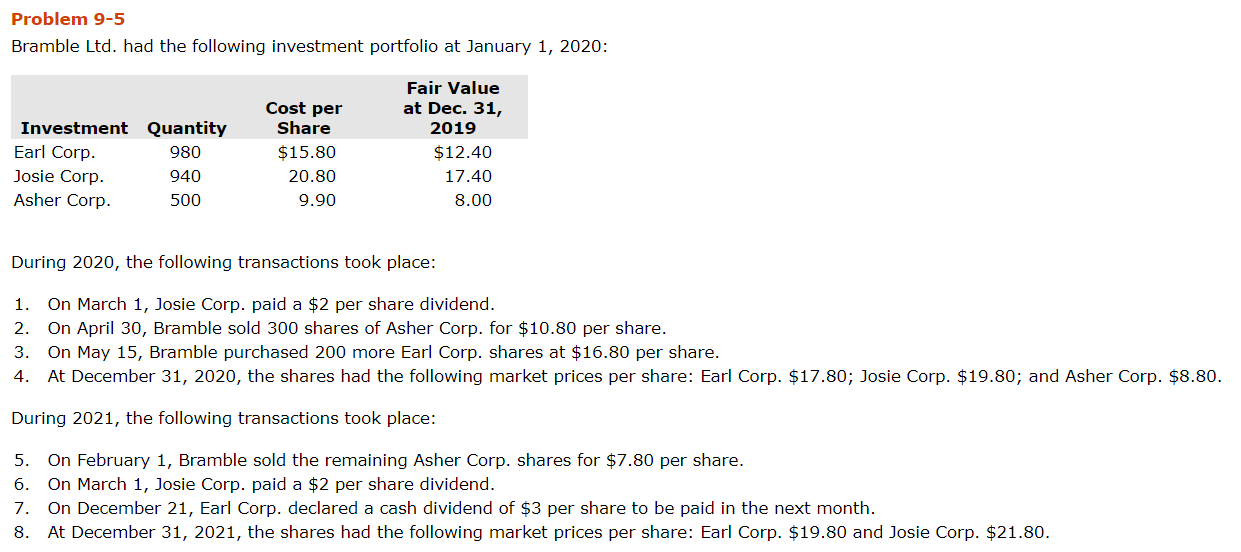

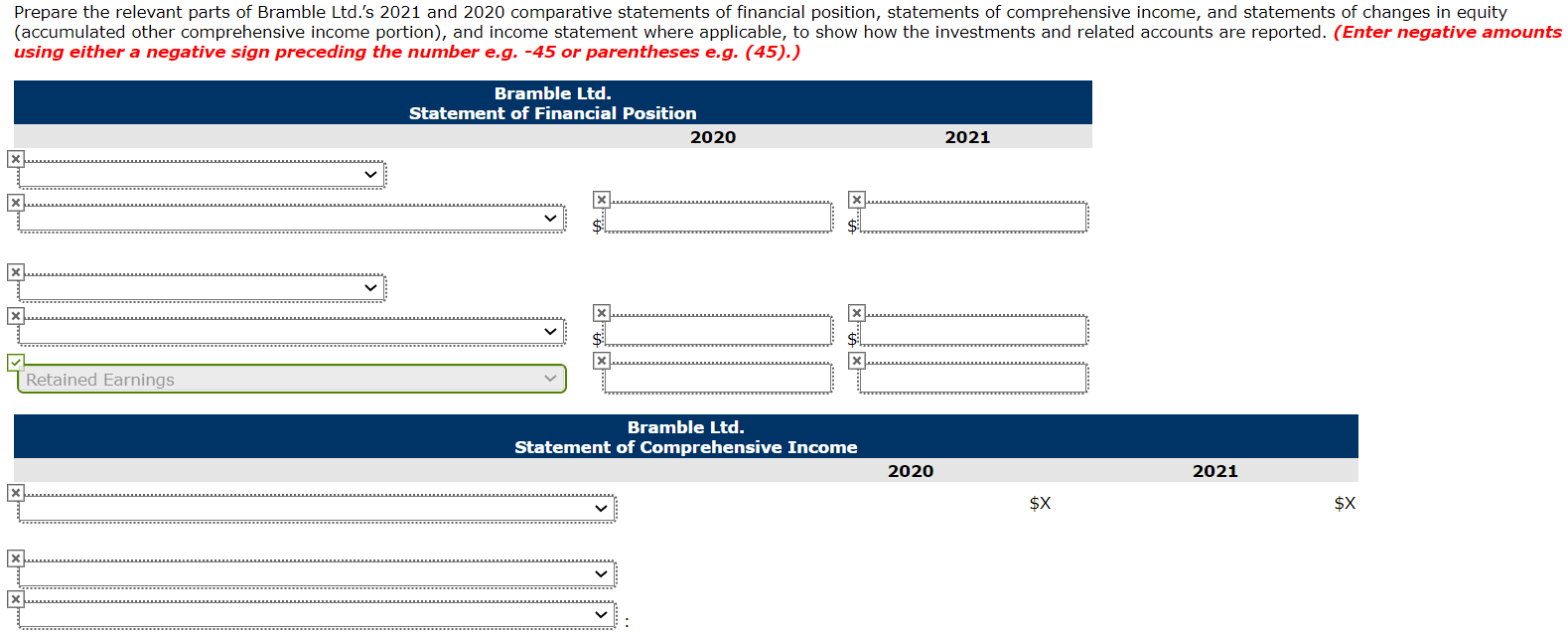

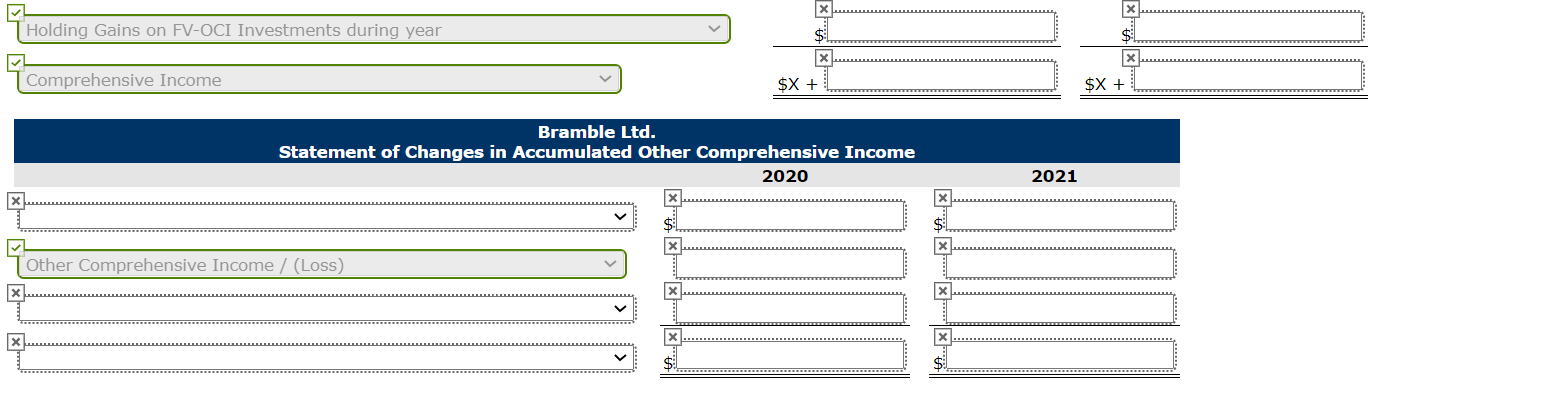

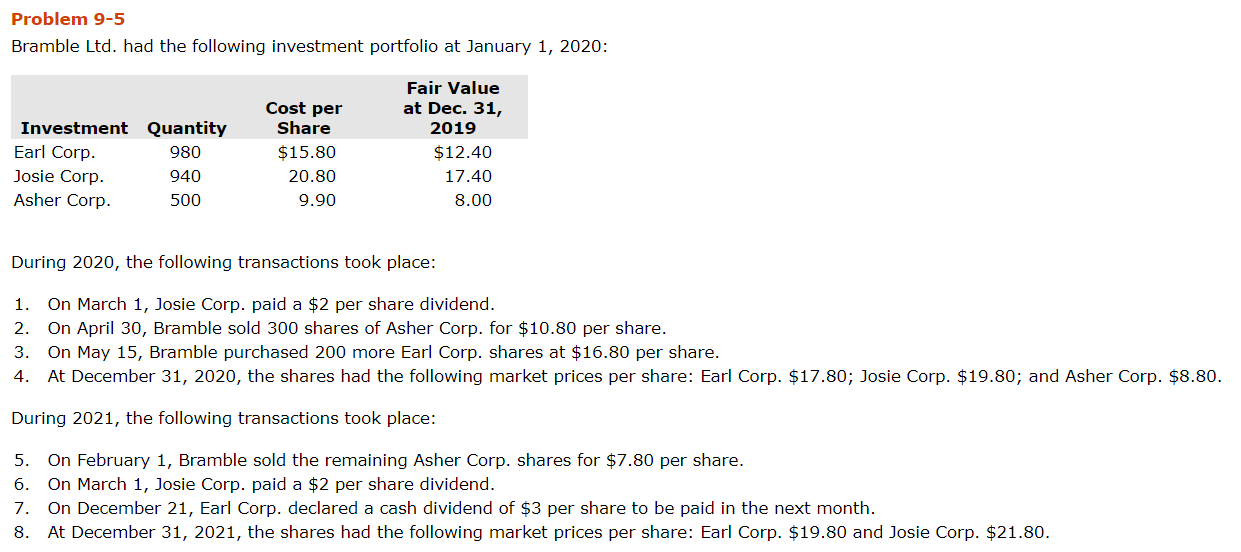

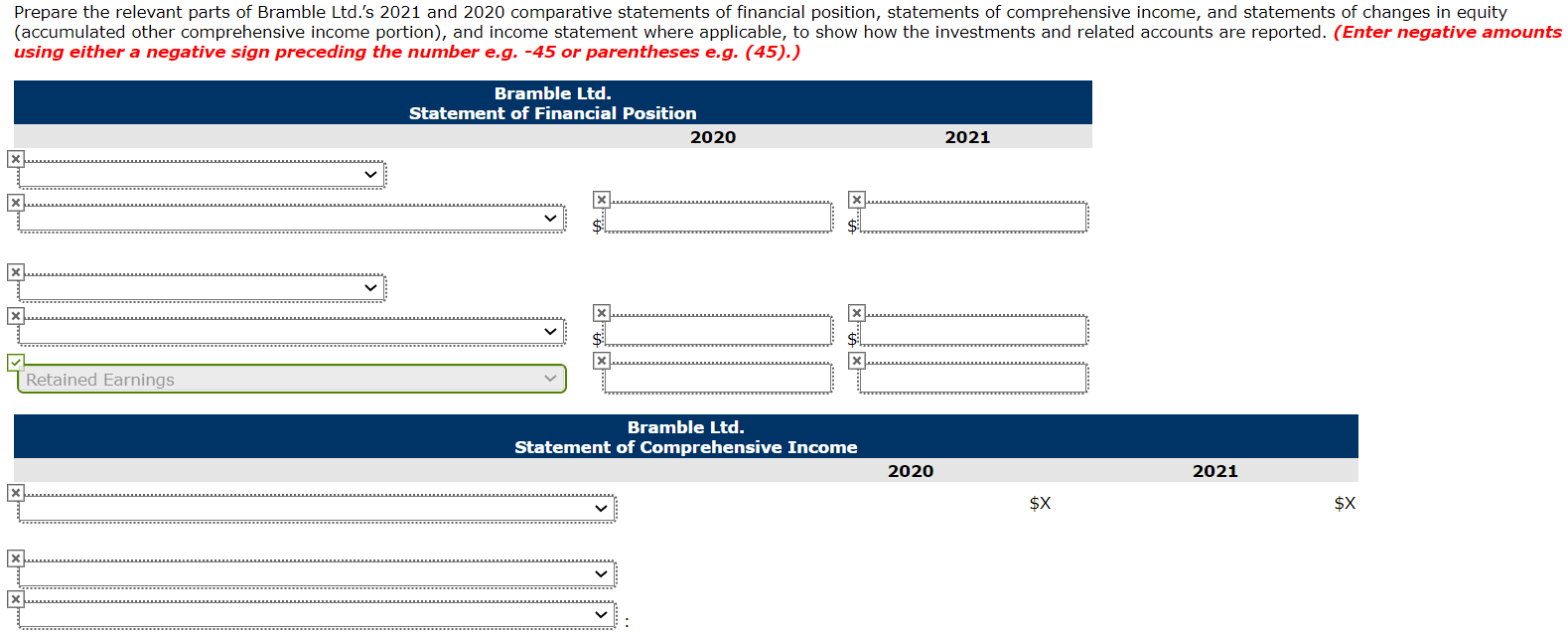

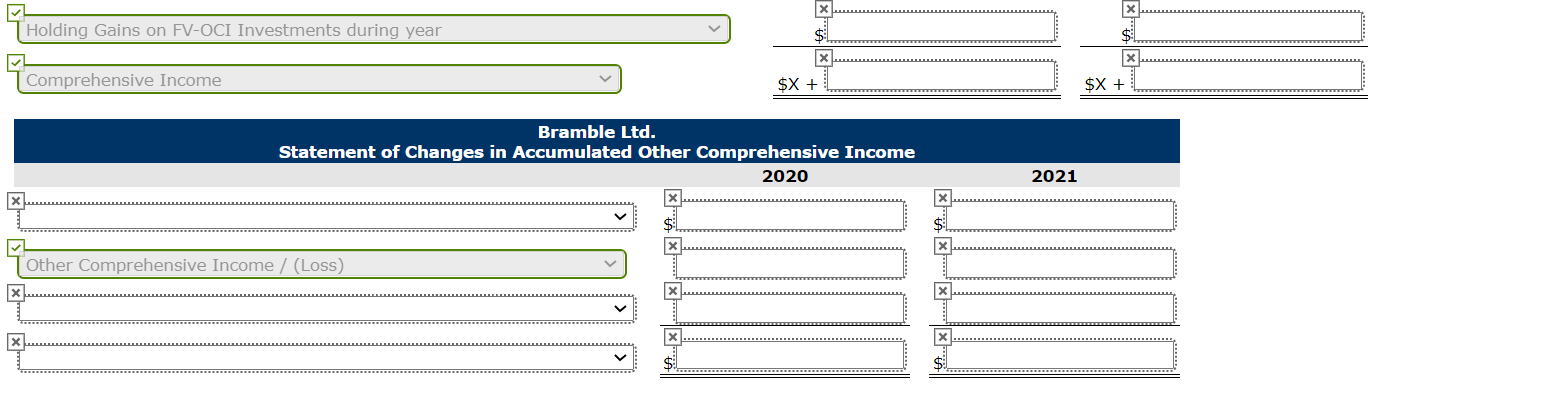

Problem 9-5 Bramble Ltd. had the following investment portfolio at January 1, 2020: Investment Quantity Earl Corp. 980 Josie Corp. 940 Asher Corp. 500 Cost per Share $15.80 20.80 9.90 Fair Value at Dec. 31, 2019 $12.40 17.40 8.00 During 2020, the following transactions took place: 1. On March 1, Josie Corp. paid a $2 per share dividend. 2. On April 30, Bramble sold 300 shares of Asher Corp. for $10.80 per share. 3. On May 15, Bramble purchased 200 more Earl Corp. shares at $16.80 per share. 4. At December 31, 2020, the shares had the following market prices per share: Earl Corp. $17.80; Josie Corp. $19.80; and Asher Corp. $8.80. During 2021, the following transactions took place: 5. On February 1, Bramble sold the remaining Asher Corp. shares for $7.80 per share. 6. On March 1, Josie Corp. paid a $2 per share dividend. 7. On December 21, Earl Corp. declared a cash dividend of $3 per share to be paid in the next month. 8. At December 31, 2021, the shares had the following market prices per share: Earl Corp. $19.80 and Josie Corp. $21.80. Prepare the relevant parts of Bramble Ltd.'s 2021 and 2020 comparative statements of financial position, statements of comprehensive income, and statements of changes in equity (accumulated other comprehensive income portion), and income statement where applicable, to show how the investments and related accounts are reported. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Bramble Ltd. Statement of Financial Position 2020 2021 Retained Earnings Bramble Ltd. Statement of Comprehensive Income 2020 2021 $X $X X x Holding Gains on FV-OCI Investments during year X Comprehensive Income X $X + $X + Bramble Ltd. Statement of Changes in Accumulated Other Comprehensive Income 2020 2021 Other Comprehensive Income / (Loss) Assume that Bramble Ltd. is a private enterprise that applies ASPE and accounts for its investment portfolio at cost (that is, the securities do not have actively traded market prices). Determine the amount by which the company's 2020 net income and 2021 net income would differ from the amounts reported under the assumptions given above. 2020 2021 Net Income The net income would not change