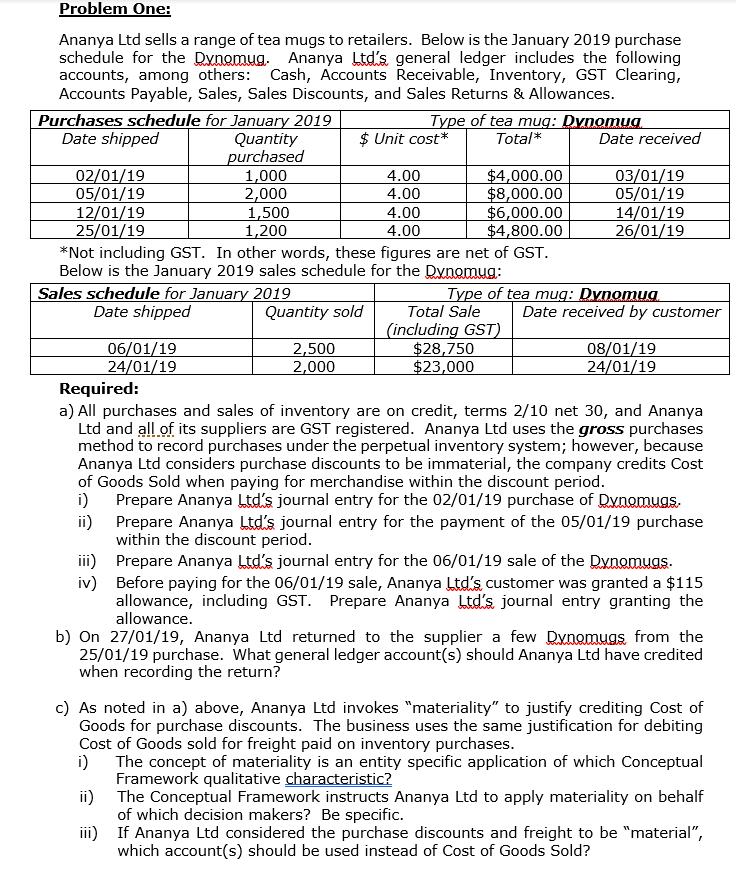

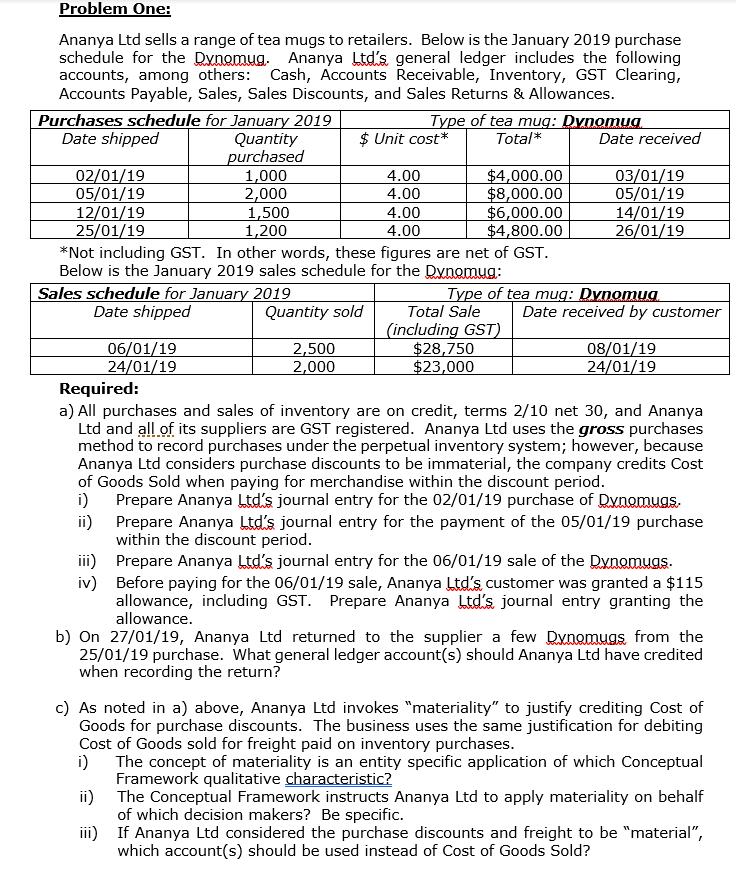

Problem One: Ananya Ltd sells a range of tea mugs to retailers. Below is the January 2019 purchase schedule for the Dyngmug. Ananya Ltd's general ledger includes the following accounts, among others: Cash, Accounts Receivable, Inventory, GST Clearing, Accounts Payable, Sales, Sales Discounts, and Sales Returns & Allowances. Purchases schedule for January 2019 Type of tea mug: Dvnomug. Date shipped Quantity $ Unit cost* Total* Date received purchased 02/01/19 1,000 4.00 $4,000.00 03/01/19 05/01/19 2,000 4.00 $8,000.00 05/01/19 12/01/19 1,500 4.00 $6,000.00 14/01/19 25/01/19 1,200 4.00 $4,800.00 26/01/19 *Not including GST. In other words, these figures are net of GST. Below is the January 2019 sales schedule for the Dynomug: Sales schedule for January 2019 Type of tea mug: Dvnomug Date shipped Quantity sold Total Sale Date received by customer (including GST) 06/01/19 2,500 $28,750 08/01/19 24/01/19 2,000 $23,000 24/01/19 Required: a) All purchases and sales of inventory are on credit, terms 2/10 net 30, and Ananya Ltd and all of its suppliers are GST registered. Ananya Ltd uses the gross purchases method to record purchases under the perpetual inventory system; however, because Ananya Ltd considers purchase discounts to be immaterial, the company credits Cost of Goods Sold when paying for merchandise within the discount period. i) Prepare Ananya Ltd's journal entry for the 02/01/19 purchase of Dyngmugs. ii) Prepare Ananya Ltd's journal entry for the payment of the 05/01/19 purchase within the discount period. iii) Prepare Ananya Ltd's journal entry for the 06/01/19 sale of the Dynamugs. iv) Before paying for the 06/01/19 sale, Ananya Ltd's customer was granted a $115 allowance, including GST. Prepare Ananya Ltd's journal entry granting the allowance. b) On 27/01/19, Ananya Ltd returned to the supplier a few Dyngmugs from the 25/01/19 purchase. What general ledger account(s) should Ananya Ltd have credited when recording the return? c) As noted in a) above, Ananya Ltd invokes "materiality" to justify crediting Cost of Goods for purchase discounts. The business uses the same justification for debiting Cost of Goods sold for freight paid on inventory purchases. i) The concept of materiality is an entity specific application of which conceptual Framework qualitative characteristic? ii) The Conceptual Framework instructs Ananya Ltd to apply materiality on behalf of which decision makers? Be specific. iii) If Ananya Ltd considered the purchase discounts and freight to be "material", which account(s) should be used instead of Cost of Goods Sold