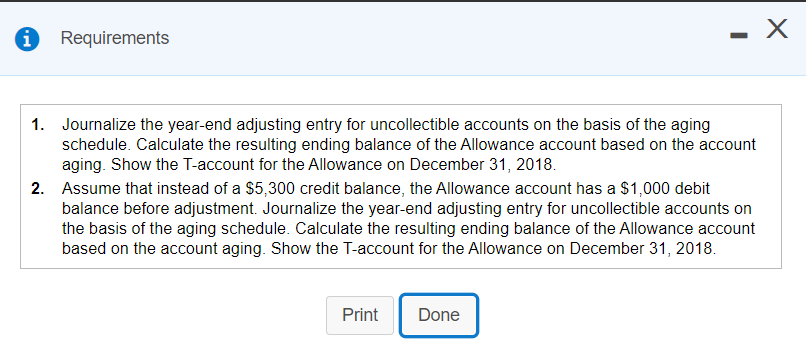

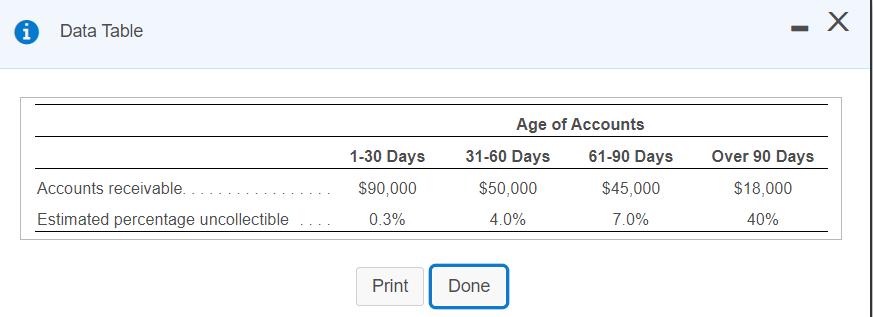

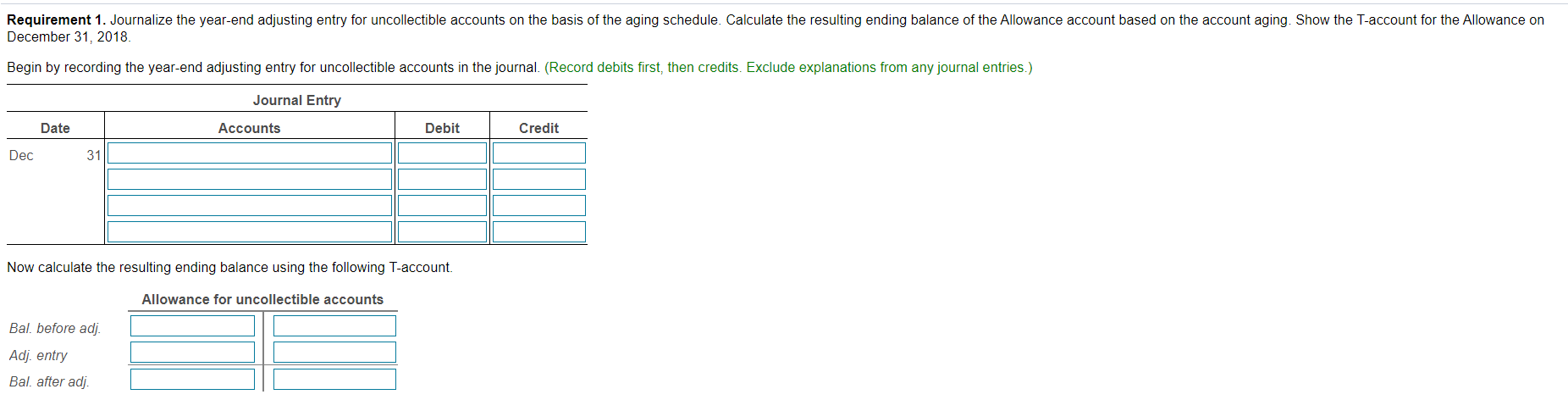

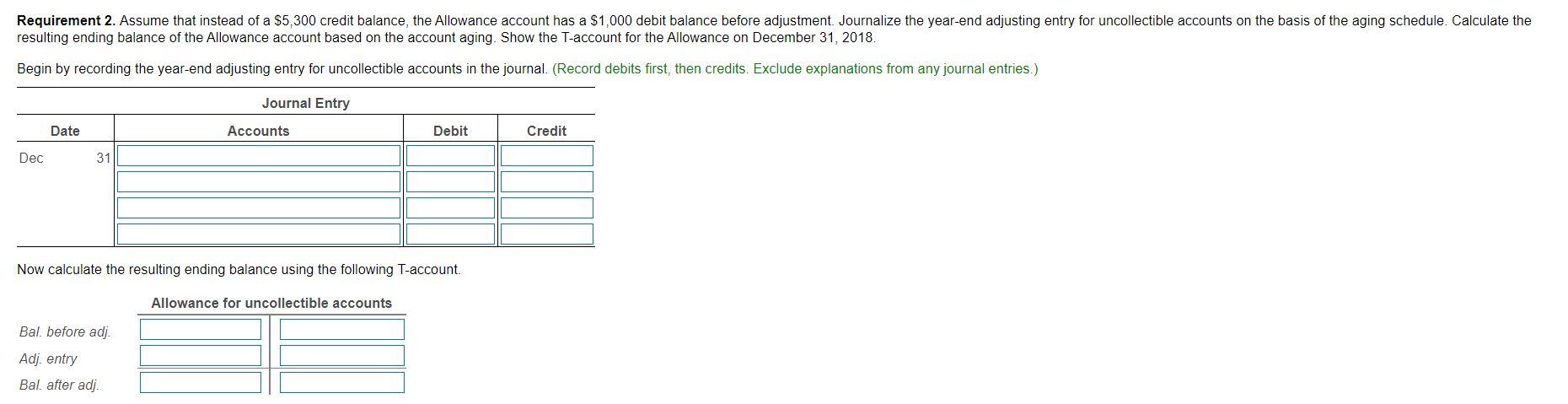

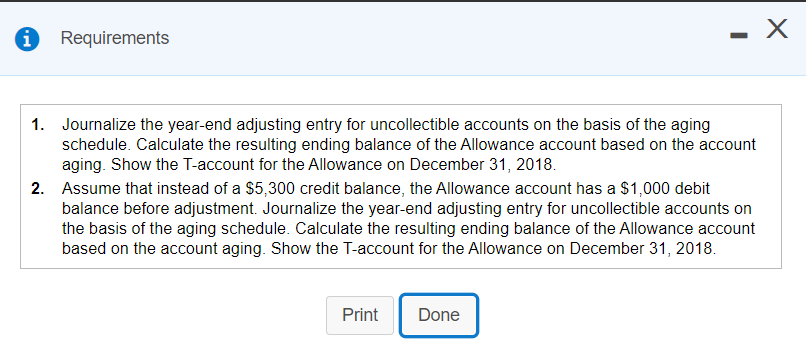

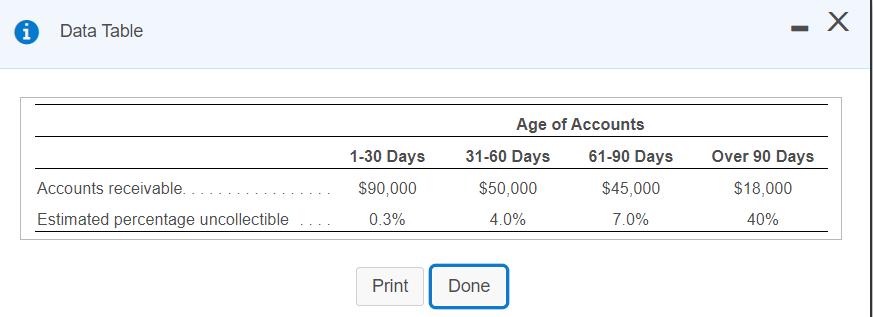

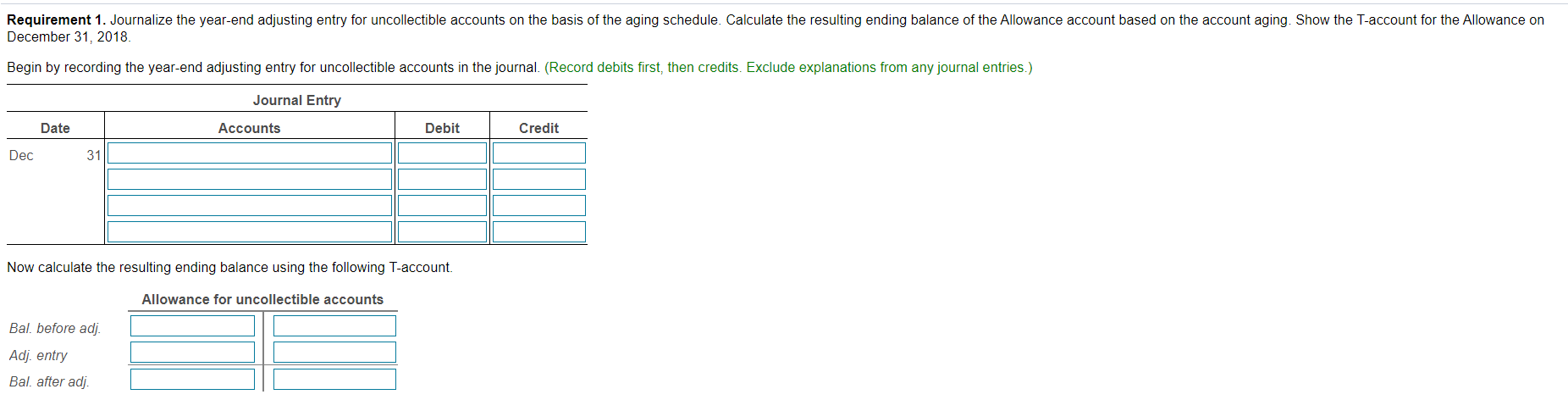

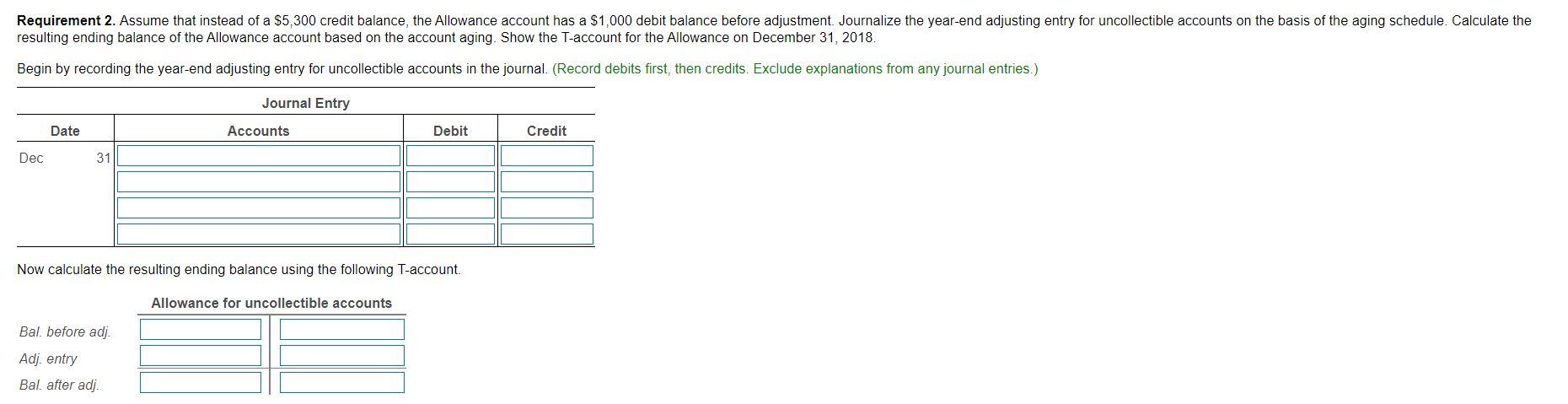

i Requirements 1. Journalize the year-end adjusting entry for uncollectible accounts on the basis of the aging schedule. Calculate the resulting ending balance of the Allowance account based on the account aging. Show the T-account for the Allowance on December 31, 2018. 2. Assume that instead of a $5,300 credit balance, the Allowance account has a $1,000 debit balance before adjustment. Journalize the year-end adjusting entry for uncollectible accounts on the basis of the aging schedule. Calculate the resulting ending balance of the Allowance account based on the account aging. Show the T-account for the Allowance on December 31, 2018. Print Done i Data Table - Over 90 Days 1-30 Days $90,000 Age of Accounts 31-60 Days 61-90 Days $50,000 $45,000 4.0% 7.0% $18,000 Accounts receivable. Estimated percentage uncollectible 0.3% 40% Print Done Requirement 1. Journalize the year-end adjusting entry for uncollectible accounts on the basis of the aging schedule. Calculate the resulting ending balance of the Allowance account based on the account aging. Show the T-account for the Allowance on December 31, 2018. Begin by recording the year-end adjusting entry for uncollectible accounts in the journal. (Record debits first, then credits. Exclude explanations from any journal entries.) Journal Entry Date Accounts Debit Credit Dec 31 Now calculate the resulting ending balance using the following T-account. Allowance for uncollectible accounts Bal, before adj. Adj. entry Bal. after adj. Requirement 2. Assume that instead of a $5,300 credit balance, the Allowance account has a $1,000 debit balance before adjustment. Journalize the year-end adjusting entry for uncollectible accounts on the basis of the aging schedule. Calculate the resulting ending balance of the Allowance account based on the account aging. Show the T-account for the Allowance on December 31, 2018. Begin by recording the year-end adjusting entry for uncollectible accounts in the journal. (Record debits first, then credits. Exclude explanations from any journal entries.) Journal Entry Date Accounts Debit Credit Dec 31 Now calculate the resulting ending balance using the following T-account. Allowance for uncollectible accounts Bal, before adj. Adj. entry Bal. after adj