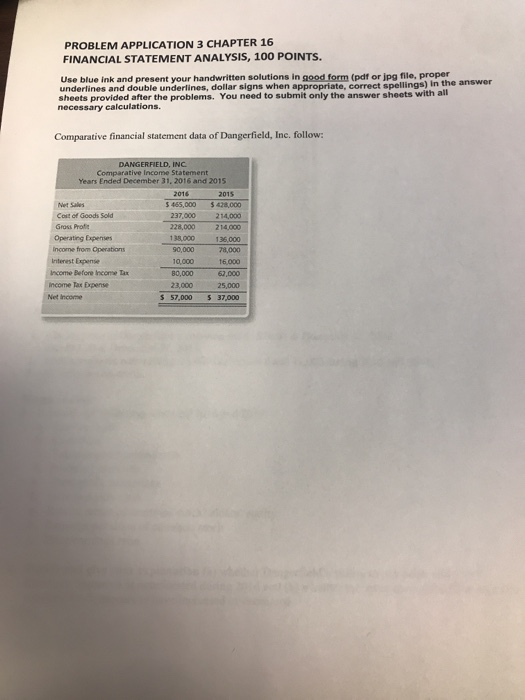

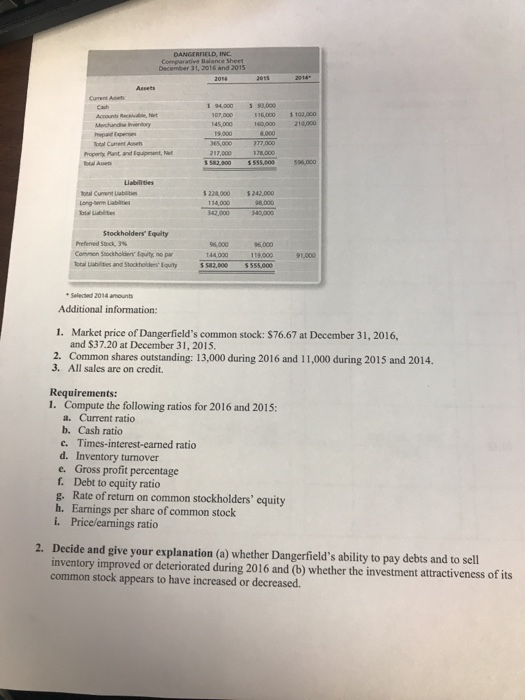

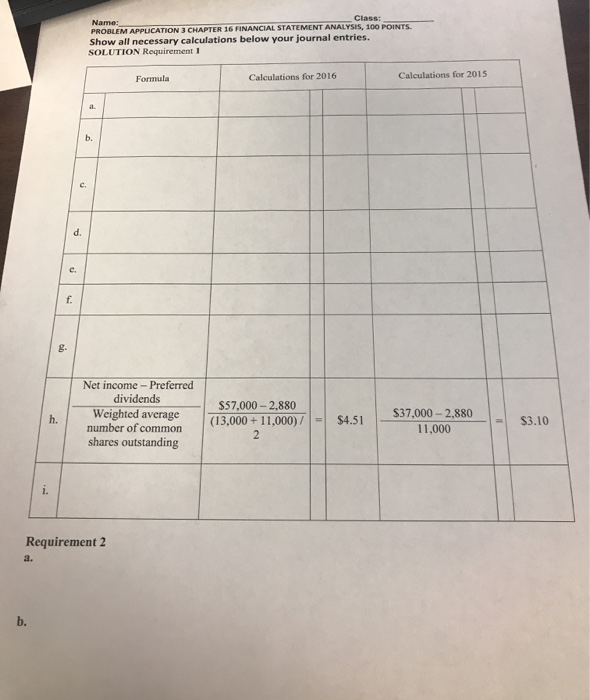

PROBLEM APPLICATION 3 CHAPTER 16 FINANCIAL STATEMENT ANALYSIS, 100 POINTS. Use blue ink and present your handwritten solutions in good form (pdf or jpg file, proper underlines and double underlines, dollar signs when appropriate, correct spellings) in the answer sheets provided after the problems. You need to submit only the answer sheets with all necessary calculations. Comparative financial statement data of Dangerfield, Inc. follow: DANGERFIELD, INC Comparative Income Statement Years Ended December 31, 2016 and 2015 2016 2015 Net Sales $ 465,000 $428,000 Cost of Goods Sold 237,000 214,000 Gross Profe 228,000 214,000 Operating Expenses 138,000 136.000 Income from Operations 90,000 78,000 Interest Expense 10.000 16.000 62.000 Income Before Income Tax 80,000 income Tax Expense 23.000 25.000 Net income S 57,000 S 37,000 DANGERFIELD, INC Comparative Balance Sheet December 31, 2016 and 2015 2016 2015 2014" Assets curent Aets S 93.000 94.000 Cash 5 102,000 Accounts Recbe, Net Merchandhe Invendorys paid Expeses 107,000 116.000 210,000 145,000 160000 19.000 8,000 365.000 Total Cuent Aet 377,000 178,000 s 555,000 Property Pant and Equipment, Net 217,000 s 582,000 596,000 al Ausetu Liabilities Total Cunent Liabilibe $ 228.000 $242,000 98.000 Long-tem Lablties 114,0008 342 000 340,000 Total Liabltes Stockholders' Equity Preferned Stock, 3% 96,000 96.000 Common Stockholders tquity no par 144 000 119,000 91,000 Total Liabilties and Stockholders Equity S 555,000 S82,000 Selected 2014 amounts Additional information: 1. Market price of Dangerfield's common stock: $76.67 at December 31, 2016, and $37.20 at December 31, 2015 2. Common shares outstanding: 13,000 during 2016 and 11,000 during 2015 and 2014. 3. All sales are on credit. Requirements: 1. Compute the following ratios for 2016 and 2015 a. Current ratio b. Cash ratio c. Times-interest-earned ratio d. Inventory turnover e. Gross profit percentage f. Debt to equity ratio g. Rate of return on common stockholders' equity h. Earnings per share of common stock iPrice/earnings ratio 2. Decide and give your explanation (a) whether Dangerfield's ability to pay debts and to sell inventory improved or deteriorated during 2016 and (b) whether the investment attractiveness of its common stock appears to have increased or decreased. Class: Name: PROBLEM APPLICATION 3 CHAPTER 16 FINANCIAL STATEMENT ANALYSIS, 100 POINTS. Show all necessary calculations below your journal entries. SOLUTION Requirement 1 Calculations for 2015 Calculations for 2016 Formula b. d. e. f Net income-Preferred dividends $57,000-2,880 (13,000 11,000)/ Weighted average number of common shares outstanding $37,000-2,880 h. $4.51 $3.10 11,000 2 i. Requirement 2 a. b