Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PROBLEMS 1. To what extent would the following taxes be deductible by Married Couple under $ 164? (a) A state income tax of $12,000. 4

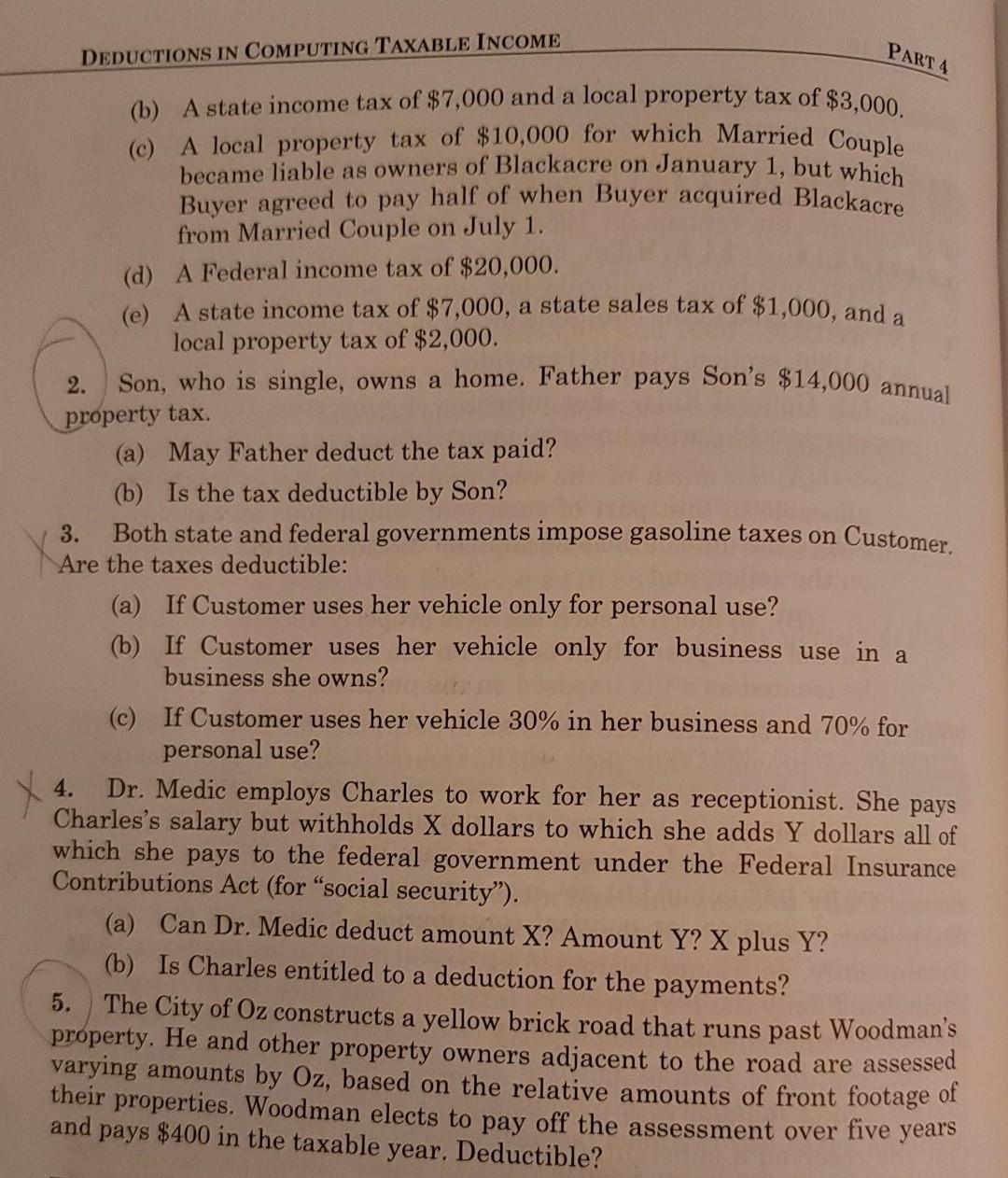

PROBLEMS 1. To what extent would the following taxes be deductible by Married Couple under $ 164? (a) A state income tax of $12,000. 4 Of course, if petitioner were ever to recover on the judgment which she obtained against Osborn, that recovery would constitute income subject to the limitations of sec. 111. Rev.RO PROBLEMS To what extent would the following taxes be deductible by Married 1. Couple under $ 164? (a) A state income tax of $12,000. nhtained against DEDUCTIONS IN COMPUTING TAXABLE INCOME PART 4 (b) A state income tax of $7,000 and a local property tax of $3,000. (c) A local property tax of $10,000 for which Married Couple became liable as owners of Blackacre on January 1, but which Buyer agreed to pay half of when Buyer acquired Blackacre from Married Couple on July 1. (d) A Federal income tax of $20,000. (e) A state income tax of $7,000, a state sales tax of $1,000, and a local property tax of $2,000. Son, who is single, owns a home. Father pays Son's $14,000 annual property tax (a) May Father deduct the tax paid? (b) Is the tax deductible by Son? 3. Both state and federal governments impose gasoline taxes on Customer. Are the taxes deductible: (a) If Customer uses her vehicle only for personal use? (b) If Customer uses her vehicle only for business use in a business she owns? 2. (c) If Customer uses her vehicle 30% in her business and 70% for personal use? 4. Dr. Medic employs Charles to work for her as receptionist. She pays Charles's salary but withholds X dollars to which she adds Y dollars all of which she pays to the federal government under the Federal Insurance Contributions Act (for "social security'). (a) Can Dr. Medic deduct amount X? Amount Y? X plus Y? (b) Is Charles entitled to a deduction for the payments? 5. The City of Oz constructs a yellow brick road that runs past Woodman's property. He and other property owners adjacent to the road are assessed varying amounts by Oz, based on the relative amounts of front footage of their properties. Woodman elects to pay off the assessment over five years and pays $400 in the taxable year. Deductible

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started