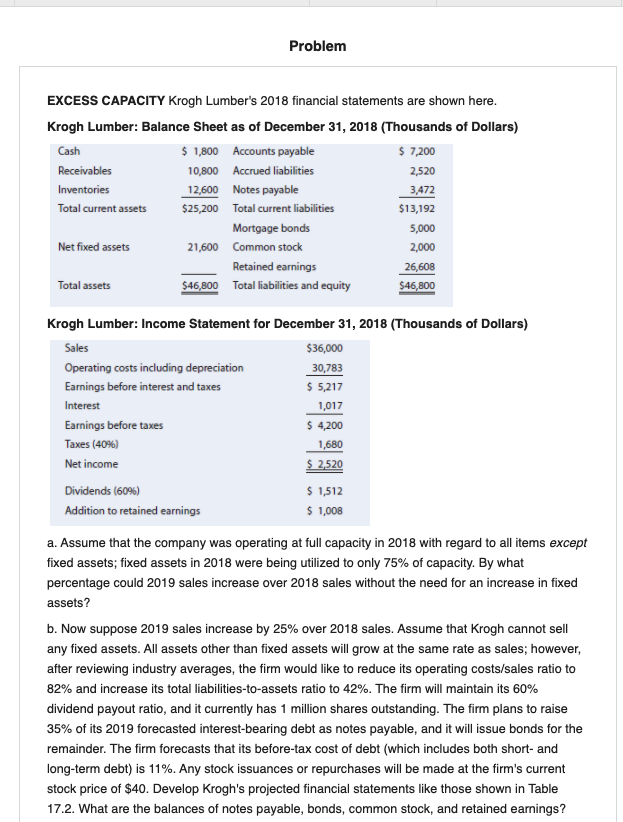

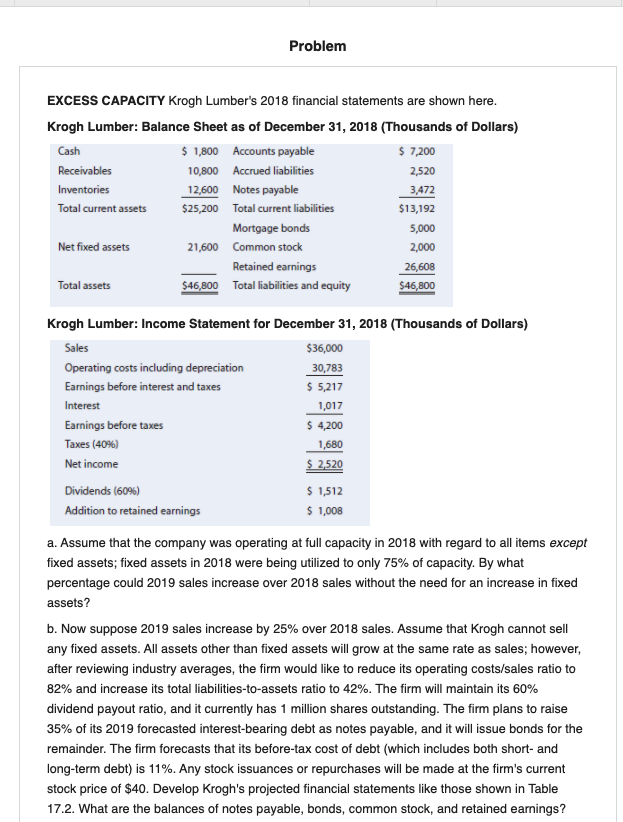

Problem EXCESS CAPACITY Krogh Lumber's 2018 financial statements are shown here. Krogh Lumber: Balance Sheet as of December 31, 2018 (Thousands of Dollars) Cash $ 1,800 Accounts payable $ 7,200 Receivables 10,800 Accrued liabilities 2,520 Inventories 12,600 Notes payable 3,472 Total current assets $25,200 Total current liabilities $13,192 Mortgage bonds 5,000 Net fixed assets 21,600 Common stock 2,000 Retained earnings 26,608 Total assets $46,800 Total liabilities and equity $46,800 Krogh Lumber: Income Statement for December 31, 2018 (Thousands of Dollars) Sales $36,000 Operating costs including depreciation 30,783 Earnings before interest and taxes $ 5,217 Interest 1,017 Earnings before taxes $ 4,200 Taxes (40%) 1,680 Net income $ 2,520 Dividends (60%) $ 1,512 Addition to retained earnings $ 1,008 a. Assume that the company was operating at full capacity in 2018 with regard to all items except fixed assets; fixed assets in 2018 were being utilized to only 75% of capacity. By what percentage could 2019 sales increase over 2018 sales without the need for an increase in fixed assets? b. Now suppose 2019 sales increase by 25% over 2018 sales. Assume that Krogh cannot sell any fixed assets. All assets other than fixed assets will grow at the same rate as sales; however, after reviewing industry averages, the firm would like to reduce its operating costs/sales ratio to 82% and increase its total liabilities-to-assets ratio to 42%. The firm will maintain its 60% dividend payout ratio, and it currently has 1 million shares outstanding. The firm plans to raise 35% of its 2019 forecasted interest-bearing debt as notes payable, and it will issue bonds for the remainder. The firm forecasts that its before-tax cost of debt (which includes both short- and long-term debt) is 11%. Any stock issuances or repurchases will be made at the firm's current stock price of $40. Develop Krogh's projected financial statements like those shown in Table 17.2. What are the balances of notes payable, bonds, common stock, and retained earnings