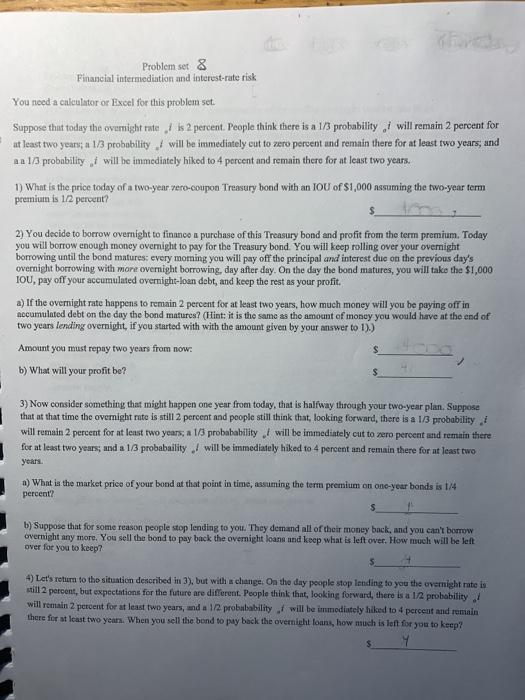

Problem set 8 Financial intermediation and interest-rate risk You need a calculator or Excel for this problem set. Suppose that today the overnight rate / ks 2 percent. People think there is a 1/3 probability will remain 2 percent for at least two years; a 1/3 probability will be immediately cut to zero percent and remain there for at least two years, and 2 a 13 probability , I will be immedintely hiked to 4 percent and remain there for at least two years. 1) What is the price today of a two-year vero-coupon Treasury bond with an JOU of $1,000 assuming the two-year term premium is 12 percent? 2) You decide to borrow overnight to financo a purchase of this Treasury bond and profit from the term premium. Today you will borrow enough money overight to pay for the Treasury bond You will keep rolling over your overnight borrowing until the bond matures: every moming you will pay off the principal and interest due on the previous day's overnight borrowing with more overnight borrowing, day after day. On the day the bond matures, you will take the $1,000 TOU, pay off your accumulated overnight-loan debt, and keep the rest as your profit. a) If the overnight rate happens to remain 2 percent for at least two years, how much money will you be paying off in accumulated debt on the day the bond matures? (Hint: it is the same as the amount of money you would have at the end of two years lending overnight, if you started with with the amount given by your answer to 1).) Amount you must reply two years from now. b) What will your profit be? 3) Now consider something that might happen one year from today, that is halfway through your two-year plan. Suppose that at that time the overnight rate is still 2 percent and people still think that, looking forward, there is a 13 probability will remain 2 percent for at least two years, a 1/3 probabability will be immediately cut to vero percent and remain there for at least two years; and a 13 probability will be immediately hiked to 4 percent and remain there for at least two years 1) What is the market price of your bond at that point in time, assuming the term premium on one-year bonds is 144 percent? b) Suppose that for some reason people stop lending to you. They demand all of their money back, and you can't borrow overnight any more. You sell the bond to pay back the overnight loans and keep what is left over. How much will be left over for you to keep? 4) Let's return to the situation described in 3), but with a change. On the day people stop lending to you the overnight rate is still 2 percent, but expectations for the future are different. People think that, looking forward, there is a 12 probability will remain 2 percent for at least two years, and a 1/2 probalability will be immediately hiked to 4 percent and remain there for at least two years. When you sell the bond to pay back the overnicht loans, how much is left for you to keep? $ Y Problem set 8 Financial intermediation and interest-rate risk You need a calculator or Excel for this problem set. Suppose that today the overnight rate / ks 2 percent. People think there is a 1/3 probability will remain 2 percent for at least two years; a 1/3 probability will be immediately cut to zero percent and remain there for at least two years, and 2 a 13 probability , I will be immedintely hiked to 4 percent and remain there for at least two years. 1) What is the price today of a two-year vero-coupon Treasury bond with an JOU of $1,000 assuming the two-year term premium is 12 percent? 2) You decide to borrow overnight to financo a purchase of this Treasury bond and profit from the term premium. Today you will borrow enough money overight to pay for the Treasury bond You will keep rolling over your overnight borrowing until the bond matures: every moming you will pay off the principal and interest due on the previous day's overnight borrowing with more overnight borrowing, day after day. On the day the bond matures, you will take the $1,000 TOU, pay off your accumulated overnight-loan debt, and keep the rest as your profit. a) If the overnight rate happens to remain 2 percent for at least two years, how much money will you be paying off in accumulated debt on the day the bond matures? (Hint: it is the same as the amount of money you would have at the end of two years lending overnight, if you started with with the amount given by your answer to 1).) Amount you must reply two years from now. b) What will your profit be? 3) Now consider something that might happen one year from today, that is halfway through your two-year plan. Suppose that at that time the overnight rate is still 2 percent and people still think that, looking forward, there is a 13 probability will remain 2 percent for at least two years, a 1/3 probabability will be immediately cut to vero percent and remain there for at least two years; and a 13 probability will be immediately hiked to 4 percent and remain there for at least two years 1) What is the market price of your bond at that point in time, assuming the term premium on one-year bonds is 144 percent? b) Suppose that for some reason people stop lending to you. They demand all of their money back, and you can't borrow overnight any more. You sell the bond to pay back the overnight loans and keep what is left over. How much will be left over for you to keep? 4) Let's return to the situation described in 3), but with a change. On the day people stop lending to you the overnight rate is still 2 percent, but expectations for the future are different. People think that, looking forward, there is a 12 probability will remain 2 percent for at least two years, and a 1/2 probalability will be immediately hiked to 4 percent and remain there for at least two years. When you sell the bond to pay back the overnicht loans, how much is left for you to keep? $ Y