Answered step by step

Verified Expert Solution

Question

1 Approved Answer

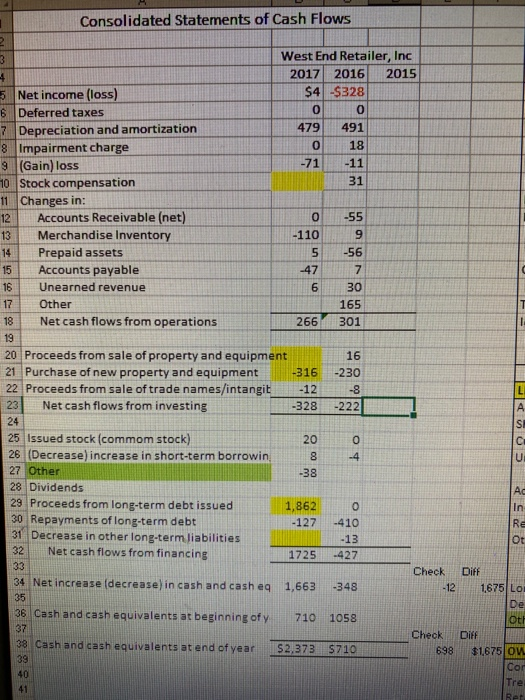

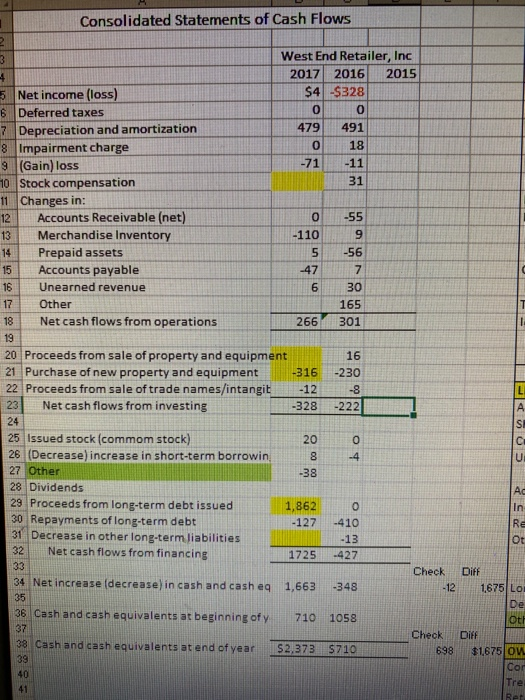

Problem: complete cash flow statement for North End Retailer using indirect method Consolidated Statements of Cash Flows West End Retailer, Inc 2017 2016 2015 $4

Problem: complete cash flow statement for North End Retailer using indirect method

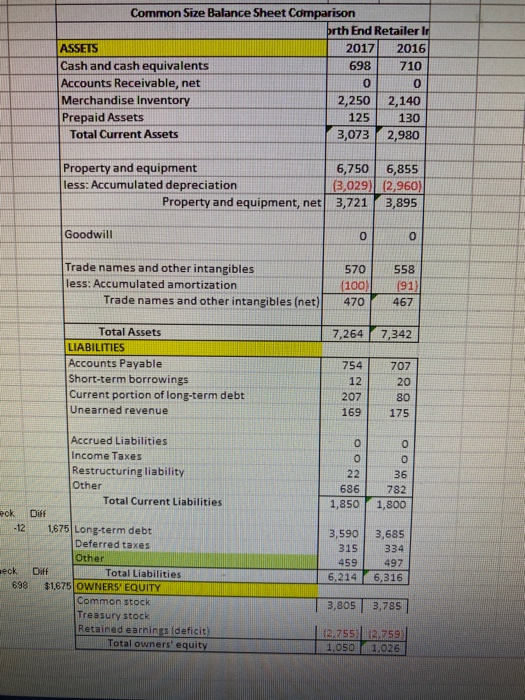

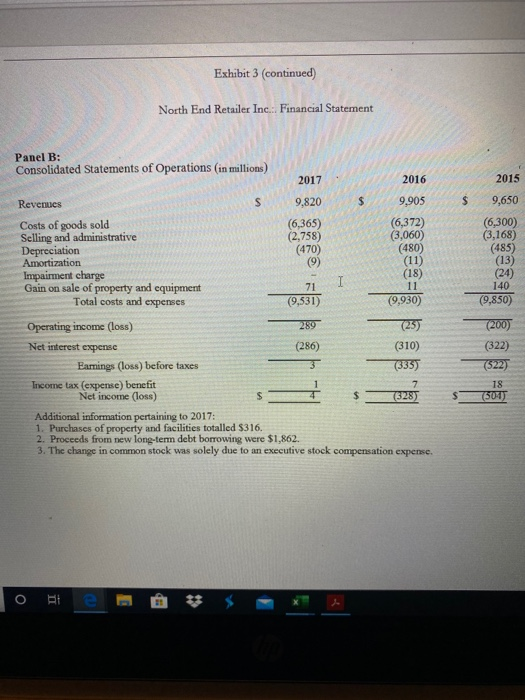

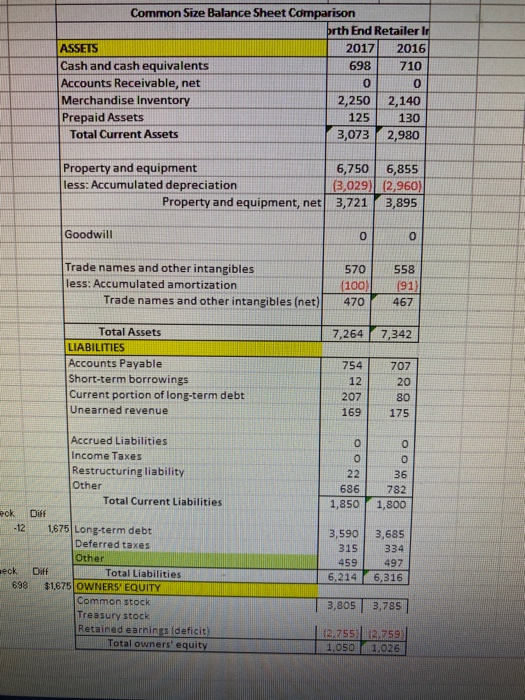

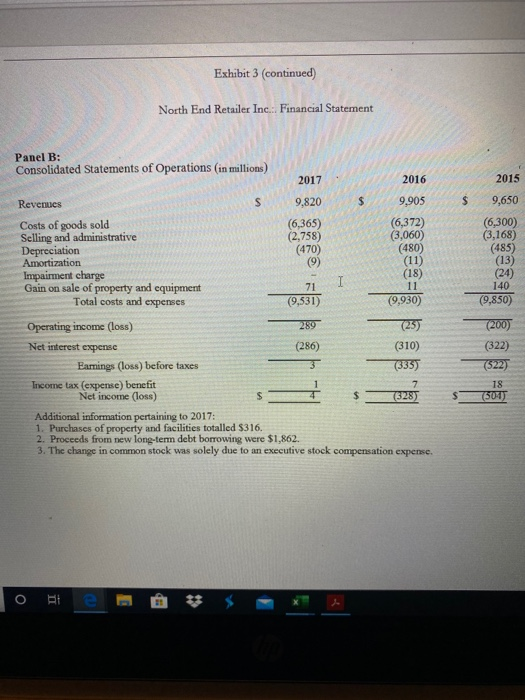

Consolidated Statements of Cash Flows West End Retailer, Inc 2017 2016 2015 $4 -$328 479 Net income (loss) Deferred taxes Depreciation and amortization Impairment charge (Gain) loss 10 Stock compensation 11 Changes in: Accounts Receivable (net) Merchandise Inventory Prepaid assets Accounts payable Unearned revenue Other 18 Net cash flows from operations 12 165 201 266 19 16 -230 20 Proceeds from sale of property and equipment ment 21 Purchase of new property and equipment -316 -316 22 Proceeds from sale of trade names/intangit -12 Net cash flows from investing -328 -222 24 25 Issued stock (commom stock) 26 (Decrease) increase in short-term borrowin 27 Other 28 Dividends 29 Proceeds from long-term debt issued 30 Repayments of long-term debt 31 Decrease in other long-term liabilities 32 Net cash flows from financing PCOS -38 1,862 -127 -410 1725 -427 34 Net increase (decrease) in cash and cash eq 1,663 Check -12 -348 Diff 1675L 36 Cash and cash equivalents at beginning of y 710 1058 38 Cash and cash equivalents at end of year 52,373 5710M L Check Diff 698 $1675 OM Common Size Balance Sheet Comparison prth End Retailer Ir ASSETS 2017 2016 Cash and cash equivalents 698 710 Accounts Receivable, net Merchandise Inventory 2,250 2,140 Prepaid Assets 125 130 Total Current Assets 3,073 2,980 Property and equipment 6,750 6,855 less: Accumulated depreciation (3,029) (2,960) Property and equipment, net 3,7213,895 Goodwill 558 Trade names and other intangibles less: Accumulated amortization Trade names and other intangibles (net) 570 (100) 470 191 467 7,2647,342 Total Assets LIABILITIES Accounts Payable Short-term borrowings Current portion of long-term debt Unearned revenue 707 782 686 1,850 1,800 Accrued Liabilities Income Taxes Restructuring liability Other Total Current Liabilities Pok Diff -12 1675 Long-term debt Deferred taxes Other eck Du Total Liabilities 698 $1675 OWNERS' EQUITY 3,590 3,685 315 334 459 497 6.2146,316 3,805 3,785 Treasury stock Retained earningsideficit) Total owners' equity 13.755 13,759 1,050 1,026 Exhibit 3 (continued) North End Retailer Inc. Financial Statement Panel B: Consolidated Statements of Operations (in millions) 2015 $ 2017 9,820 (6,365) (2,758) (470) (9) 2016 9,905 (6,372) (3,060) (480) Revenues Costs of goods sold Selling and administrative Depreciation Amortization Impairment charge Gain on sale of property and equipment Total costs and expenses (11) (6,300) (3,168) (485) (13) (24) 140 (9,850) (18) (9.531) (9,930) (233 (200) (322) (522) Operating income (loss) Net interest expense (310) Earnings (loss) before taxes (335) Income tax (expense) benefit Net income (loss) (328) Additional information pertaining to 2017: 1. Purchases of property and facilities totalled $316. 2. Proceeds from new long-term debt borrowing were $1,862. 3. The change in common stock was solely due to an executive stock compensation expense. 18 (500)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started