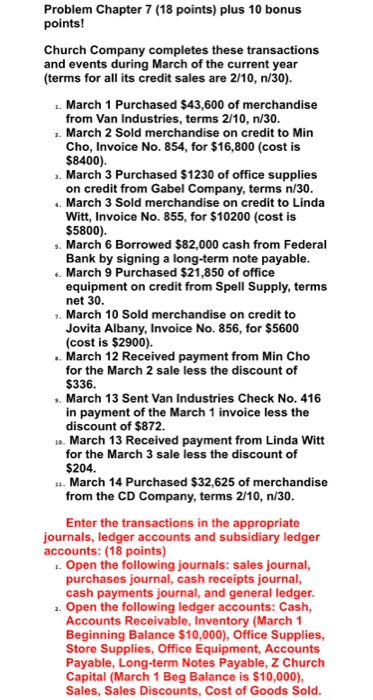

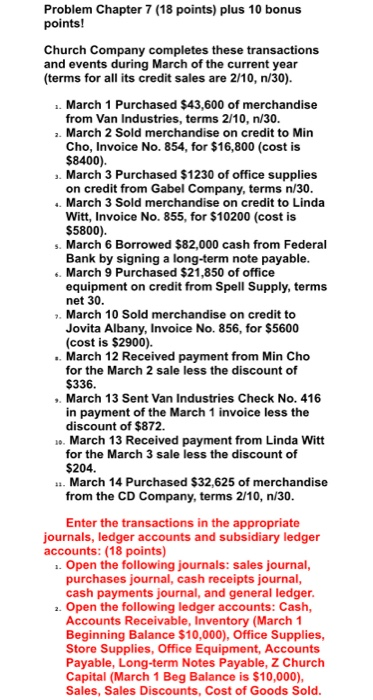

Problem Chapter 7 (18 points) plus 10 bonus points! Church Company completes these transactions and events during March of the current year (terms for all its credit sales are 2/10, n/30). 1. March 1 Purchased $43,600 of merchandise from Van Industries, terms 2/10, n/30. 2. March 2 Sold merchandise on credit to Min Cho, Invoice No. 854, for $16,800 (cost is $8400) 2. March 3 Purchased $1230 of office supplies on credit from Gabel Company, terms n/30. ..March 3 Sold merchandise on credit to Linda Witt, Invoice No. 855, for $10200 (cost is $5800) s. March 6 Borrowed $82,000 cash from Federal Bank by signing a long-term note payable. March 9 Purchased $21,850 of office equipment on credit from Spell Supply, terms net 30. - March 10 Sold merchandise on credit to Jovita Albany, Invoice No. 856, for $5600 (cost is $2900). .. March 12 Received payment from Min Cho for the March 2 sale less the discount of $336. March 13 Sent Van Industries Check No. 416 in payment of the March 1 invoice less the discount of $872. 20. March 13 Received payment from Linda Witt for the March 3 sale less the discount of $204. 12. March 14 Purchased $32,625 of merchandise from the CD Company, terms 2/10, n/30. Enter the transactions in the appropriate journals, ledger accounts and subsidiary ledger accounts: (18 points) 1. Open the following journals: sales journal, purchases journal, cash receipts journal, cash payments journal, and general ledger. 2. Open the following ledger accounts: Cash, Accounts Receivable, Inventory (March 1 Beginning Balance $10,000), Office Supplies, Store Supplies, Office Equipment, Accounts Payable, Long-term Notes Payable, Z Church Capital (March 1 Beg Balance is $10,000), Sales, Sales Discounts, Cost of Goods Sold. Problem Chapter 7 (18 points) plus 10 bonus points! Church Company completes these transactions and events during March of the current year (terms for all its credit sales are 2/10, n/30). 1. March 1 Purchased $43,600 of merchandise from Van Industries, terms 2/10, n/30. 2. March 2 Sold merchandise on credit to Min Cho, Invoice No. 854, for $16,800 (cost is $8400) 2. March 3 Purchased $1230 of office supplies on credit from Gabel Company, terms n/30. ..March 3 Sold merchandise on credit to Linda Witt, Invoice No. 855, for $10200 (cost is $5800) s. March 6 Borrowed $82,000 cash from Federal Bank by signing a long-term note payable. March 9 Purchased $21,850 of office equipment on credit from Spell Supply, terms net 30. - March 10 Sold merchandise on credit to Jovita Albany, Invoice No. 856, for $5600 (cost is $2900). .. March 12 Received payment from Min Cho for the March 2 sale less the discount of $336. March 13 Sent Van Industries Check No. 416 in payment of the March 1 invoice less the discount of $872. 20. March 13 Received payment from Linda Witt for the March 3 sale less the discount of $204. 12. March 14 Purchased $32,625 of merchandise from the CD Company, terms 2/10, n/30. Enter the transactions in the appropriate journals, ledger accounts and subsidiary ledger accounts: (18 points) 1. Open the following journals: sales journal, purchases journal, cash receipts journal, cash payments journal, and general ledger. 2. Open the following ledger accounts: Cash, Accounts Receivable, Inventory (March 1 Beginning Balance $10,000), Office Supplies, Store Supplies, Office Equipment, Accounts Payable, Long-term Notes Payable, Z Church Capital (March 1 Beg Balance is $10,000), Sales, Sales Discounts, Cost of Goods Sold