Answered step by step

Verified Expert Solution

Question

1 Approved Answer

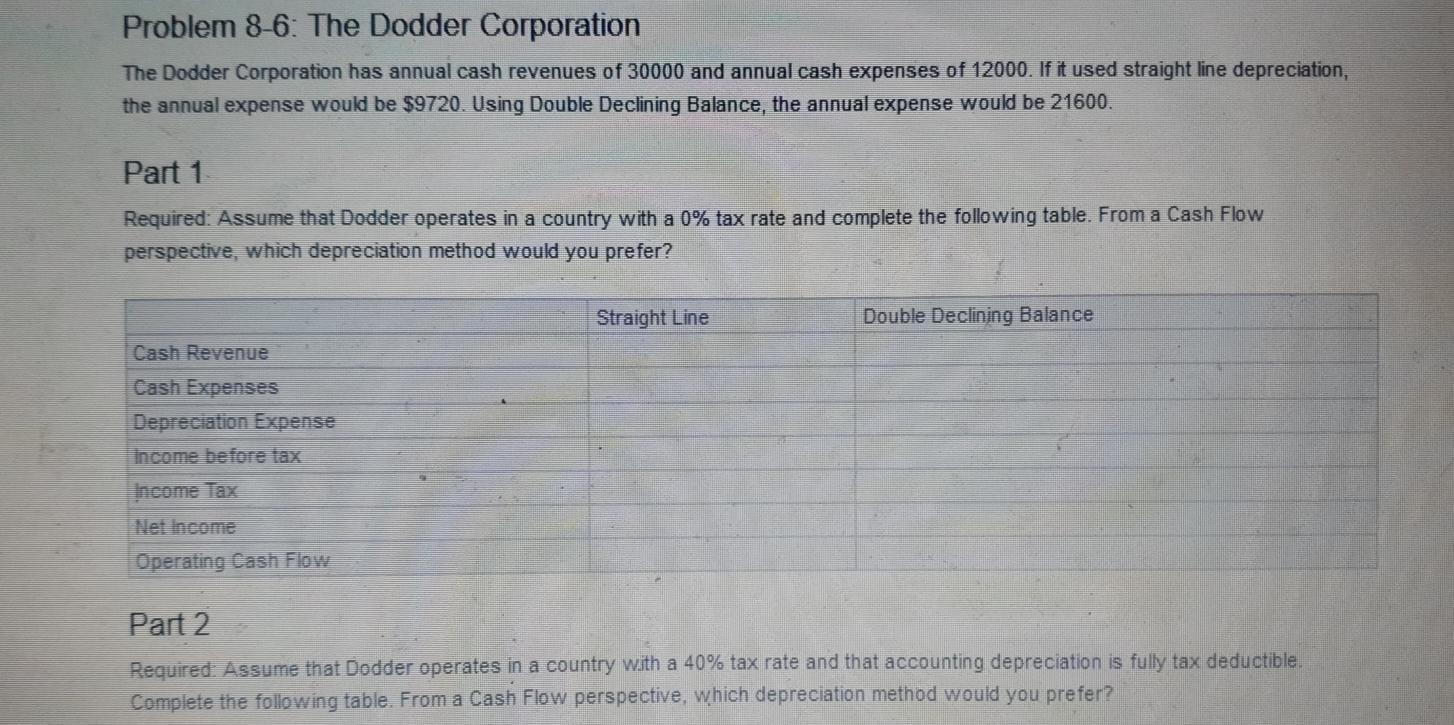

Problem 8-6: The Dodder Corporation The Dodder Corporation has annual cash revenues of 30000 and annual cash expenses of 12000. If it used straight line

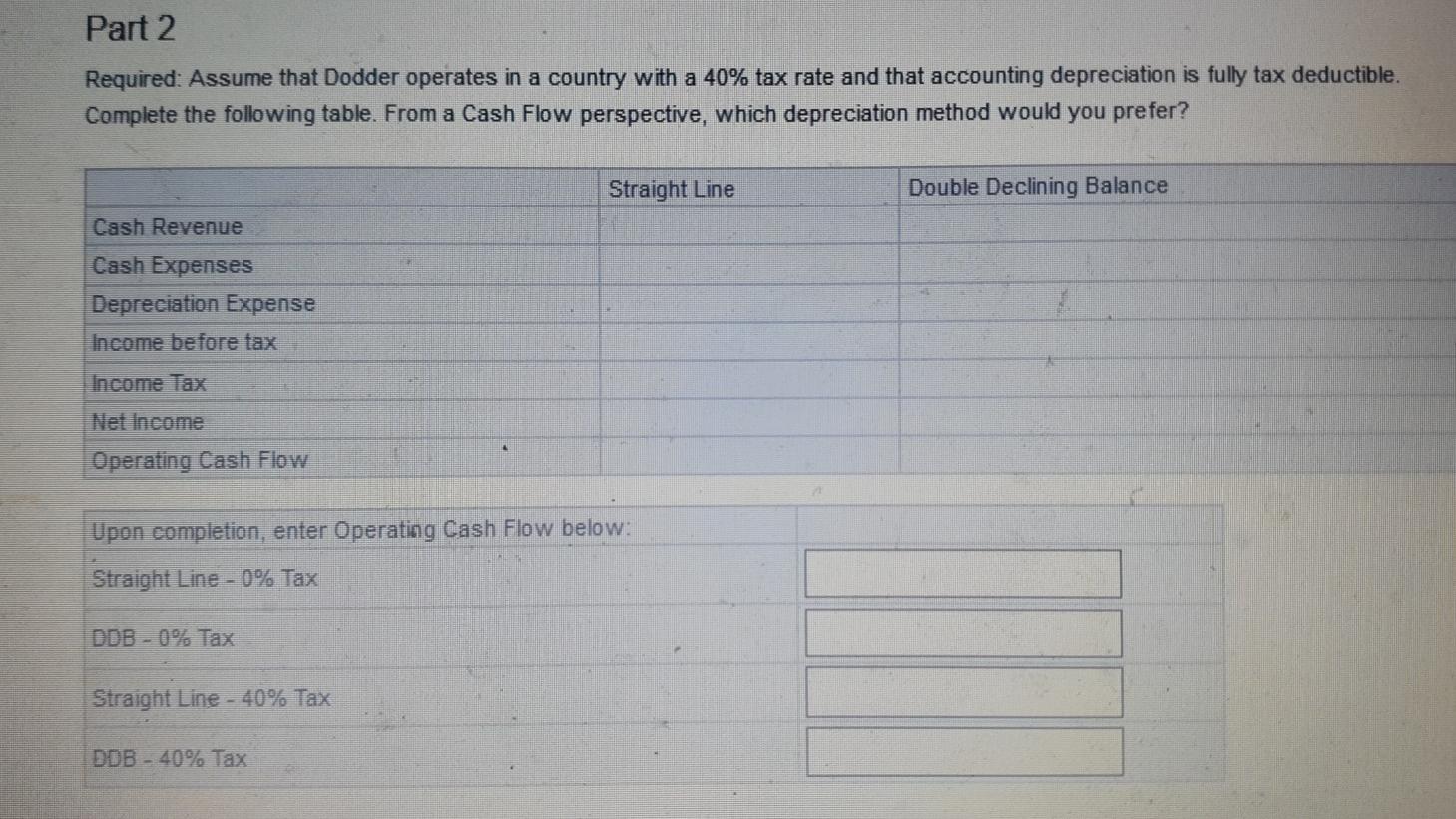

Problem 8-6: The Dodder Corporation The Dodder Corporation has annual cash revenues of 30000 and annual cash expenses of 12000. If it used straight line depreciation, the annual expense would be $9720. Using Double Declining Balance, the annual expense would be 21600. Part 1 Required: Assume that Dodder operates in a country with a 0% tax rate and complete the following table. From a Cash Flow perspective, which depreciation method would you prefer? Straight Line Double Declining Balance Cash Revenue Cash Expenses Depreciation Expense income before tax Income Tax Net Income Operating Cash Flow Part 2 Required: Assume that Dodder operates in a country with a 40% tax rate and that accounting depreciation is fully tax deductible. Complete the following table. From a Cash Flow perspective, which depreciation method would you prefer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started