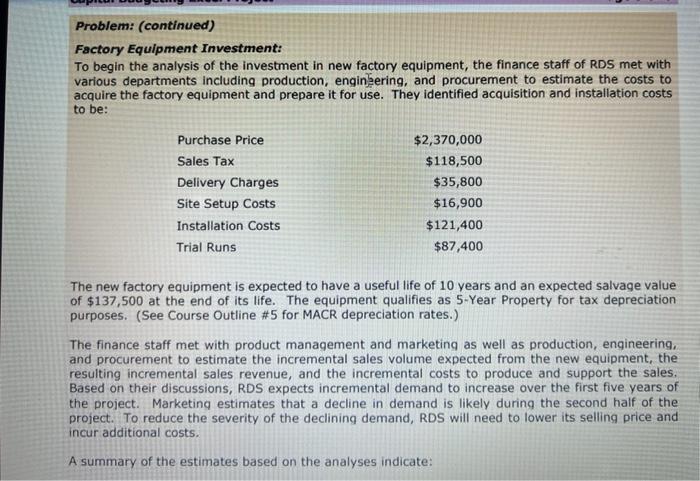

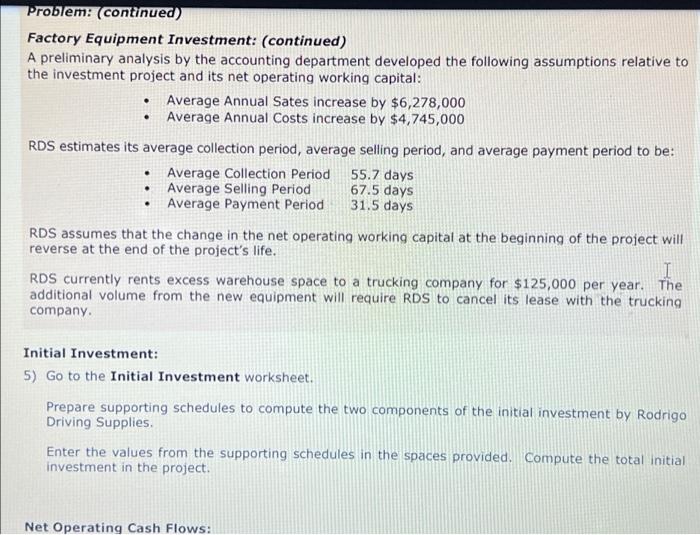

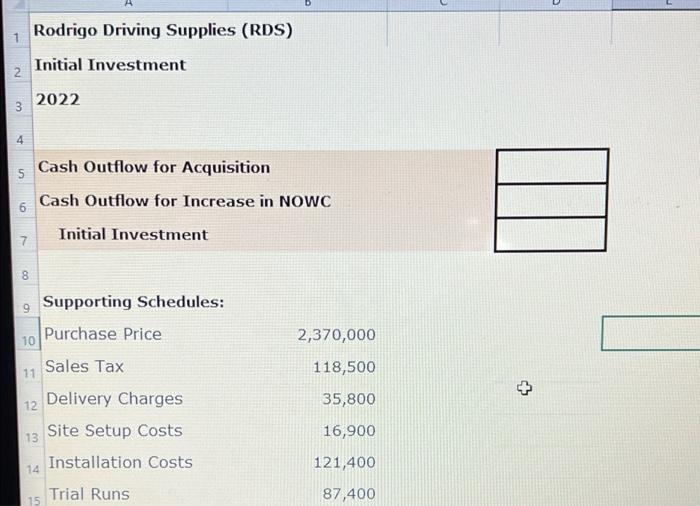

Problem: (continued) Factory Equipment Investment: To begin the analysis of the investment in new factory equipment, the finance staff of RDS met with various departments including production, engineering, and procurement to estimate the costs to acquire the factory equipment and prepare it for use. They identified acquisition and installation costs to be: Purchase Price Sales Tax Delivery Charges Site Setup Costs Installation Costs Trial Runs $2,370,000 $118,500 $35,800 $16,900 $121,400 $87,400 The new factory equipment is expected to have a useful life of 10 years and an expected salvage value of $137,500 at the end of its life. The equipment qualifies as 5-Year Property for tax depreciation purposes. (See Course Outline #5 for MACR depreciation rates.) The finance staff met with product management and marketing as well as production, engineering, and procurement to estimate the incremental sales volume expected from the new equipment, the resulting incremental sales revenue, and the incremental costs to produce and support the sales. Based on their discussions, RDS expects incremental demand to increase over the first five years of the project. Marketing estimates that a decline in demand is likely during the second half of the project. To reduce the severity of the declining demand, RDS will need to lower its selling price and incur additional costs. A summary of the estimates based on the analyses indicate: Problem: (continued) Factory Equipment Investment: (continued) A preliminary analysis by the accounting department developed the following assumptions relative to the investment project and its net operating working capital: Average Annual Sates increase by $6,278,000 Average Annual Costs increase by $4,745,000 RDS estimates its average collection period, average selling period, and average payment period to be: 55.7 days: 67.5 days 31.5 days Average Collection Period Average Selling Period Average Payment Period RDS assumes that the change in the net operating working capital at the beginning of the project will reverse at the end of the project's life. RDS currently rents excess warehouse space to a trucking company for $125,000 per year. The additional volume from the new equipment will require RDS to cancel its lease with the trucking company. Initial Investment: 5) Go to the Initial Investment worksheet. Prepare supporting schedules to compute the two components of the initial investment by Rodrigo Driving Supplies. Enter the values from the supporting schedules in the spaces provided. Compute the total initial investment in the project. Net Operating Cash Flows: 1 2 3 4 5 6 7 8 00 9 Rodrigo Driving Supplies (RDS) Initial Investment 2022 10 11 12 Cash Outflow for Acquisition Cash Outflow for Increase in NOWC Initial Investment 13 14 15 Supporting Schedules: Purchase Price Sales Tax Delivery Charges Site Setup Costs Installation Costs Trial Runs 2,370,000 118,500 35,800 16,900 121,400 87,400 + Problem: (continued) Factory Equipment Investment: To begin the analysis of the investment in new factory equipment, the finance staff of RDS met with various departments including production, engineering, and procurement to estimate the costs to acquire the factory equipment and prepare it for use. They identified acquisition and installation costs to be: Purchase Price Sales Tax Delivery Charges Site Setup Costs Installation Costs Trial Runs $2,370,000 $118,500 $35,800 $16,900 $121,400 $87,400 The new factory equipment is expected to have a useful life of 10 years and an expected salvage value of $137,500 at the end of its life. The equipment qualifies as 5-Year Property for tax depreciation purposes. (See Course Outline #5 for MACR depreciation rates.) The finance staff met with product management and marketing as well as production, engineering, and procurement to estimate the incremental sales volume expected from the new equipment, the resulting incremental sales revenue, and the incremental costs to produce and support the sales. Based on their discussions, RDS expects incremental demand to increase over the first five years of the project. Marketing estimates that a decline in demand is likely during the second half of the project. To reduce the severity of the declining demand, RDS will need to lower its selling price and incur additional costs. A summary of the estimates based on the analyses indicate: Problem: (continued) Factory Equipment Investment: (continued) A preliminary analysis by the accounting department developed the following assumptions relative to the investment project and its net operating working capital: Average Annual Sates increase by $6,278,000 Average Annual Costs increase by $4,745,000 RDS estimates its average collection period, average selling period, and average payment period to be: 55.7 days: 67.5 days 31.5 days Average Collection Period Average Selling Period Average Payment Period RDS assumes that the change in the net operating working capital at the beginning of the project will reverse at the end of the project's life. RDS currently rents excess warehouse space to a trucking company for $125,000 per year. The additional volume from the new equipment will require RDS to cancel its lease with the trucking company. Initial Investment: 5) Go to the Initial Investment worksheet. Prepare supporting schedules to compute the two components of the initial investment by Rodrigo Driving Supplies. Enter the values from the supporting schedules in the spaces provided. Compute the total initial investment in the project. Net Operating Cash Flows: 1 2 3 4 5 6 7 8 00 9 Rodrigo Driving Supplies (RDS) Initial Investment 2022 10 11 12 Cash Outflow for Acquisition Cash Outflow for Increase in NOWC Initial Investment 13 14 15 Supporting Schedules: Purchase Price Sales Tax Delivery Charges Site Setup Costs Installation Costs Trial Runs 2,370,000 118,500 35,800 16,900 121,400 87,400 +