Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem The ABC general partnership, a law firm, has the following unusual but pedagogically useful balance sheet: A is leaving the firm and retiring. He

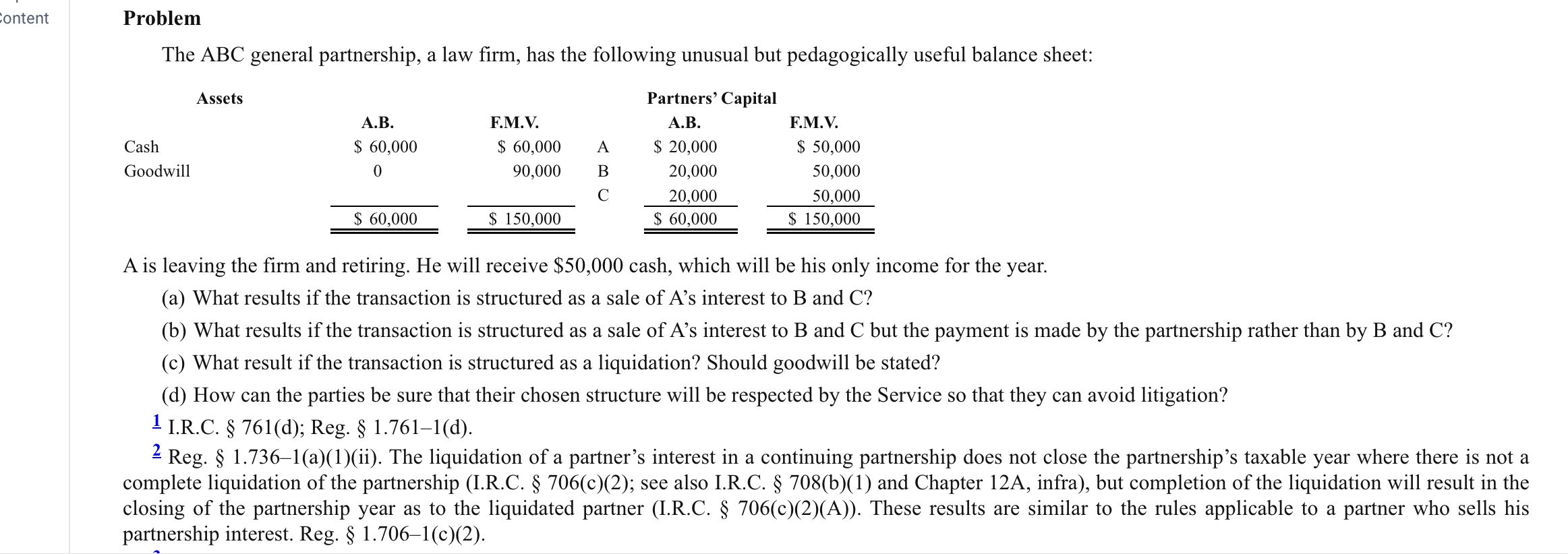

Problem The ABC general partnership, a law firm, has the following unusual but pedagogically useful balance sheet: A is leaving the firm and retiring. He will receive $50,000cash, which will be his only income for the year. (a) What results if the transaction is structured as a sale of A's interest to B and C? (b) What results if the transaction is structured as a sale of A's interest to B and C but the payment is made by the partnership rather than by B and C? (c) What result if the transaction is structured as a liquidation? Should goodwill be stated? (d) How can the parties be sure that their chosen structure will be respected by the Service so that they can avoid litigation? 1 I.R.C. 761(d); Reg. 1.7611(d). 2 Reg. 1.7361(a)(1)(ii). The liquidation of a partner's interest in a continuing partnership does not close the partnership's taxable year where there is not a complete liquidation of the partnership (I.R.C. 706(c)(2); see also I.R.C. 708(b)(1) and Chapter 12A, infra), but completion of the liquidation will result in the closing of the partnership year as to the liquidated partner (I.R.C. 706(c)(2)(A) ). These results are similar to the rules applicable to a partner who sells his partnership interest. Reg. 1.7061(c)(2)

Problem The ABC general partnership, a law firm, has the following unusual but pedagogically useful balance sheet: A is leaving the firm and retiring. He will receive $50,000cash, which will be his only income for the year. (a) What results if the transaction is structured as a sale of A's interest to B and C? (b) What results if the transaction is structured as a sale of A's interest to B and C but the payment is made by the partnership rather than by B and C? (c) What result if the transaction is structured as a liquidation? Should goodwill be stated? (d) How can the parties be sure that their chosen structure will be respected by the Service so that they can avoid litigation? 1 I.R.C. 761(d); Reg. 1.7611(d). 2 Reg. 1.7361(a)(1)(ii). The liquidation of a partner's interest in a continuing partnership does not close the partnership's taxable year where there is not a complete liquidation of the partnership (I.R.C. 706(c)(2); see also I.R.C. 708(b)(1) and Chapter 12A, infra), but completion of the liquidation will result in the closing of the partnership year as to the liquidated partner (I.R.C. 706(c)(2)(A) ). These results are similar to the rules applicable to a partner who sells his partnership interest. Reg. 1.7061(c)(2) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started