Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 9 - 3 1 ( LO . 5 ) Christine is a full - time fourth - grade teacher at Vireo Academy. During the

Problem LO

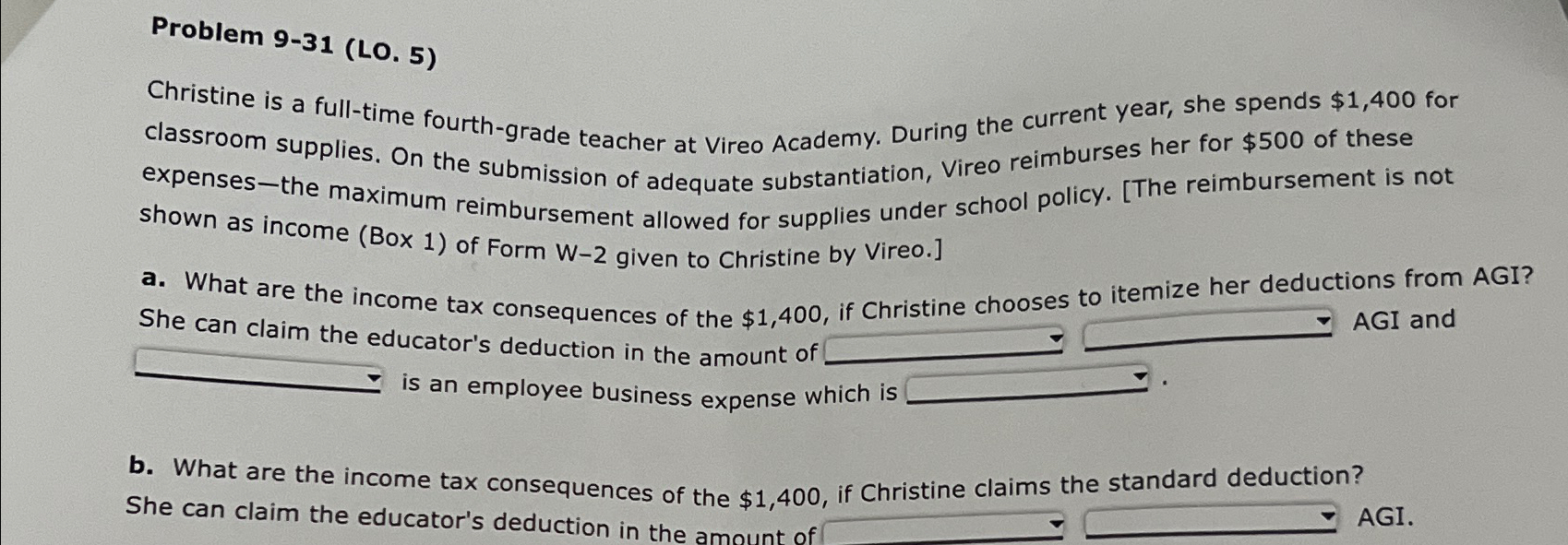

Christine is a fulltime fourthgrade teacher at Vireo Academy. During the current year, she spends $ for classroom supplies. On the submission of adequate substantiation, Vireo reimburses her for $ of these expenses the maximum reimbursement allowed for supplies under school policy. The reimbursement is not shown as income Box of Form W given to Christine by Vireo.

a What are the income tax consequences of the $ if Christine chooses to itemize her deductions from AGI? She can claim the educator's deduction in the amount of $ if Christine chooses to ind and is an employee business expense which is

b What are the income tax consequences of the $ if Christine claims the standard deduction? She can claim the educator's deduction in the amount of

AGI.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started