Answered step by step

Verified Expert Solution

Question

1 Approved Answer

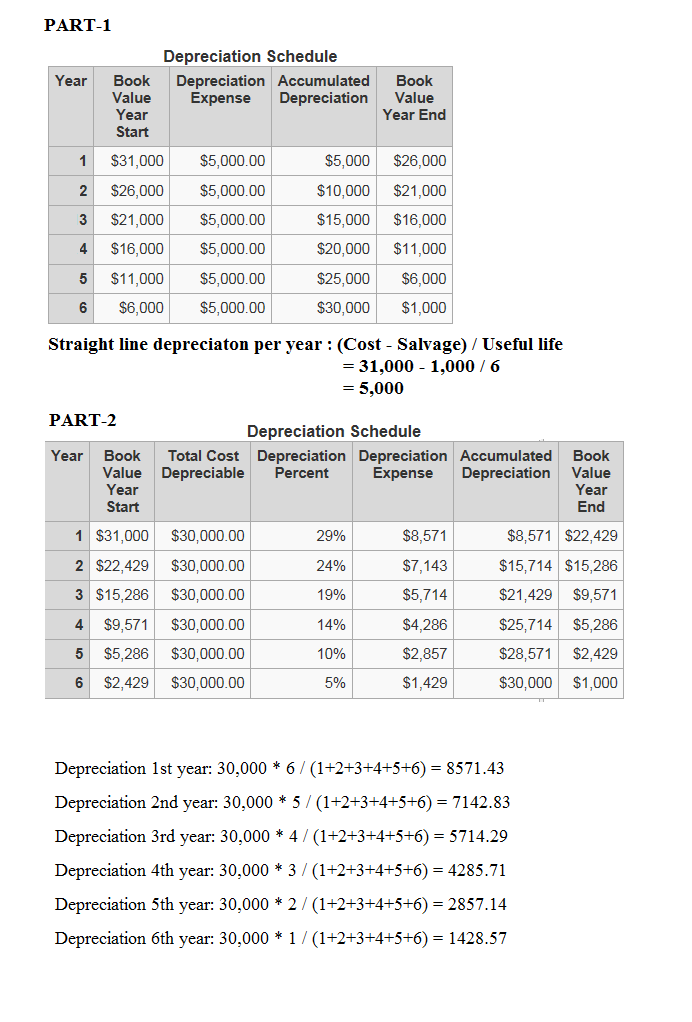

Problem1: A machine with initial cost $31,000 is to be depreciated over six years. The salvage value is $1,000. (a) Compute SLD depreciation and schedule

Problem1: A machine with initial cost $31,000 is to be depreciated over six years. The salvage value is $1,000.

(a) Compute SLD depreciation and schedule of book value.

(b) Compute SOYD depreciation and schedule of book value. Problem2: Compute the DDB depreciation with switch to SL and show the schedule of book value for an asset with the initial cost of $100,000. The depreciation period is six years. Salvage value is 0.

Problem2: Compute the DDB depreciation with switch to SL and show the schedule of book value for an asset with the initial cost of $100,000. The depreciation period is six years. Salvage value is 0.

Problem 1 is answered. Can I get an answer for Problem 2?

Book Value Year End PART-1 Depreciation Schedule Year Book Depreciation Accumulated Value Expense Depreciation Year Start $31,000 $5,000.00 $5,000 2 $26,000 $5,000.00 $10,000 3 $21,000 $5,000.00 $15,000 4 $16,000 $5,000.00 $20,000 5 $11,000 $5,000.00 $25,000 6 $6,000 $5,000.00 $30,000 $26,000 $21,000 $16,000 $11,000 $6,000 $1,000 Straight line depreciaton per year : (Cost - Salvage) / Useful life = 31,000 - 1,000 / 6 = 5,000 PART-2 Depreciation Schedule Total Cost Depreciation Depreciation Accumulated Depreciable Percent Expense Depreciation Book Value Year 29% Year Book Value Year Start 1 $31,000 2 $22,429 3 $15,286 4 $9,571 5 $5,286 6 $2,429 24% $30,000.00 $30,000.00 $30,000.00 $30,000.00 $30,000.00 $30,000.00 19% 14% $8,571 $7,143 $5,714 $4,286 $2,857 $1,429 End $8,571 $22,429 $15,714 $15,286 $21,429 $9,571 $25,714 $5,286 $28,571 $2,429 $30,000 $1,000 10% 5% Depreciation 1st year: 30,000 * 6/(1+2+3+4+5+6) = 8571.43 Depreciation 2nd year: 30,000 * 5/(1+2+3+4+5+6) = 7142.83 Depreciation 3rd year: 30,000 * 4/(1+2+3+4+5+6) = 5714.29 Depreciation 4th year: 30,000 * 3 / (1+2+3+4+5+6) = 4285.71 Depreciation 5th year: 30,000 * 2/(1+2+3+4+5+6) = 2857.14 Depreciation 6th year: 30,000 * 1/(1+2+3+4+5+6) = 1428.57 Book Value Year End PART-1 Depreciation Schedule Year Book Depreciation Accumulated Value Expense Depreciation Year Start $31,000 $5,000.00 $5,000 2 $26,000 $5,000.00 $10,000 3 $21,000 $5,000.00 $15,000 4 $16,000 $5,000.00 $20,000 5 $11,000 $5,000.00 $25,000 6 $6,000 $5,000.00 $30,000 $26,000 $21,000 $16,000 $11,000 $6,000 $1,000 Straight line depreciaton per year : (Cost - Salvage) / Useful life = 31,000 - 1,000 / 6 = 5,000 PART-2 Depreciation Schedule Total Cost Depreciation Depreciation Accumulated Depreciable Percent Expense Depreciation Book Value Year 29% Year Book Value Year Start 1 $31,000 2 $22,429 3 $15,286 4 $9,571 5 $5,286 6 $2,429 24% $30,000.00 $30,000.00 $30,000.00 $30,000.00 $30,000.00 $30,000.00 19% 14% $8,571 $7,143 $5,714 $4,286 $2,857 $1,429 End $8,571 $22,429 $15,714 $15,286 $21,429 $9,571 $25,714 $5,286 $28,571 $2,429 $30,000 $1,000 10% 5% Depreciation 1st year: 30,000 * 6/(1+2+3+4+5+6) = 8571.43 Depreciation 2nd year: 30,000 * 5/(1+2+3+4+5+6) = 7142.83 Depreciation 3rd year: 30,000 * 4/(1+2+3+4+5+6) = 5714.29 Depreciation 4th year: 30,000 * 3 / (1+2+3+4+5+6) = 4285.71 Depreciation 5th year: 30,000 * 2/(1+2+3+4+5+6) = 2857.14 Depreciation 6th year: 30,000 * 1/(1+2+3+4+5+6) = 1428.57

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started