and the chance event concerning the demand of the units. The statement of the decision problem is to select the size of the new complex that will lead to the largest profit given the uncertainty concerning the demand of for the units. The information for the PDC case (in terms of action and states of nature), including the corresponding payoffs can be summarised as follows:States of Nature Strong Demand (s_1) Weak Probability Demand(s_2) 0.8 0.2 Decision Alternative Small Complex (d_1) 8 Medium Complex (d_2) 14 5 Large Complex (d_3) 20 -9 The management of PDC is considering a six month market research study designed to learn more about the potential market's acceptance of the PDC project. Management anticipates that the market research study will provide the following two results: (1) Favourable report: A significant number of the individuals contacted express interest in purchasing a PDC unit (2) Unfavourable report: very few individuals contacted express interest in purchasing a PDC unit. If the market study is undertaken then P(Favourable report) = 0.77 and P(Unfavourable report) = 0.23 If the market report is favourable P(strong demand given favourable report) = 0.94 P(weak demand given favourable report) = 0.06 If the market report is unfavourable P(strong demand given unfavourable report) = 0.35 P(weak demand given an unfavourable report) = 0.65. (@) Given the above information use the tree diagram to advise PDC on the best strategy. (b) Based on your analysis, provide a corresponding risk profile for the optimal decision strategy