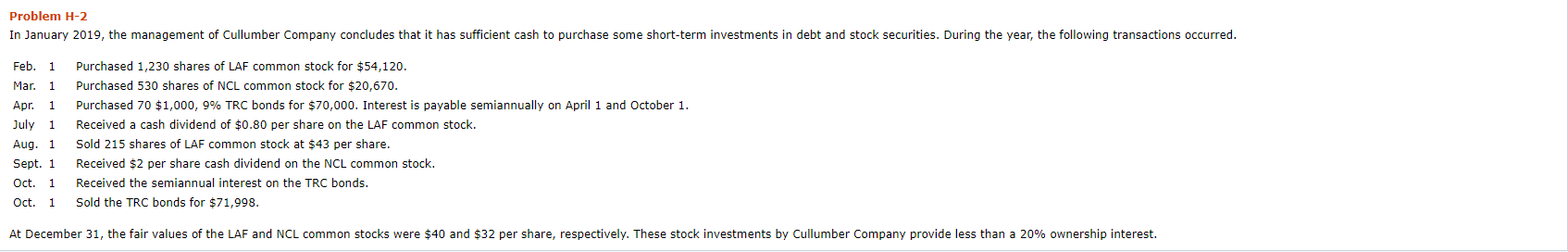

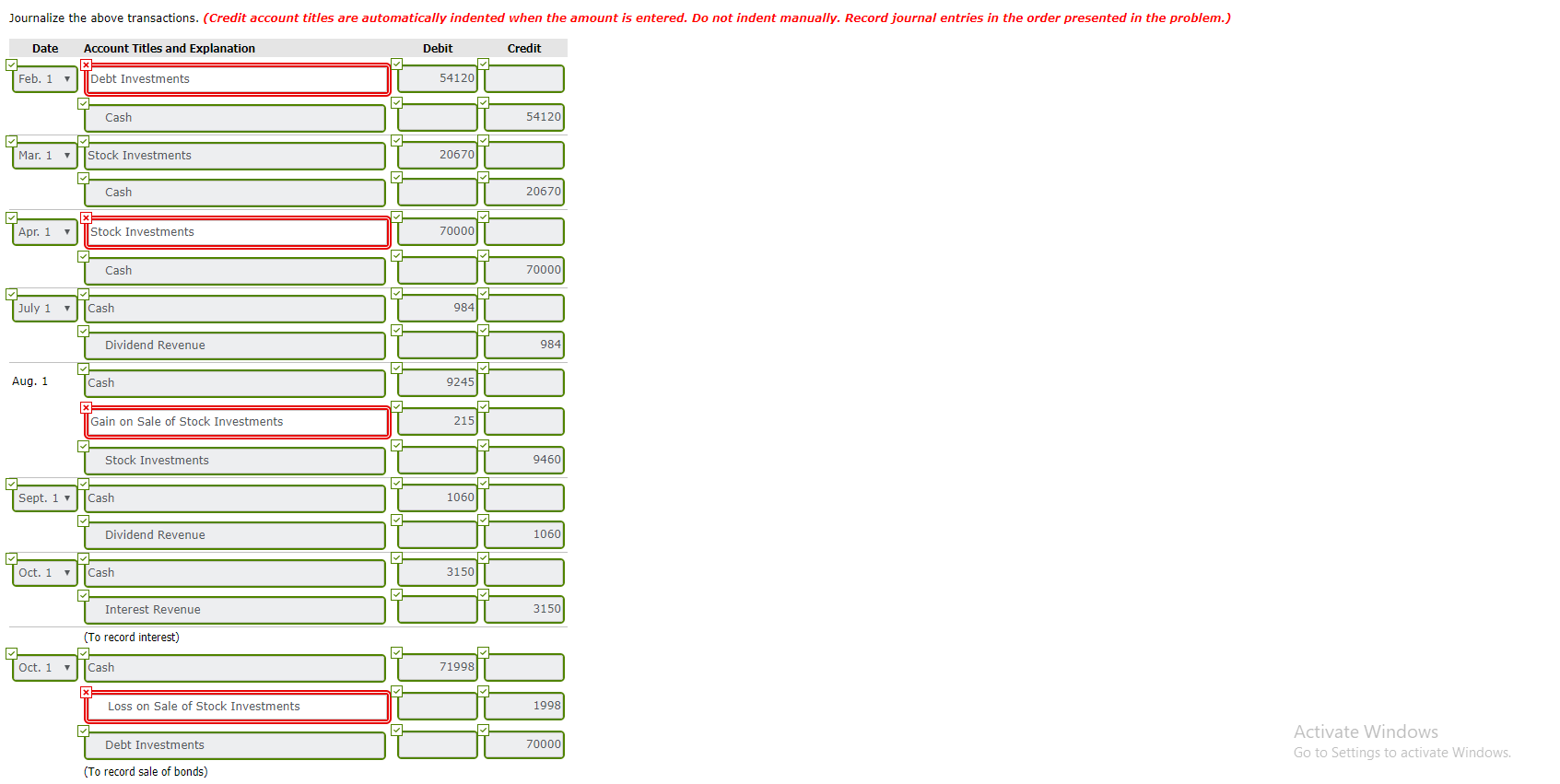

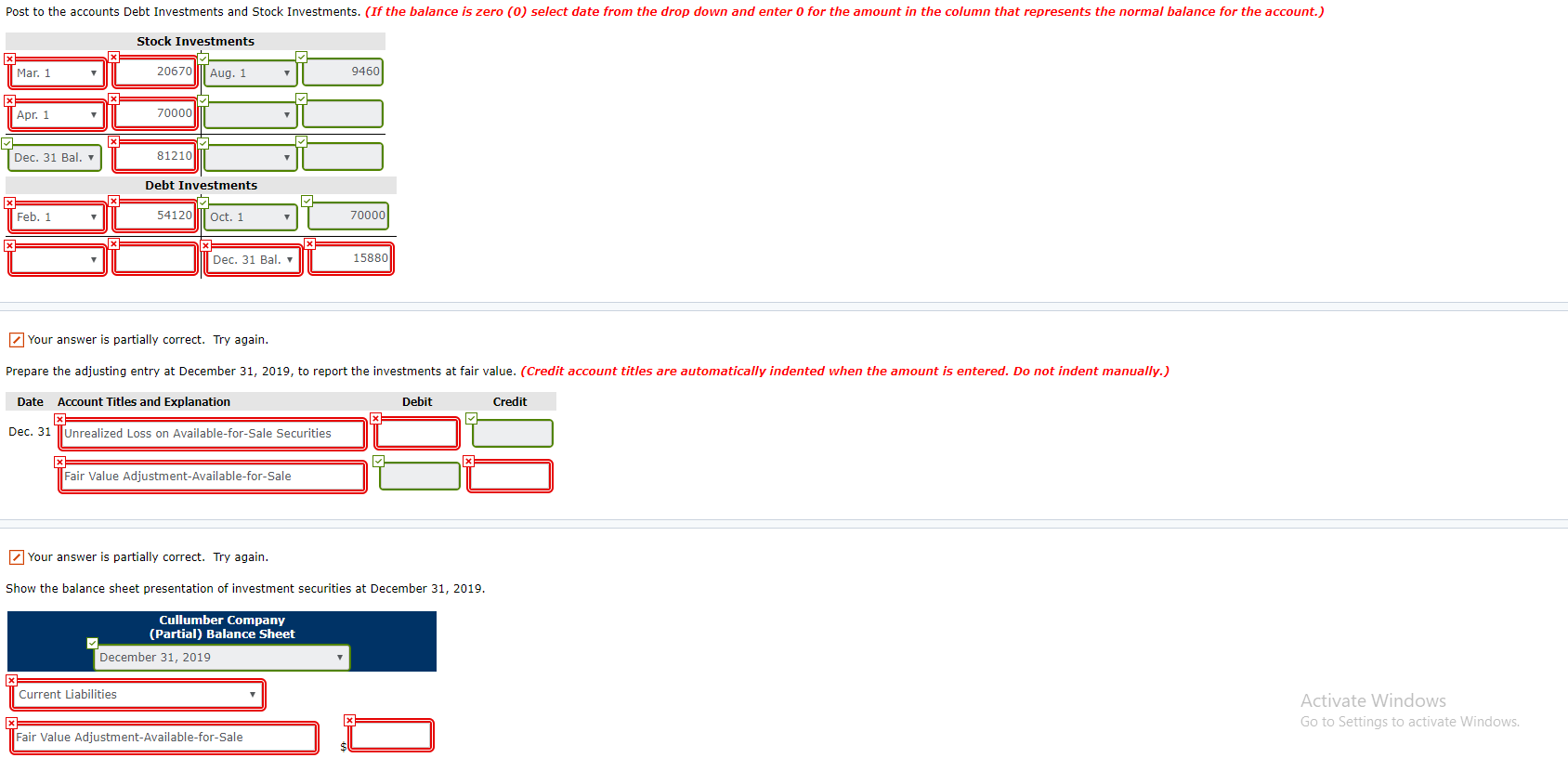

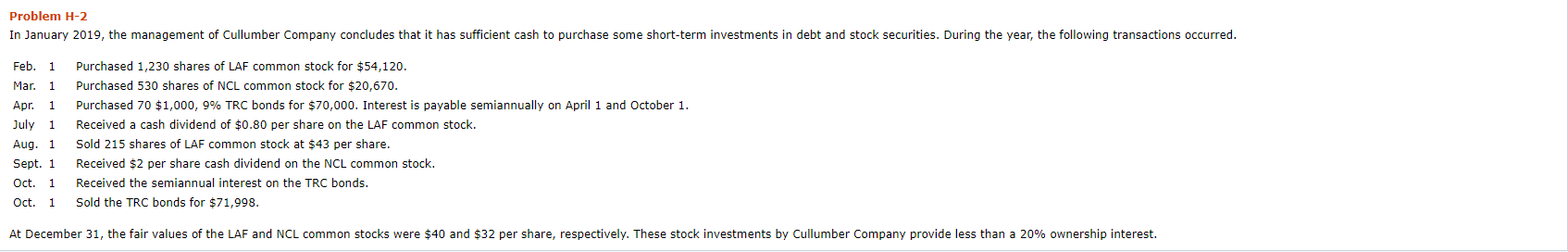

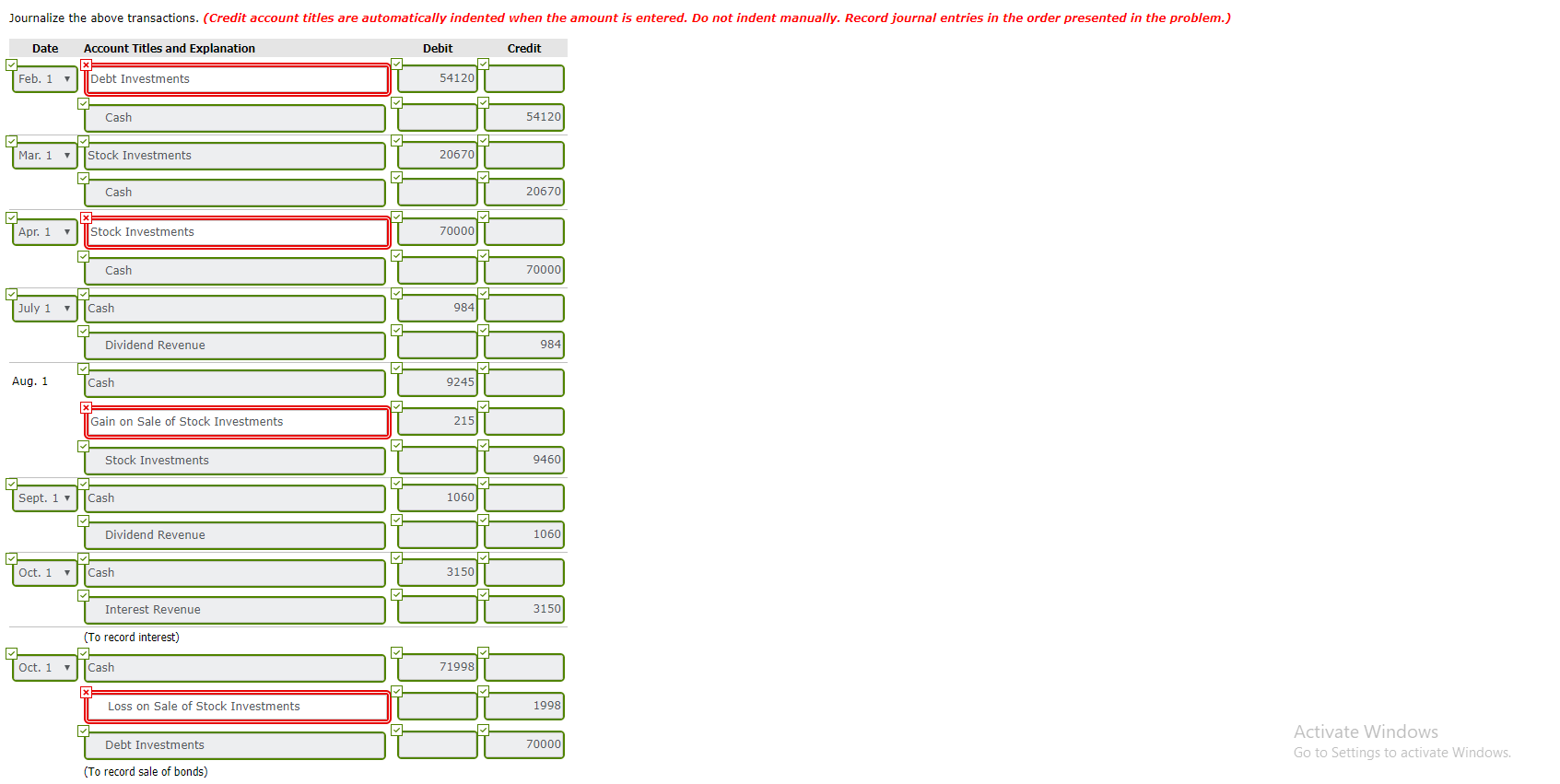

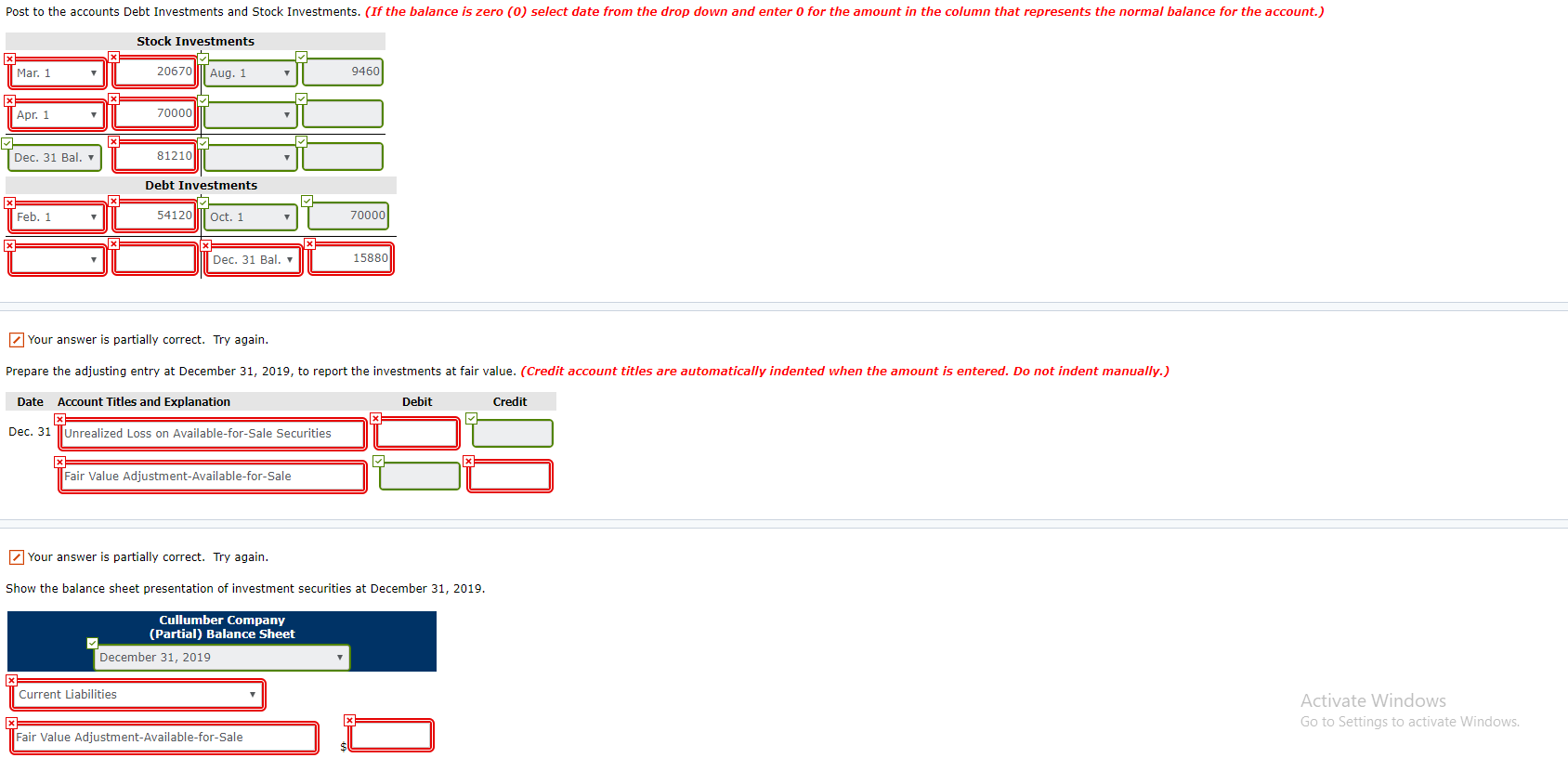

Problem H-2 In January 2019, the management of Cullumber Company concludes that it has sufficient cash to purchase some short-term investments in debt and stock securities. During the year, the following transactions occurred. Feb. 1 Mar. 1 Apr. 1 July 1 Aug. 1 Sept. 1 Oct. 1 Oct. 1 Purchased 1,230 shares of LAF common stock for $54,120. Purchased 530 shares of NCL common stock for $20,670. Purchased 70 $1,000, 9% TRC bonds for $70,000. Interest is payable semiannually on April 1 and October 1. Received a cash dividend of $0.80 per share on the LAF common stock. Sold 215 shares of LAF common stock at $43 per share. Received $2 per share cash dividend on the NCL common stock. Received the semiannual interest on the TRC bonds. Sold the TRC bonds for $71,998. At December 31, the fair values of the LAF and NCL common stocks were $40 and $32 per share, respectively. These stock investments by Cullumber Company provide less than a 20% ownership interest. Journalize the above transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit Feb. 1 Debt Investments I Cash 54120 Mar. 1 Stock Investments 20670 Cash 1 20670 Apr. 1 Stock Investments 70000 Cash 70000 July 1 Cash Dividend Revenue 984 Aug. 1 Cash Gain on Sale of Stock Investments Stock Investments 9460 Sept. 1 cash Dividend Revenue 1060 Oct. 1 Cash Interest Revenue Toct. 1 o (To record interest) cash 71998 SA T Loss on Sale of Stock Investments 1998 Debt Investments T 70000 Activate Windows Go to Settings to activate Windows. (To record sale of bonds) Post to the accounts Debt Investments and Stock Investments. (If the balance is zero (0) select date from the drop down and enter o for the amount in the column that represents the normal balance for the account.) Stock Investments T Mar. 1 T 20670 |||| Aug. 1 9460 "Apr. 1 T 70000 Dec. 31 Bal. 81210 Debt Investments Feb. 54120|| Oct. 1 70000 Dec. 31 Bal. i 15880 15880 Your answer is partially correct. Try again. Prepare the adjusting entry at December 31, 2019, to report the investments at fair value. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Dec. 31 Unrealized Loss on Available-for-Sale Securities JU Fair Value Adjustment-Available-for-Sale Your answer is partially correct. Try again. Show the balance sheet presentation of investment securities at December 31, 2019. Cullumber Company (Partial) Balance Sheet December 31, 2019 Current Liabilities Activate Windows Go to Settings to activate Windows. Fair Value Adjustment-Available-for-Sale