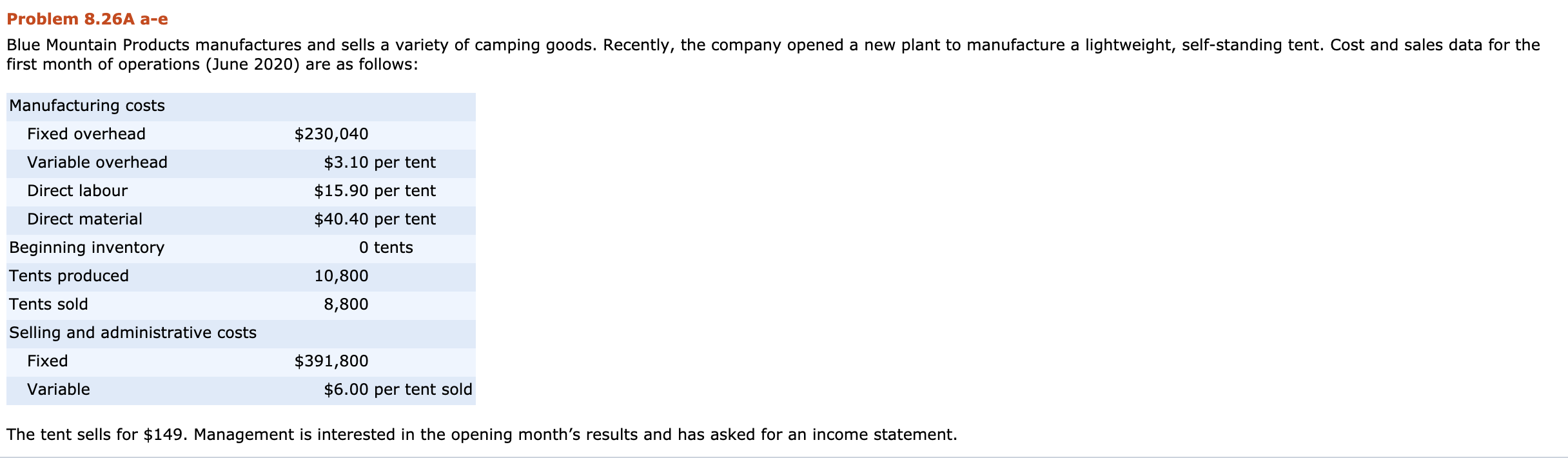

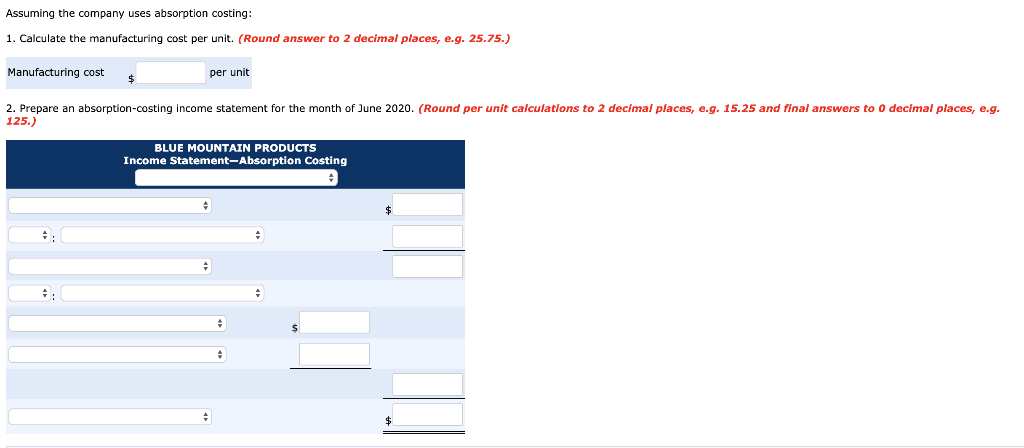

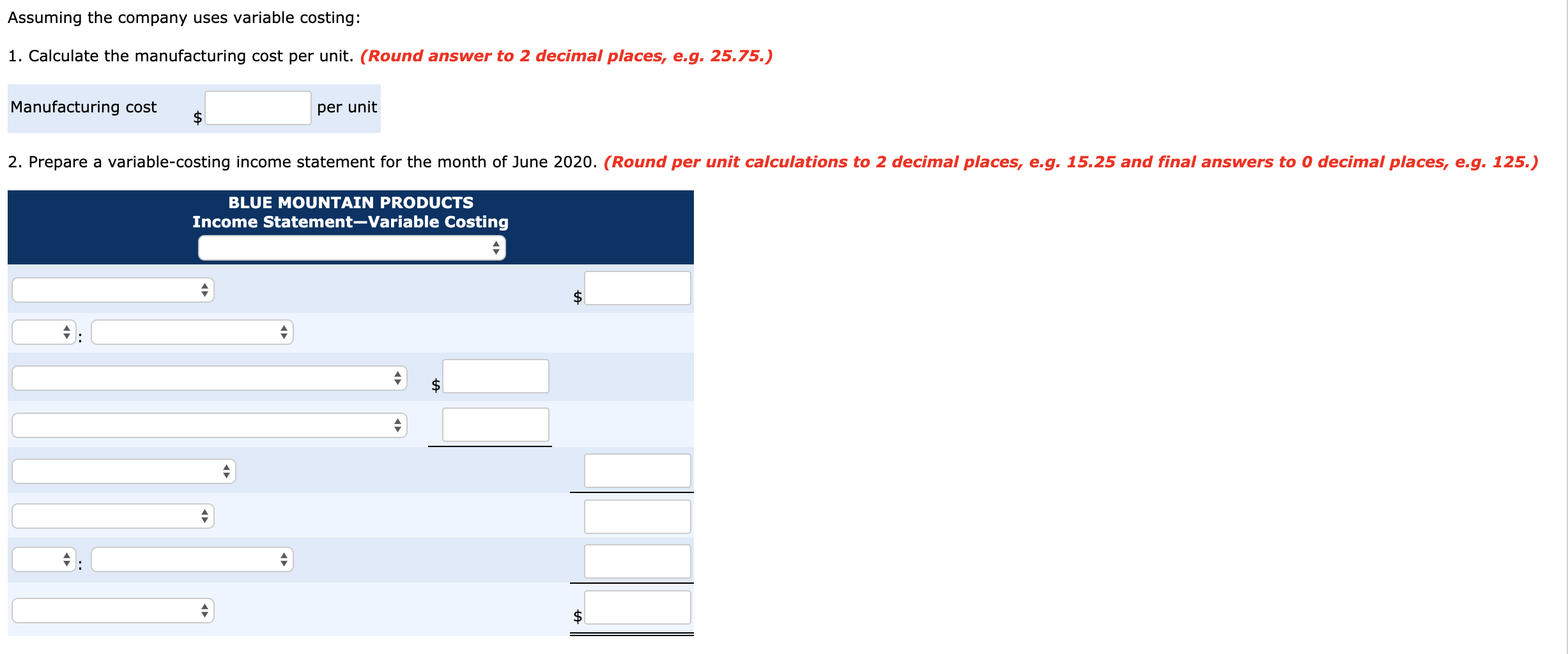

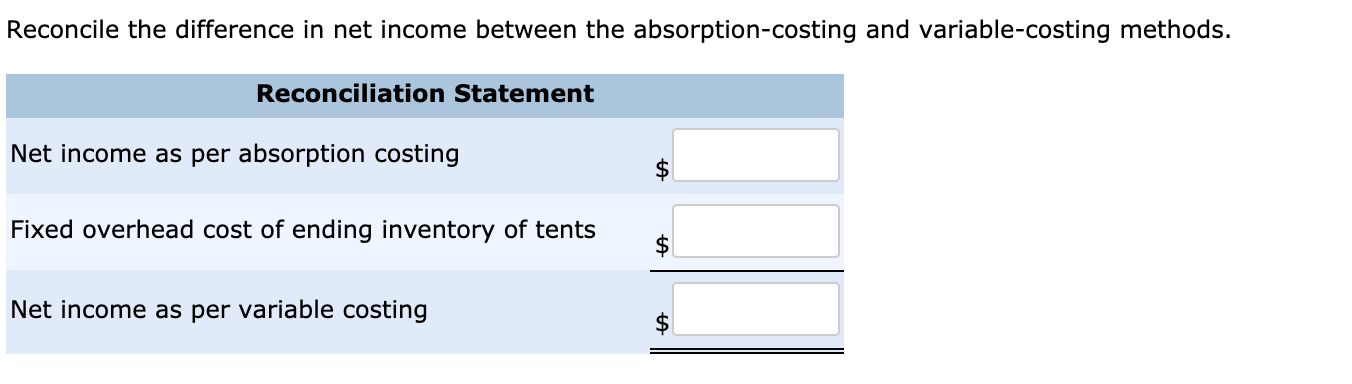

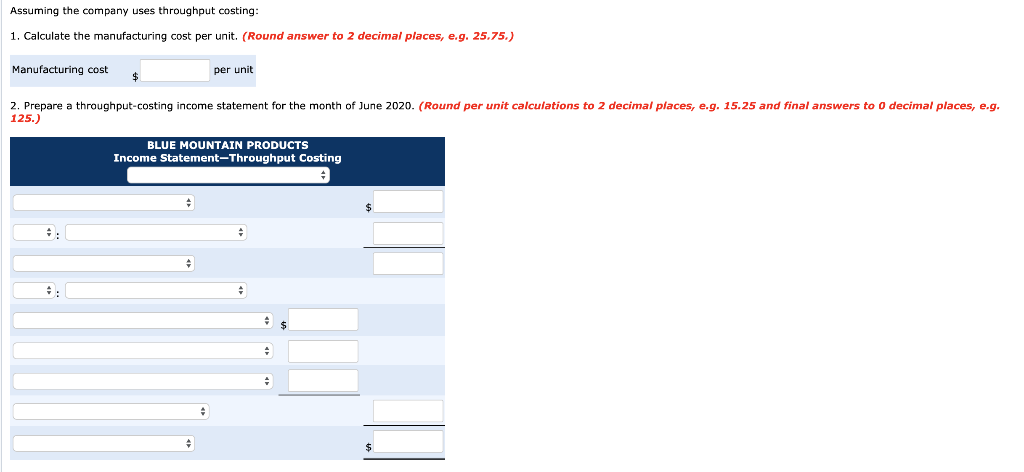

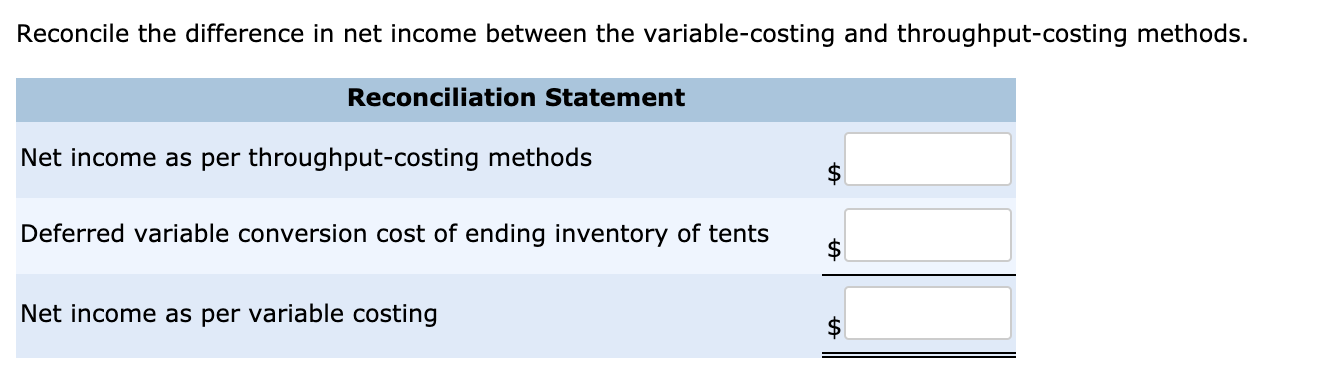

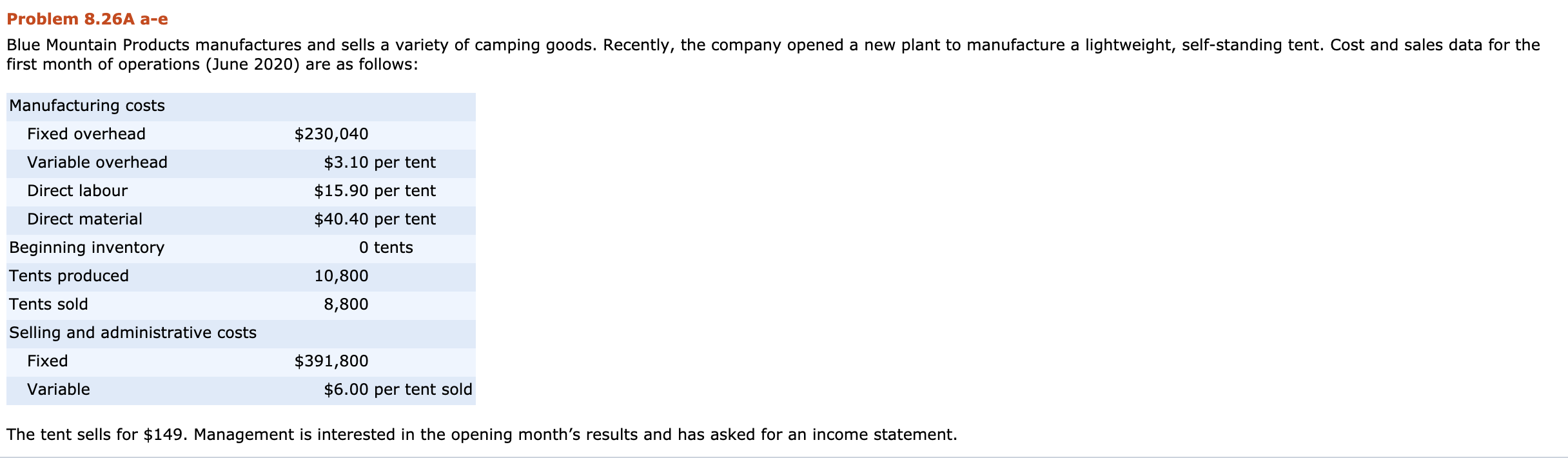

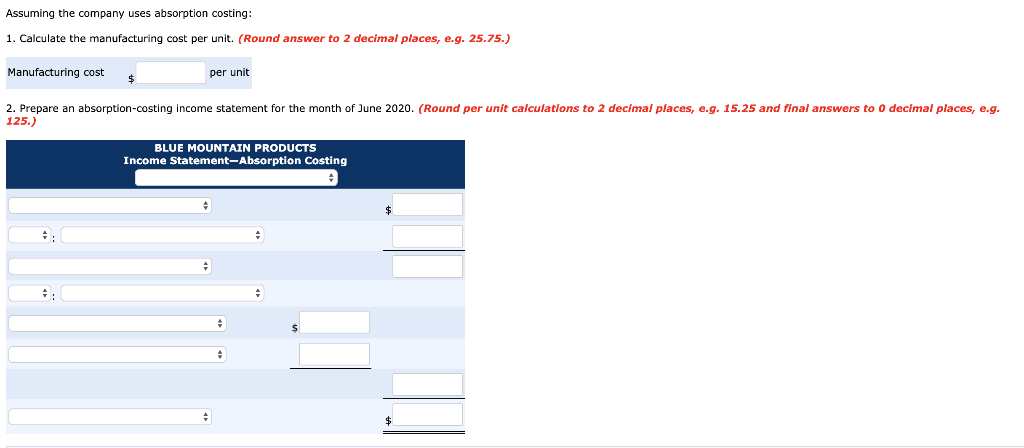

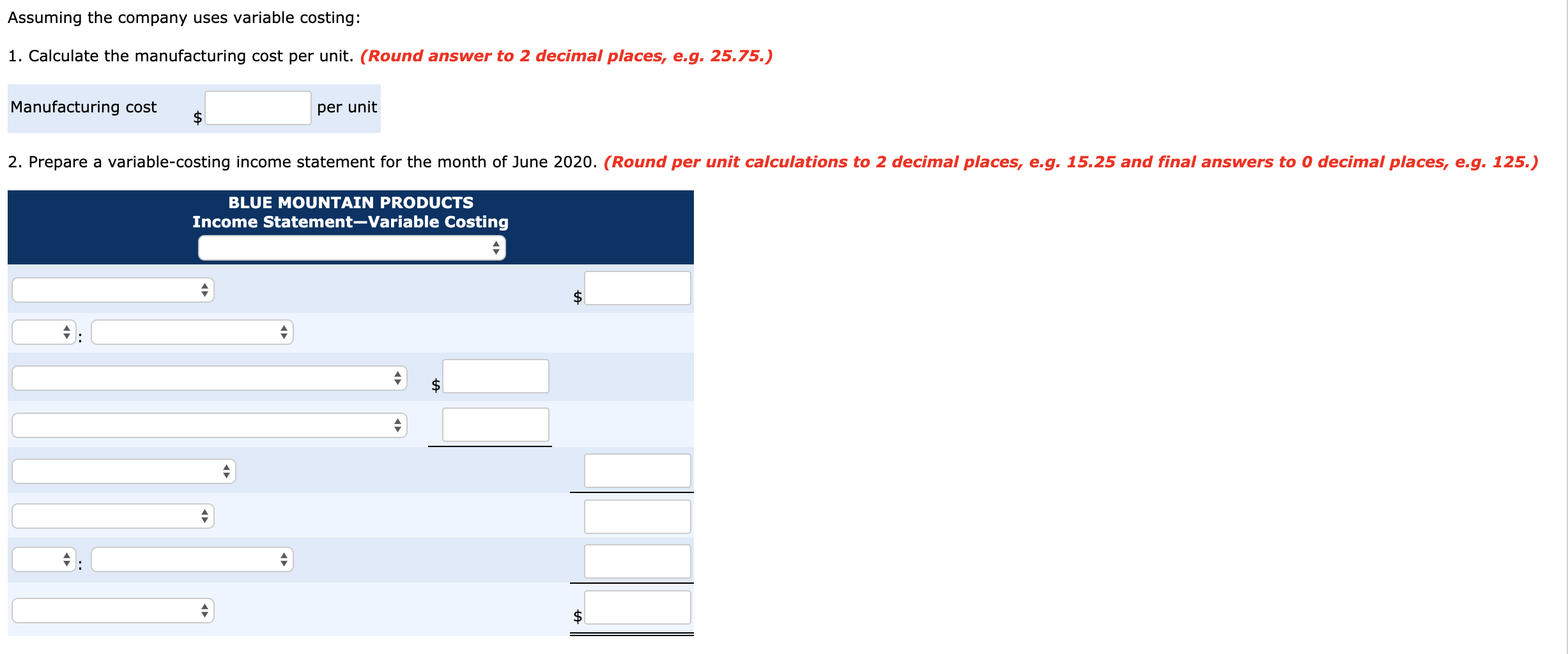

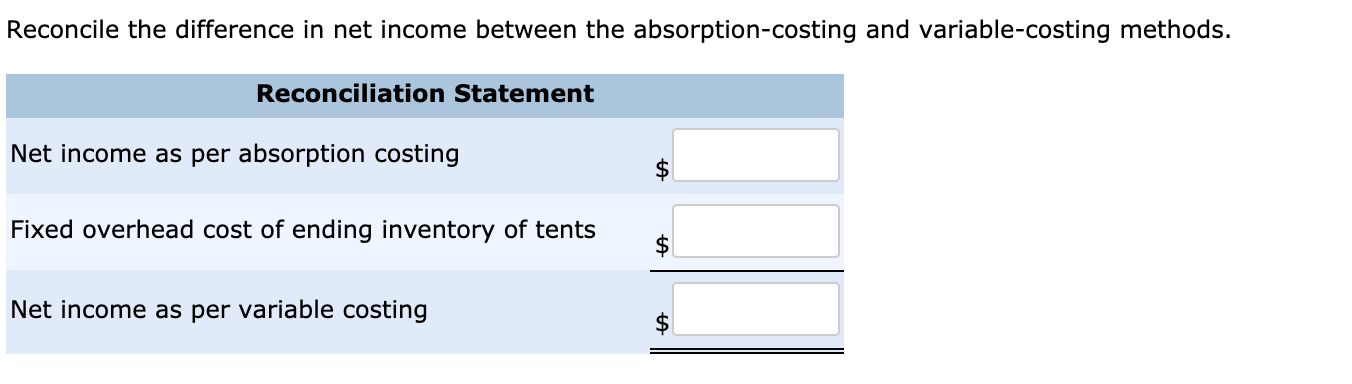

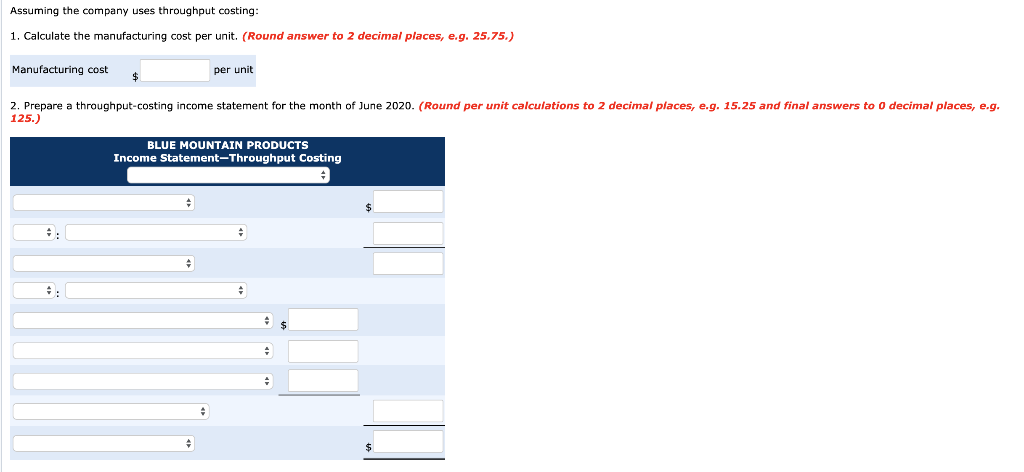

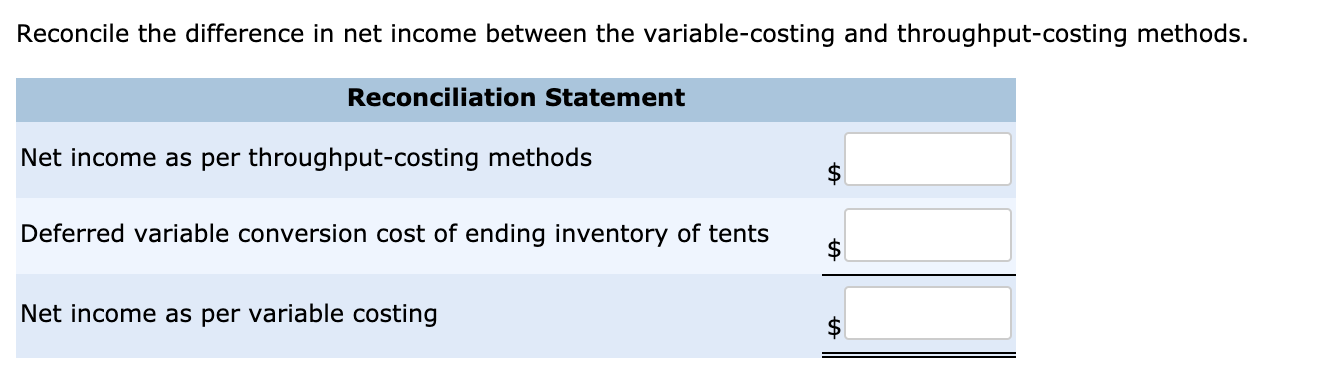

Problem 8.26A a-e Blue Mountain Products manufactures and sells a variety of camping goods. Recently, the company opened a new plant to manufacture a lightweight, self-standing tent. Cost and sales data for the first month of operations (June 2020) are as follows: Manufacturing costs Fixed overhead Variable overhead Direct labour Direct material $230,040 $3.10 per tent $15.90 per tent $40.40 per tent O tents 10,800 8,800 Beginning inventory Tents produced Tents sold Selling and administrative costs Fixed $391,800 $6.00 per tent sold Variable The tent sells for $149. Management is interested in the opening month's results and has asked for an income statement. Assuming the company uses absorption costing: 1. Calculate the manufacturing cost per unit. (Round answer to 2 decimal places, e.g. 25.75.) Manufacturing costs per unit 2. Prepare an absorption-costing income statement for the month of June 2020. (Round per unit calculations to 2 decimal places, e.g. 15.25 and final answers to 0 decimal places, e.g. 125.) BLUE MOUNTAIN PRODUCTS Income Statement-Absorption Costing Assuming the company uses variable costing: 1. Calculate the manufacturing cost per unit. (Round answer to 2 decimal places, e.g. 25.75.) Manufacturing cost & per unit 2. Prepare a variable-costing income statement for the month of June 2020. (Round per unit calculations to 2 decimal places, e.g. 15.25 and final answers to 0 decimal places, e.g. 125.) BLUE MOUNTAIN PRODUCTS Income Statement-Variable Costing $ $ Reconcile the difference in net income between the absorption-costing and variable-costing methods. Reconciliation Statement Net income as per absorption costing Fixed overhead cost of ending inventory of tents Net income as per variable costing Assuming the company uses throughput costing: 1. Calculate the manufacturing cost per unit. (Round answer to 2 decimal places, e.g. 25.75.) Manufacturing cost per unit 2. Prepare a throughput-costing income statement for the month of June 2020. (Round per unit calculations to 2 decimal places, e.g. 15.25 and final answers to o decimal places, e.g. 125.) BLUE MOUNTAIN PRODUCTS Income Statement-Throughput Costing Reconcile the difference in net income between the variable-costing and throughput-costing methods. Reconciliation Statement Net income as per throughput-costing methods A Deferred variable conversion cost of ending inventory of tents A Net income as per variable costing A