Answered step by step

Verified Expert Solution

Question

1 Approved Answer

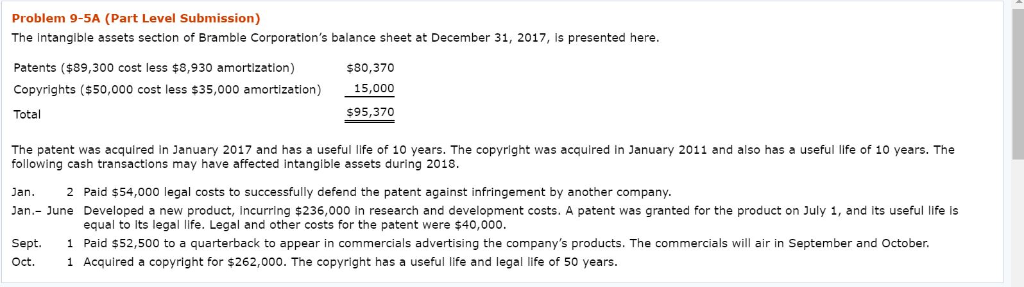

Problem 9-5A (Part Level Submission) The Intangible assets section of Bramble Corporation's balance sheet at December 31, 2017, is presented here. Patents ($89,300 cost less

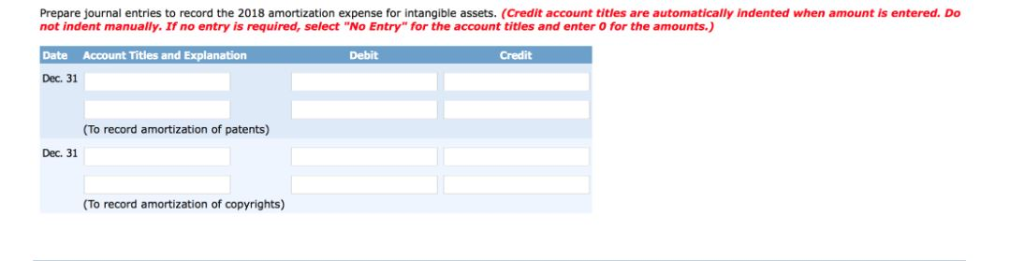

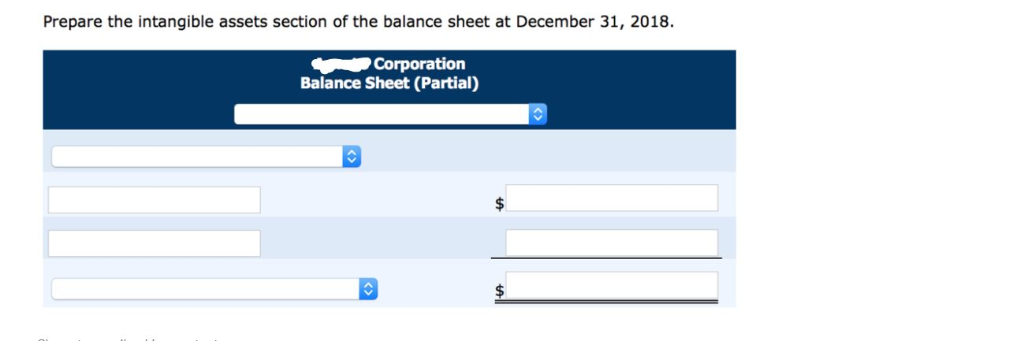

Problem 9-5A (Part Level Submission) The Intangible assets section of Bramble Corporation's balance sheet at December 31, 2017, is presented here. Patents ($89,300 cost less $8,930 amortization) $80,370 Copyrights ($50,000 cost less $35,000 amortization) 15,000 $95,370 Total The patent was acquired in January 2017 and has a useful life of 10 years. The copyright was acquired in January 2011 and also has following cash transactions may have affected intangible assets during 2018 useful life of 10 years. The 2 Paid $54,000 legal costs to successrully defend the patent against intringe A patent was granted for the product on July 1, and its useful life is ement by another company. Jan. Jan.- June Developed a hew 236,000 in research and 0 Legal and oth de equal to Its legal 1 Paid $52,500 to a quarterback to appear in commercials advertising the company's products. The commercials will air in September and October. 1 Acquired a copyright for $262,000. The copyright has a useful life and legal life of 50 years. 40,000 the paten Sept. Oct. Prepare journal entries not indent manually. record the 2018 amortization expense for intangible assets. (Credit account titles are automatically indented when amount f no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) entered. Do Date Credit Account Titles and Explanation Debit Dec. 31 (To record amortization of patents) Dec. 31 (To record amortization of copyrights) Prepare the intangible assets section of the balance sheet at December 31, 2018 Corporation Balance Sheet (Partial) $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started