Answered step by step

Verified Expert Solution

Question

1 Approved Answer

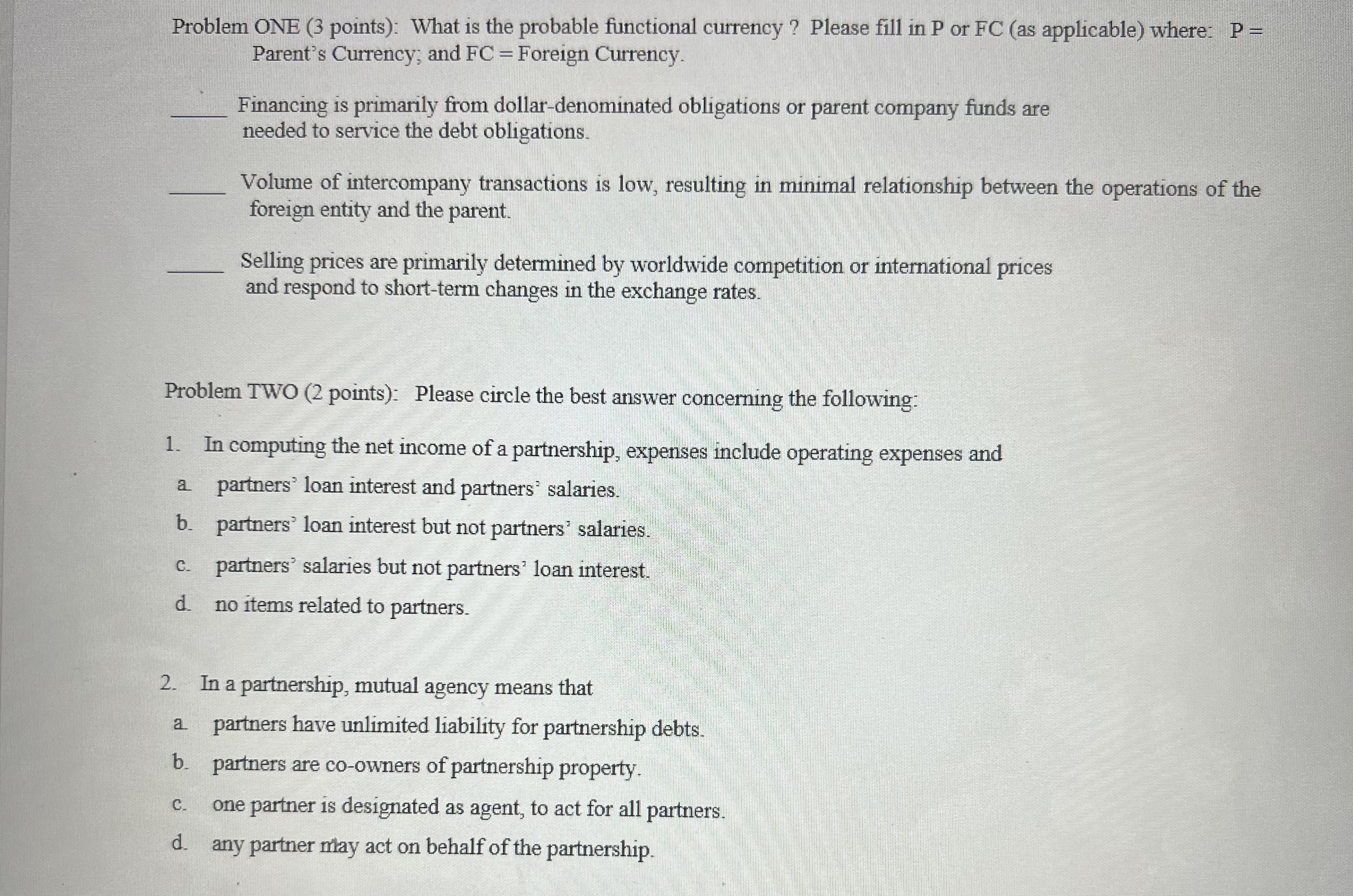

Problem ONE (3 points): What is the probable functional currency? Please fill in P or FC (as applicable) where: P = Parent's Currency; and

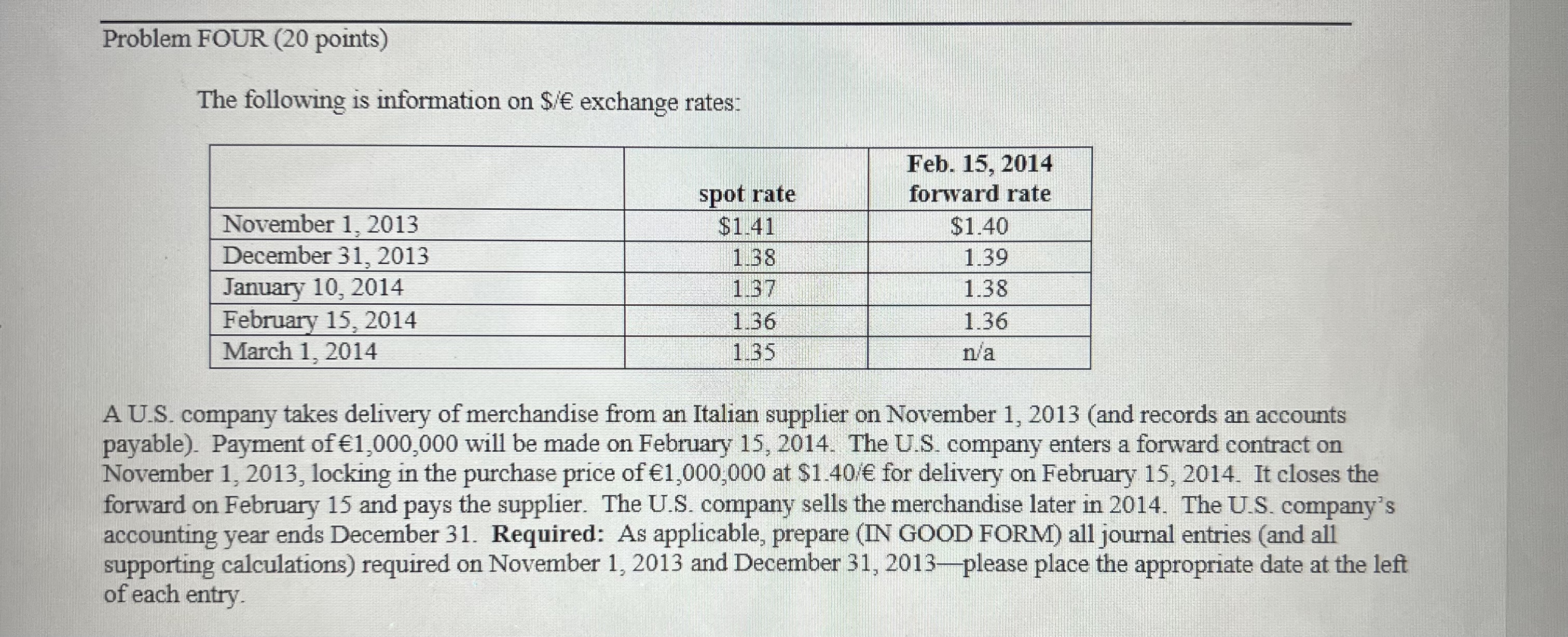

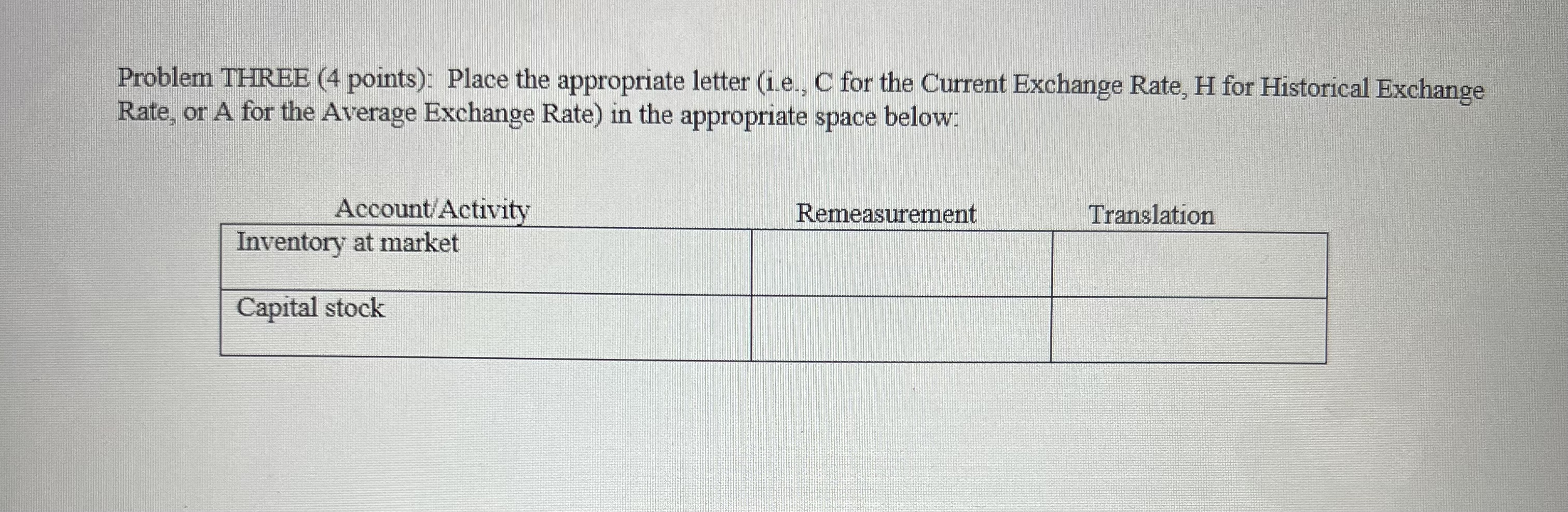

Problem ONE (3 points): What is the probable functional currency? Please fill in P or FC (as applicable) where: P = Parent's Currency; and FC = Foreign Currency. a Problem TWO (2 points): Please circle the best answer concerning the following: 1. In computing the net income of a partnership, expenses include operating expenses and partners' loan interest and partners salaries. b. partners' loan interest but not partners' salaries. C. partners' salaries but not partners' loan interest. d no items related to partners. 2. Financing is primarily from dollar-denominated obligations or parent company funds are needed to service the debt obligations. C. Volume of intercompany transactions is low, resulting in minimal relationship between the operations of the foreign entity and the parent. d. Selling prices are primarily determined by worldwide competition or international prices and respond to short-term changes in the exchange rates. In a partnership, mutual agency means that partners have unlimited liability for partnership debts. b. partners are co-owners of partnership property. one partner is designated as agent, to act for all partners. any partner may act on behalf of the partnership. EXAMPER Problem FOUR (20 points) The following is information on $/ exchange rates: November 1, 2013 December 31, 2013 January 10, 2014 February 15, 2014 March 1, 2014 spot rate $1.41 1.38 1.37 1.36 1.35 Feb. 15, 2014 forward rate $1.40 1.39 1.38 1.36 n/a A U.S. company takes delivery of merchandise from an Italian supplier on November 1, 2013 (and records an accounts payable). Payment of 1,000,000 will be made on February 15, 2014. The U.S. company enters a forward contract on November 1, 2013, locking in the purchase price of 1,000,000 at $1.40/ for delivery on February 15, 2014. It closes the forward on February 15 and pays the supplier. The U.S. company sells the merchandise later in 2014. The U.S. company's accounting year ends December 31. Required: As applicable, prepare (IN GOOD FORM) all journal entries (and all supporting calculations) required on November 1, 2013 and December 31, 2013-please place the appropriate date at the left of each entry. Problem THREE (4 points): Place the appropriate letter (i.e., C for the Current Exchange Rate, H for Historical Exchange Rate, or A for the Average Exchange Rate) in the appropriate space below: Account/Activity Inventory at market Capital stock Remeasurement Translation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Problem ONE The probable functional currency is FC Foreign Currency Explanation Financing is primari...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started