Question

Examine the following balance sheet for Jims Music Company: For the given balance sheet, calculate the current ratio and debt ratio. In addition, explain what

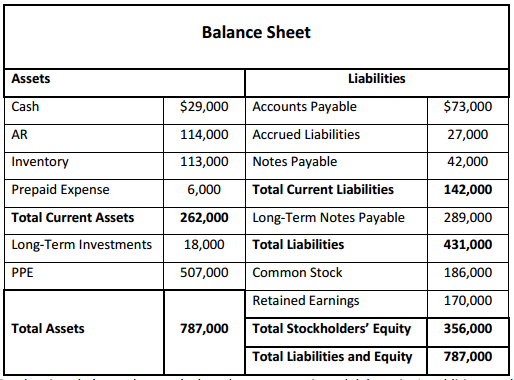

Examine the following balance sheet for Jims Music Company:

For the given balance sheet, calculate the current ratio and debt ratio. In addition, explain what each ratio represents and how it is used to determine the financial health of an organization.

Evaluation Criteria:

The lab will be evaluated using the following criteria:

Did you correctly calculate the current ratio?

Did you determine what the current ratio represents and how it determines the financial health of an organization?

Did you correctly calculate the debt ratio?

Did you determine what the debt ratio represents and how it determines the financial health of an organization?

Balance Sheet Assets Cash AR Inventory Prepaid Expense Total Current Assets Long-Term Investments PPE Liabilities $73,000 27,000 42,000 142,000 289,000 431,000 186,000 170,000 787,000Total Stockholders' Equity 356,000 Total Liabilities and Equity787,000 $29,000 Accounts Payable 114,000 Accrued Liabilities 113,000Notes Payable 6,000Total Current Liabilities 262,000 Long-Term Notes Payable 18,000 Total Liabilities 507,000 Common Stock Retained Earnings Total AssetsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started