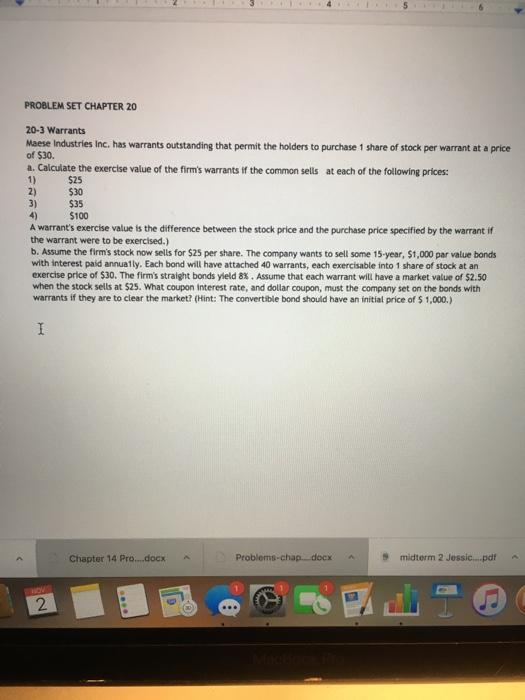

PROBLEM SET CHAPTER 20 20-3 Warrants Maese Industries Inc. has warrants outstanding that permit the holders to purchase 1 share of stock per warrant at a price of $30. a. Calculate the exercise value of the firm's warrants if the common sells at each of the following prices: 1) $25 2) $30 3) 4) $100 A warrant's exercise value is the difference between the stock price and the purchase price specified by the warrant if the warrant were to be exercised.) b. Assume the firm's stock now sells for $25 per share. The company wants to sell some 15-year, S1,000 par value bands with interest paid annually. Each bond will have attached 40 warrants, each exercisable into 1 share of stock at an exercise price of $30. The firm's straight bonds yield 8%. Assume that each warrant will have a market value of $2.50 when the stock sells at $25. What coupon Interest rate, and dollar coupon, must the company set on the bonds with warrants if they are to clear the market? (Hint: The convertible bond should have an initial price of $1,000.) $35 I Chapter 14 Pro....docx Problems-chap.docx 9 midterm 2 Jessic.pdf 2. PROBLEM SET CHAPTER 20 20-3 Warrants Maese Industries Inc. has warrants outstanding that permit the holders to purchase 1 share of stock per warrant at a price of $30. a. Calculate the exercise value of the firm's warrants if the common sells at each of the following prices: 1) $25 2) $30 3) 4) $100 A warrant's exercise value is the difference between the stock price and the purchase price specified by the warrant if the warrant were to be exercised.) b. Assume the firm's stock now sells for $25 per share. The company wants to sell some 15-year, S1,000 par value bands with interest paid annually. Each bond will have attached 40 warrants, each exercisable into 1 share of stock at an exercise price of $30. The firm's straight bonds yield 8%. Assume that each warrant will have a market value of $2.50 when the stock sells at $25. What coupon Interest rate, and dollar coupon, must the company set on the bonds with warrants if they are to clear the market? (Hint: The convertible bond should have an initial price of $1,000.) $35 I Chapter 14 Pro....docx Problems-chap.docx 9 midterm 2 Jessic.pdf 2