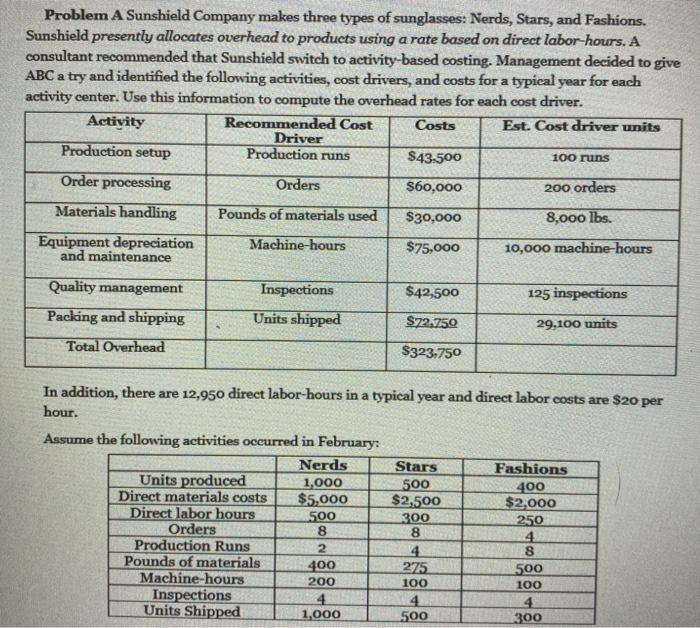

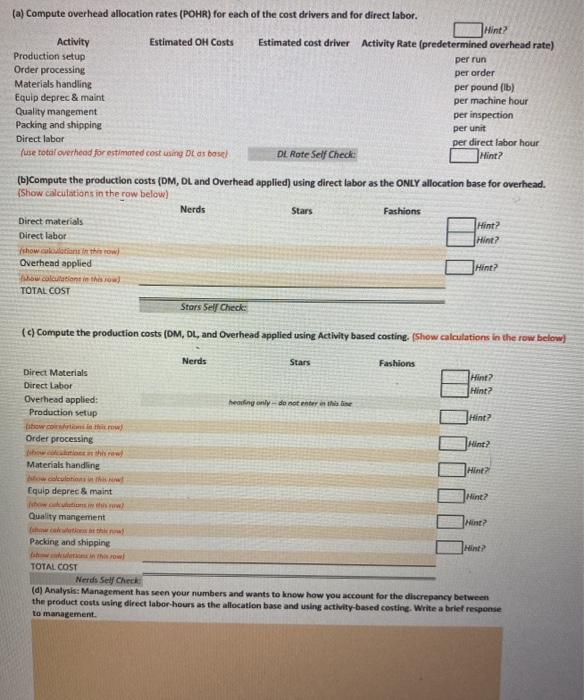

Problem A Sunshield Company makes three types of sunglasses: Nerds, Stars, and Fashions. Sunshield presently allocates overhead to products using a rate based on direct labor-hours. A consultant recommended that Sunshield switch to activity-based costing. Management decided to give ABC a try and identified the following activities, cost drivers, and costs for a typical year for each activity center. Use this information to compute the overhead rates for each cost driver. Activity Recommended Cost Costs Est. Cost driver units Driver Production setup Production runs $43.500 100 runs Order processing Orders $60,000 200 orders Materials handling Pounds of materials used $30,000 8,000 lbs. Equipment depreciation and maintenance Machine-hours $75,000 10,000 machine-hours $42,500 Quality management Packing and shipping 125 inspections Inspections Units shipped $72.750 29,100 units Total Overhead $323.750 In addition, there are 12,950 direct labor-hours in a typical year and direct labor costs are $20 per hour. Assume the following activities occurred in February: Nerds Stars Fashions Units produced 1,000 500 400 Direct materials costs $5,000 $2,500 $2,000 Direct labor hours 500 300 250 Orders 8 8 4 Production Runs 2 4 8 Pounds of materials 400 275 500 Machine-hours 200 100 100 Inspections Units Shipped 1.000 500 300 (a) Compute overhead allocation rates (POHR) for each of the cost drivers and for direct labor. Hint? Activity Estimated OH Costs Estimated cost driver Activity Rate (predetermined overhead rate) Production setup per run Order processing per order Materials handling per pound (lb) Equip deprec& maint per machine hour Quality mangement per inspection Packing and shipping per unit Direct labor per direct labor hour use tocil overhead for estimated cost using De as baseh DL Rote Self Check: Hint? (b)Compute the production costs (DM, DL and Overhead applied) using direct labor as the ONLY allocation base for overhead. (Show calculations in the row below) Nerds Stars Fashions Direct materials Hint? Direct labor Hint? show culton this towi Overhead applied Hint? Awcalculation in this TOTAL COST Stors Self Check: (4) Compute the production costs (DM, DL, and Overhead applied using Activity based costing, (show calculations in the row below) Nerds Stars Fashions Direct Materials Hint? Direct Labor Hint? Overhead applied: hearing only do not enter in the line Production setup Hint? bow.com Order processing bowhow Materials handling Hint bow collow Equip deprec& maint Mine? show Quality mangement Packing and shipping TOTAL COST Nerds Self Check (d) Analysis: Management has seen your numbers and wants to know how you account for the discrepancy between the product costs using direct labor hours as the allocation base and using activity-based costing. Write a brief response to management