Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem - Tax Preparation Rental Real Estate ( Obj . 4 ) Cecily J Cook ( SSN 3 4 4 - 0 0 - 5

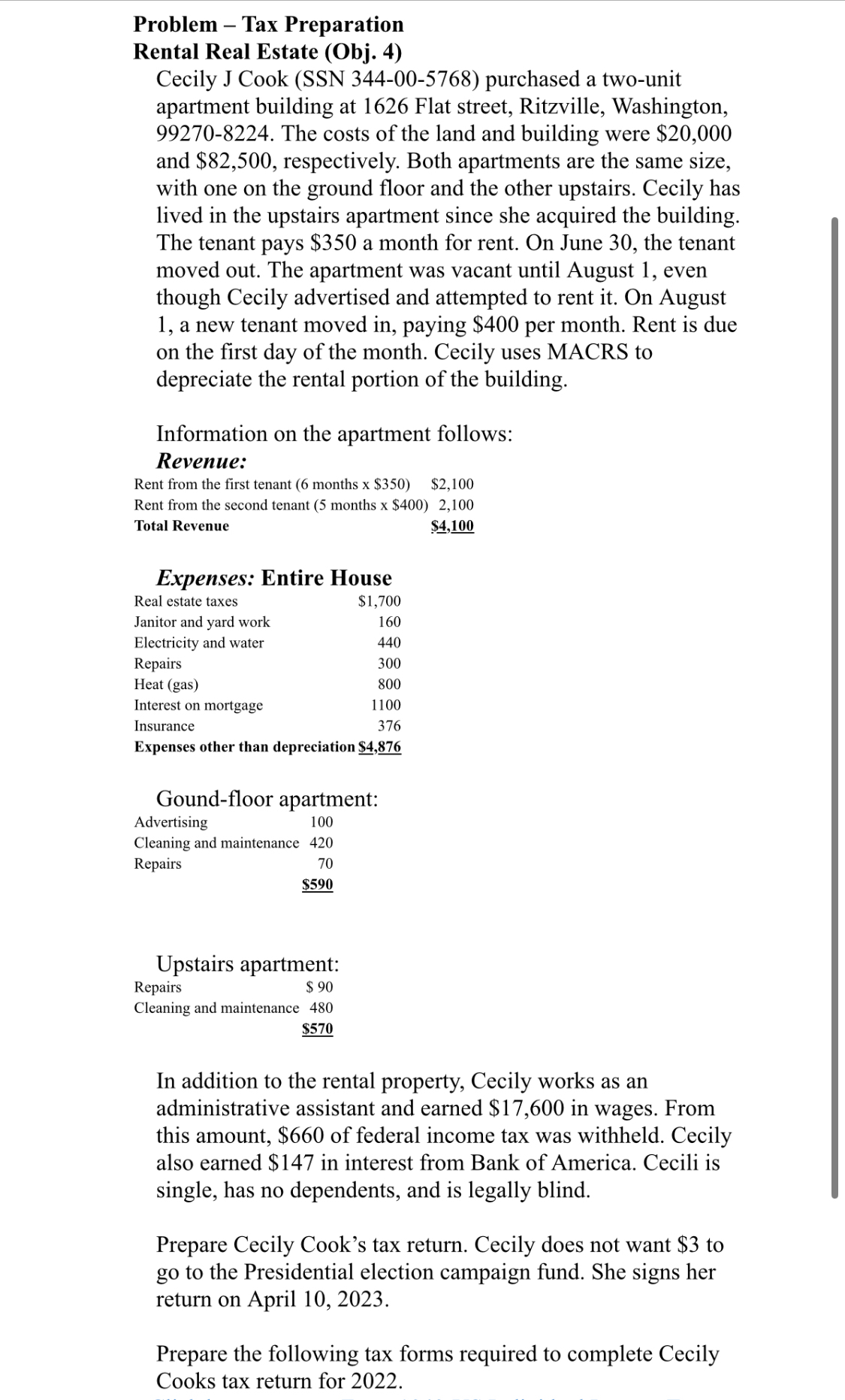

Problem Tax Preparation

Rental Real Estate Obj

Cecily J Cook SSN purchased a twounit apartment building at Flat street, Ritzville, Washington, The costs of the land and building were $ and $ respectively. Both apartments are the same size, with one on the ground floor and the other upstairs. Cecily has lived in the upstairs apartment since she acquired the building. The tenant pays $ a month for rent. On June the tenant moved out. The apartment was vacant until August even though Cecily advertised and attempted to rent it On August a new tenant moved in paying $ per month. Rent is due on the first day of the month. Cecily uses MACRS to depreciate the rental portion of the building.

Information on the apartment follows:

Revenue:

Rent from the first tenant months x $ $

Rent from the second tenant months x $

Total Revenue

$

Expenses: Entire House

tableReal estate taxes,$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started