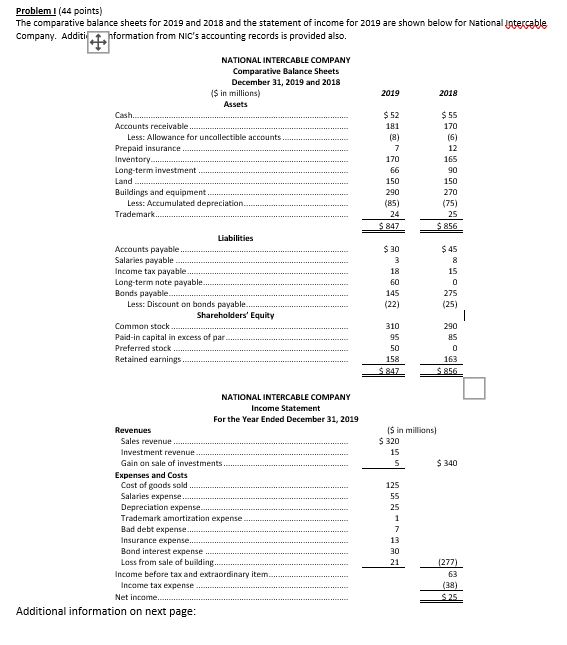

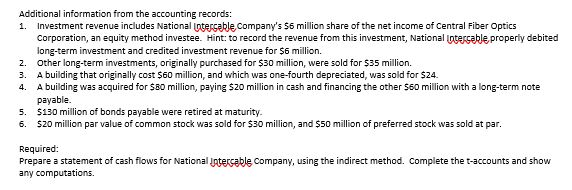

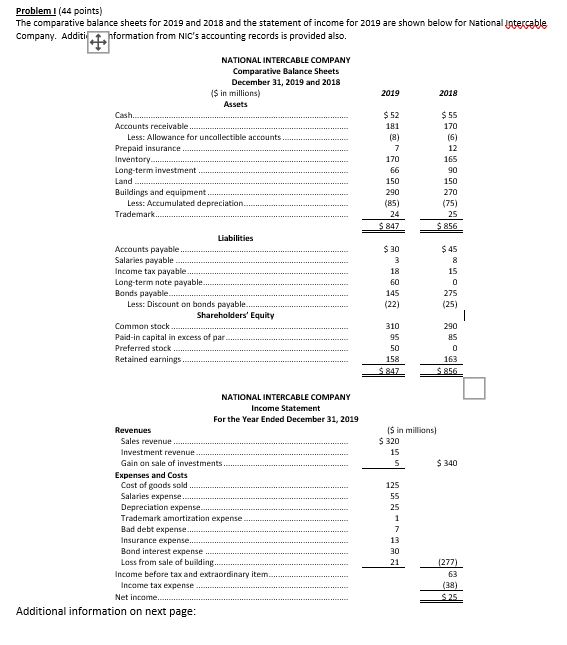

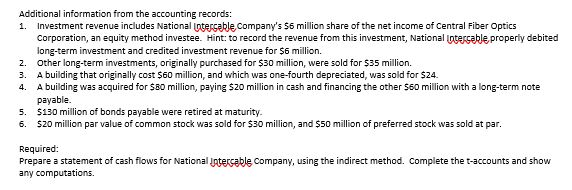

Problem I (44 points) The comparative balance sheets for 2019 and 2018 and the statement of income for 2019 are shown below for National Jatercable Company. Additi n formation from NIC's accounting records is provided also. 2019 2018 $55 170 NATIONAL INTERCABLE COMPANY Comparative Balance Sheets December 31, 2019 and 2018 ($ in millions) Assets Cash.... Accounts receivable.... Less: Allowance for uncollectible accounts. Prepaid insurance ........ Inventory............ Long-term investment ........ Land ......... Buildings and equipment................ Less: Accumulated depreciation...... Trademark.... 181 (a) 170 165 66 150 150 270 290 (85) (75) 847 $ 856 $ 30 $ 45 0 Liabilities Accounts payable................... Salaries payable ....... Income tax payable...... Long-term nate payable..... Bands payable......... Less: Discount on bonds payable....... Shareholders' Equity Common stack..... Paid-in capital in excess of par.................. Preferred stock ........ Retained earnings. 18 60 145 (22) 275 (25) 310 290 95 158 $ 847 163 S 856 IS in millions $ 320 15 $ 340 125 55 NATIONAL INTERCABLE COMPANY Income Statement For the Year Ended December 31, 2019 Revenues Sales revenue.................................. ........ Investment revenue......... Gain on sale of investments... Expenses and Costs Cast of goods sold ............ Salaries expense... .. Depreciation expense....... Trademark amortization expense.... Bad debt expense... .. Insurance expense......... Band interest expense. Lass from sale of building..... Income before tax and extraordinary item. Income tax expense.... Net income......... Additional information on next page: Additional information from the accounting records: 1. Investment revenue includes National intercable company's $5 million share of the net income of Central Fiber Optics Corporation, an equity method investee. Hint: to record the revenue from this investment, National Intercable properly debited long-term investment and credited investment revenue for $6 million. 2. Other long-term investments, originally purchased for $30 million, were sold for $35 million. 3. A building that originally cost $60 million, and which was one-fourth depreciated, was sold for $24. 4. A building was acquired for $80 million, paying $20 million in cash and financing the other $60 million with a long-term note payable. 5. $130 million of bonds payable were retired at maturity. 6. $20 million par value of common stock was sold for $30 million, and $50 million of preferred stock was sold at par. Required: Prepare a statement of cash flows for National Intercable Company, using the indirect method. Complete the t-accounts and show any computations. Problem I (44 points) The comparative balance sheets for 2019 and 2018 and the statement of income for 2019 are shown below for National Jatercable Company. Additi n formation from NIC's accounting records is provided also. 2019 2018 $55 170 NATIONAL INTERCABLE COMPANY Comparative Balance Sheets December 31, 2019 and 2018 ($ in millions) Assets Cash.... Accounts receivable.... Less: Allowance for uncollectible accounts. Prepaid insurance ........ Inventory............ Long-term investment ........ Land ......... Buildings and equipment................ Less: Accumulated depreciation...... Trademark.... 181 (a) 170 165 66 150 150 270 290 (85) (75) 847 $ 856 $ 30 $ 45 0 Liabilities Accounts payable................... Salaries payable ....... Income tax payable...... Long-term nate payable..... Bands payable......... Less: Discount on bonds payable....... Shareholders' Equity Common stack..... Paid-in capital in excess of par.................. Preferred stock ........ Retained earnings. 18 60 145 (22) 275 (25) 310 290 95 158 $ 847 163 S 856 IS in millions $ 320 15 $ 340 125 55 NATIONAL INTERCABLE COMPANY Income Statement For the Year Ended December 31, 2019 Revenues Sales revenue.................................. ........ Investment revenue......... Gain on sale of investments... Expenses and Costs Cast of goods sold ............ Salaries expense... .. Depreciation expense....... Trademark amortization expense.... Bad debt expense... .. Insurance expense......... Band interest expense. Lass from sale of building..... Income before tax and extraordinary item. Income tax expense.... Net income......... Additional information on next page: Additional information from the accounting records: 1. Investment revenue includes National intercable company's $5 million share of the net income of Central Fiber Optics Corporation, an equity method investee. Hint: to record the revenue from this investment, National Intercable properly debited long-term investment and credited investment revenue for $6 million. 2. Other long-term investments, originally purchased for $30 million, were sold for $35 million. 3. A building that originally cost $60 million, and which was one-fourth depreciated, was sold for $24. 4. A building was acquired for $80 million, paying $20 million in cash and financing the other $60 million with a long-term note payable. 5. $130 million of bonds payable were retired at maturity. 6. $20 million par value of common stock was sold for $30 million, and $50 million of preferred stock was sold at par. Required: Prepare a statement of cash flows for National Intercable Company, using the indirect method. Complete the t-accounts and show any computations