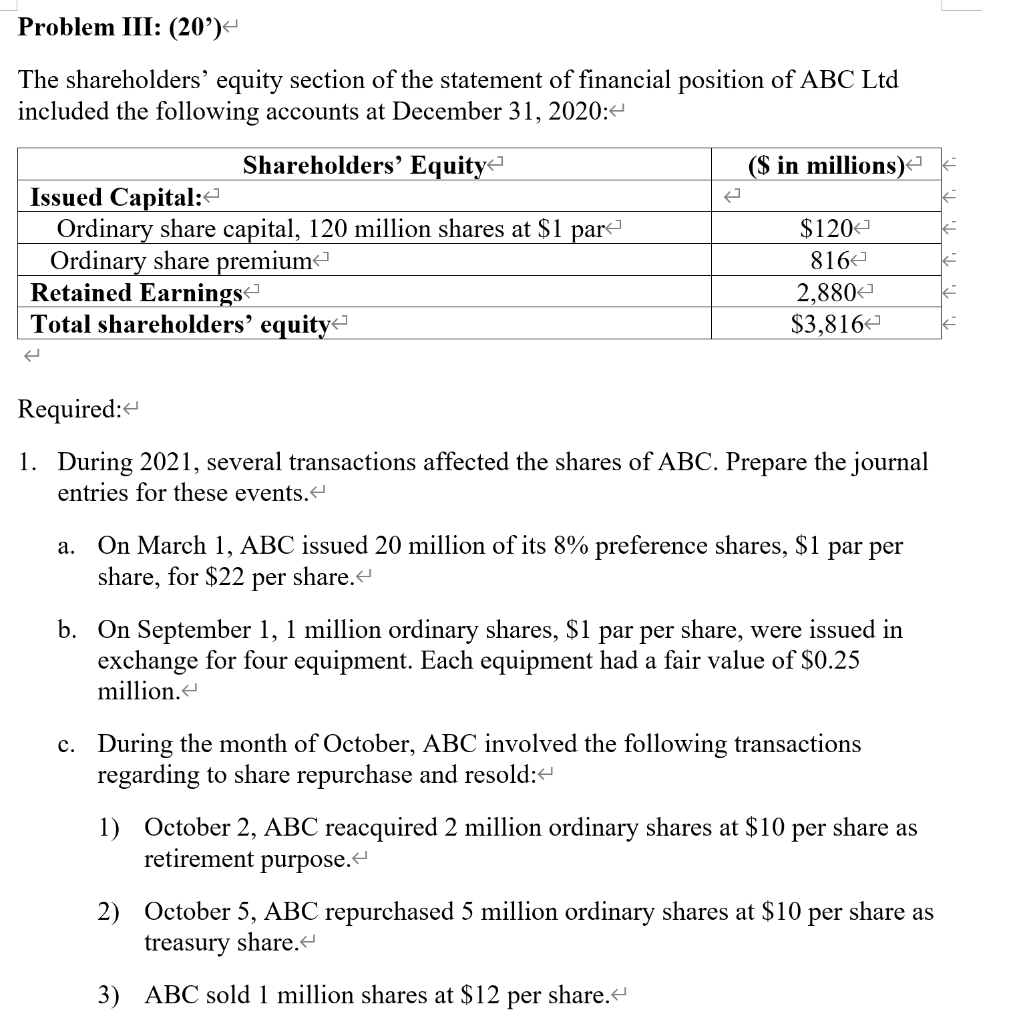

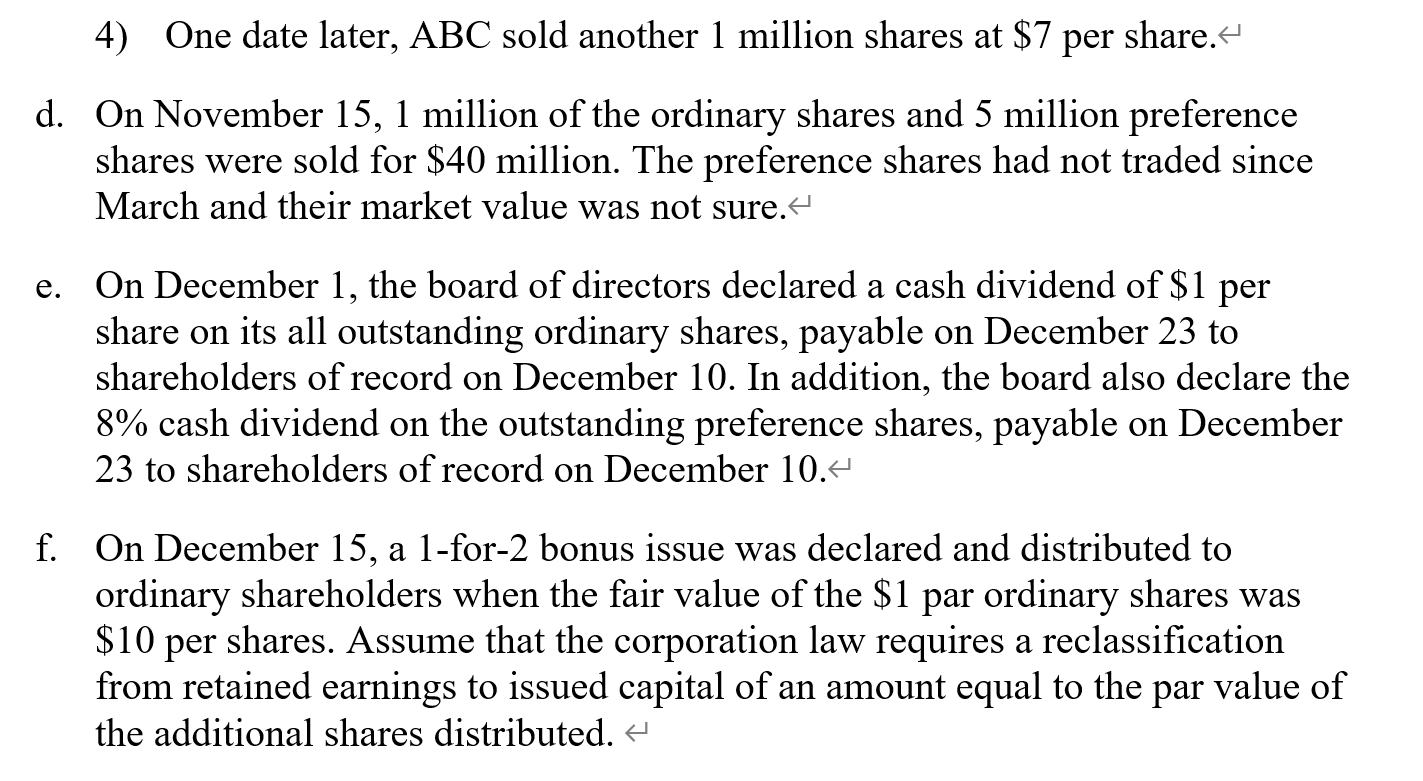

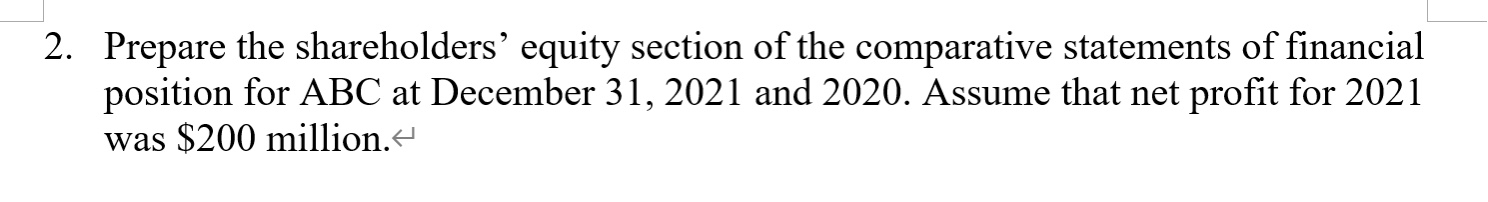

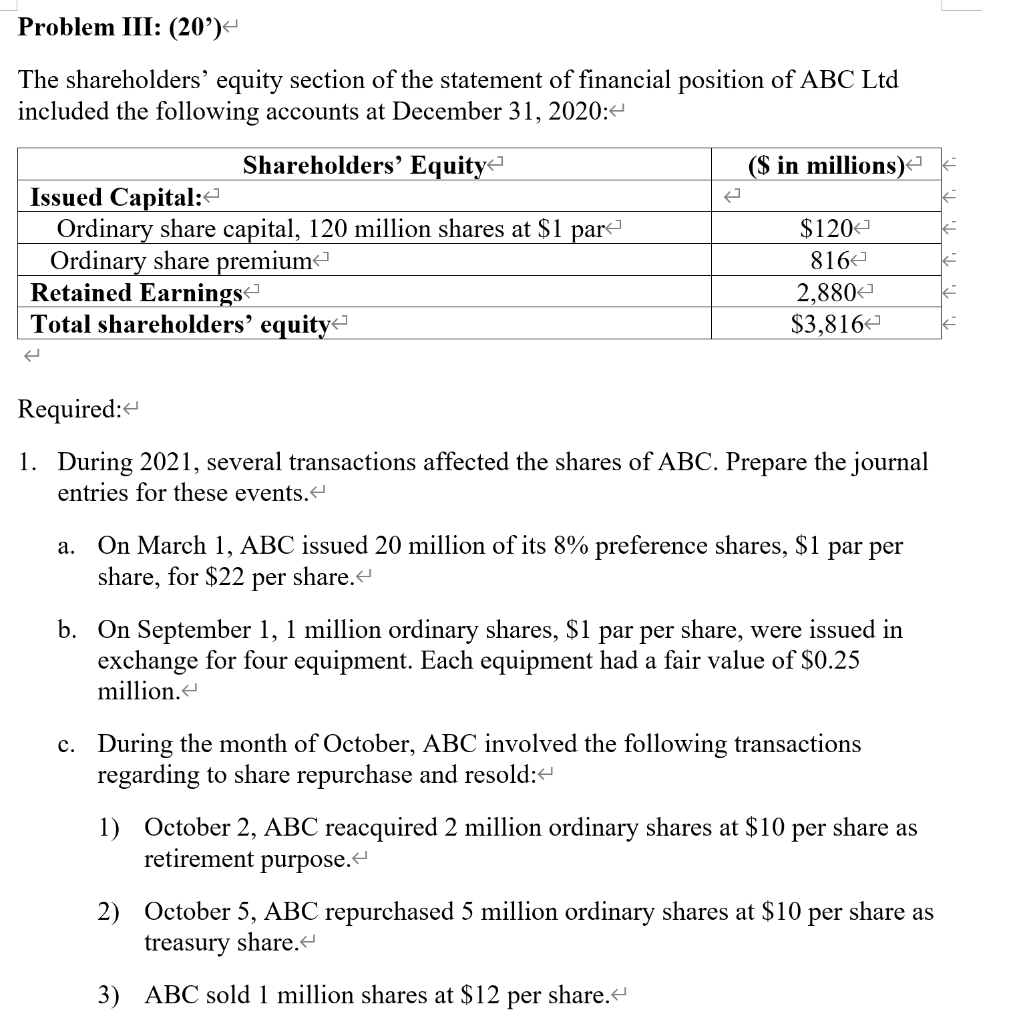

Problem III: (20%) The shareholders' equity section of the statement of financial position of ABC Ltd included the following accounts at December 31, 2020: ($ in millions) ke K Shareholders' Equity Issued Capital: Ordinary share capital, 120 million shares at $1 par Ordinary share premium Retained Earnings Total shareholders' equity ki $120 816 2,880 $3,8162 Required: 1. During 2021, several transactions affected the shares of ABC. Prepare the journal entries for these events. a. On March 1, ABC issued 20 million of its 8% preference shares, $1 par per share, for $22 per share. b. On September 1, 1 million ordinary shares, $1 par per share, were issued in exchange for four equipment. Each equipment had a fair value of $0.25 million. c. During the month of October, ABC involved the following transactions regarding to share repurchase and resold:- 1) October 2, ABC reacquired 2 million ordinary shares at $10 per share as retirement purpose. 2) October 5, ABC repurchased 5 million ordinary shares at $10 per share as treasury share. 3) ABC sold 1 million shares at $12 per share. 4) One date later, ABC sold another 1 million shares at $7 per share. d. On November 15, 1 million of the ordinary shares and 5 million preference shares were sold for $40 million. The preference shares had not traded since March and their market value was not sure. e. On December 1, the board of directors declared a cash dividend of $1 per share on its all outstanding ordinary shares, payable on December 23 to shareholders of record on December 10. In addition, the board also declare the 8% cash dividend on the outstanding preference shares, payable on December 23 to shareholders of record on December 10.4 f. On December 15, a 1-for-2 bonus issue was declared and distributed to ordinary shareholders when the fair value of the $1 par ordinary shares was $10 per shares. Assume that the corporation law requires a reclassification from retained earnings to issued capital of an amount equal to the par value of the additional shares distributed. 4 2. Prepare the shareholders' equity section of the comparative statements of financial position for ABC at December 31, 2021 and 2020. Assume that net profit for 2021 was $200 million. Problem III: (20%) The shareholders' equity section of the statement of financial position of ABC Ltd included the following accounts at December 31, 2020: ($ in millions) ke K Shareholders' Equity Issued Capital: Ordinary share capital, 120 million shares at $1 par Ordinary share premium Retained Earnings Total shareholders' equity ki $120 816 2,880 $3,8162 Required: 1. During 2021, several transactions affected the shares of ABC. Prepare the journal entries for these events. a. On March 1, ABC issued 20 million of its 8% preference shares, $1 par per share, for $22 per share. b. On September 1, 1 million ordinary shares, $1 par per share, were issued in exchange for four equipment. Each equipment had a fair value of $0.25 million. c. During the month of October, ABC involved the following transactions regarding to share repurchase and resold:- 1) October 2, ABC reacquired 2 million ordinary shares at $10 per share as retirement purpose. 2) October 5, ABC repurchased 5 million ordinary shares at $10 per share as treasury share. 3) ABC sold 1 million shares at $12 per share. 4) One date later, ABC sold another 1 million shares at $7 per share. d. On November 15, 1 million of the ordinary shares and 5 million preference shares were sold for $40 million. The preference shares had not traded since March and their market value was not sure. e. On December 1, the board of directors declared a cash dividend of $1 per share on its all outstanding ordinary shares, payable on December 23 to shareholders of record on December 10. In addition, the board also declare the 8% cash dividend on the outstanding preference shares, payable on December 23 to shareholders of record on December 10.4 f. On December 15, a 1-for-2 bonus issue was declared and distributed to ordinary shareholders when the fair value of the $1 par ordinary shares was $10 per shares. Assume that the corporation law requires a reclassification from retained earnings to issued capital of an amount equal to the par value of the additional shares distributed. 4 2. Prepare the shareholders' equity section of the comparative statements of financial position for ABC at December 31, 2021 and 2020. Assume that net profit for 2021 was $200 million