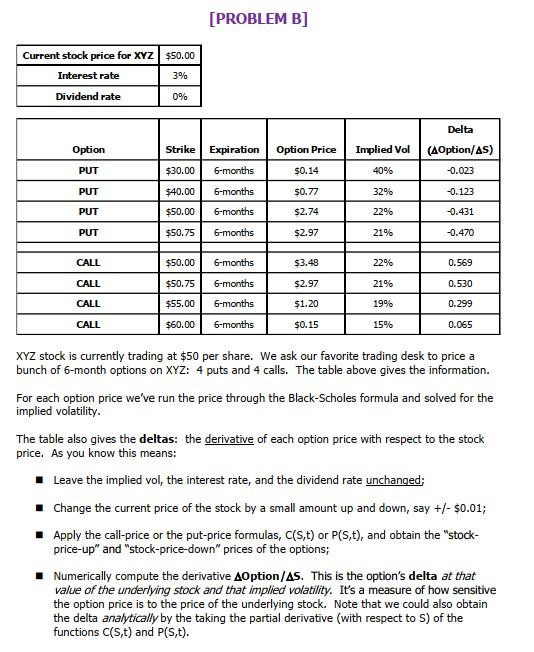

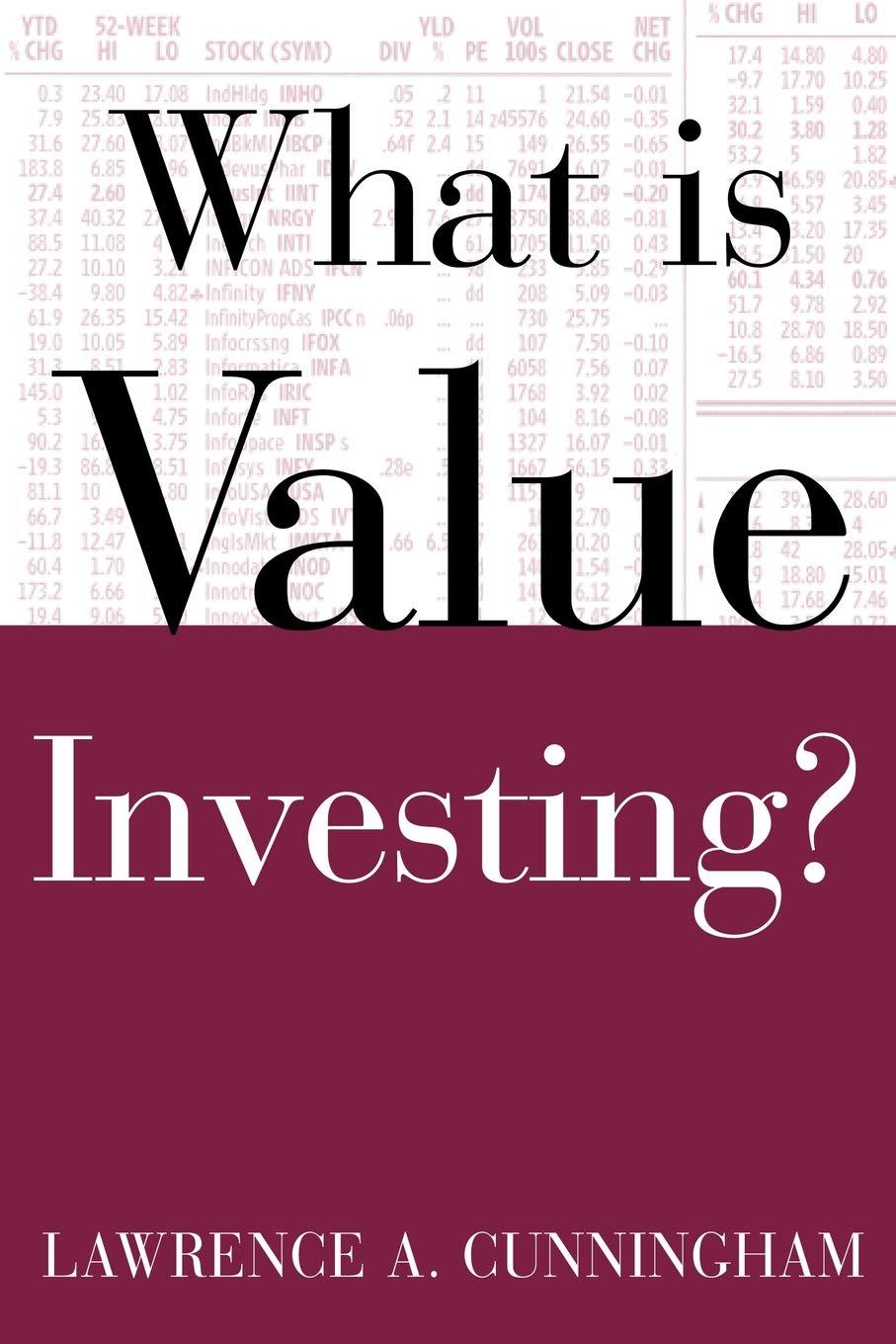

[PROBLEM B] Current stock price for XYZ $50.00 Interest rate 3% Dividend rate 0% Delta (AOption/AS) Option Option Price Implied Vol 40% PUT $0.14 -0.023 Strike Expiration $30.00 6-months $40.00 6-months $50.00 6-months PUT $0.77 32% -0.123 PUT $2.74 22% -0.431 PUT $50.75 6-months $2.97 21% -0.470 CALL $50.00 6-months $3.48 22% 0.569 CALL $50.75 6-months $2.97 21% 0.530 CALL $55.00 6-months $1.20 19% 0.299 CALL $60.00 6-months $0.15 15% 0.065 XYZ stock is currently trading at $50 per share. We ask our favorite trading desk to price a bunch of 6-month options on XYZ: 4 puts and 4 calls. The table above gives the information. For each option price we've run the price through the Black-Scholes formula and solved for the implied volatility. The table also gives the deltas: the derivative of each option price with respect to the stock price. As you know this means: Leave the implied vol, the interest rate, and the dividend rate unchanged Change the current price of the stock by a small amount up and down, say +/- $0.01; Apply the call-price or the put-price formulas, C(s, t) or PCs,t), and obtain the "stock- price-up" and "stock-price-down" prices of the options; Numerically compute the derivative AOption/As. This is the option's delta at that value of the underlying stock and that implied volatility. It's a measure of how sensitive the option price is to the price of the underlying stock. Note that we could also obtain the delta analytically by the taking the partial derivative (with respect to S) of the functions C(s, t) and P(S,t). [9] Let's focus on the $40-strike put. As we see in the table ... the trader is offering this option at $0.77, which is an implied volatility of 32%. At this implied volatility we observe a delta of -0.123. Of course, at 40% implied volatility the price you'd be charged is higher. How about the delta at 40% volatility? Would it be more negative or less negative? Explain. [PROBLEM B] Current stock price for XYZ $50.00 Interest rate 3% Dividend rate 0% Delta (AOption/AS) Option Option Price Implied Vol 40% PUT $0.14 -0.023 Strike Expiration $30.00 6-months $40.00 6-months $50.00 6-months PUT $0.77 32% -0.123 PUT $2.74 22% -0.431 PUT $50.75 6-months $2.97 21% -0.470 CALL $50.00 6-months $3.48 22% 0.569 CALL $50.75 6-months $2.97 21% 0.530 CALL $55.00 6-months $1.20 19% 0.299 CALL $60.00 6-months $0.15 15% 0.065 XYZ stock is currently trading at $50 per share. We ask our favorite trading desk to price a bunch of 6-month options on XYZ: 4 puts and 4 calls. The table above gives the information. For each option price we've run the price through the Black-Scholes formula and solved for the implied volatility. The table also gives the deltas: the derivative of each option price with respect to the stock price. As you know this means: Leave the implied vol, the interest rate, and the dividend rate unchanged Change the current price of the stock by a small amount up and down, say +/- $0.01; Apply the call-price or the put-price formulas, C(s, t) or PCs,t), and obtain the "stock- price-up" and "stock-price-down" prices of the options; Numerically compute the derivative AOption/As. This is the option's delta at that value of the underlying stock and that implied volatility. It's a measure of how sensitive the option price is to the price of the underlying stock. Note that we could also obtain the delta analytically by the taking the partial derivative (with respect to S) of the functions C(s, t) and P(S,t). [9] Let's focus on the $40-strike put. As we see in the table ... the trader is offering this option at $0.77, which is an implied volatility of 32%. At this implied volatility we observe a delta of -0.123. Of course, at 40% implied volatility the price you'd be charged is higher. How about the delta at 40% volatility? Would it be more negative or less negative? Explain