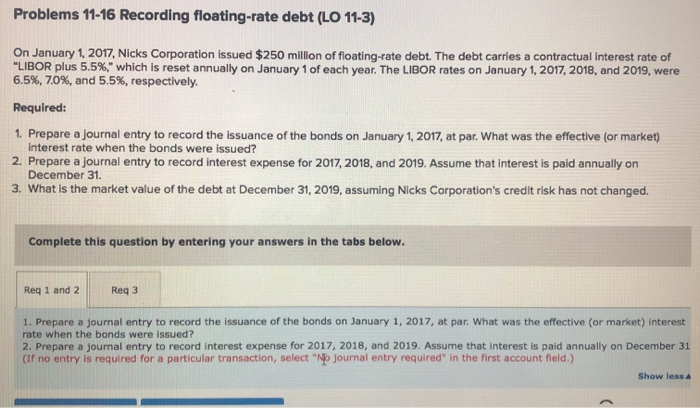

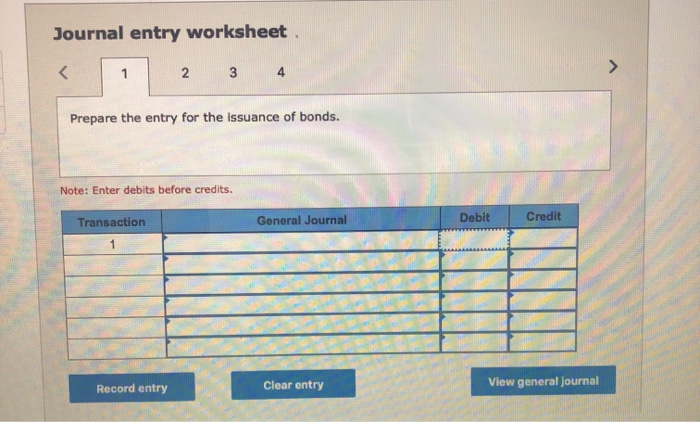

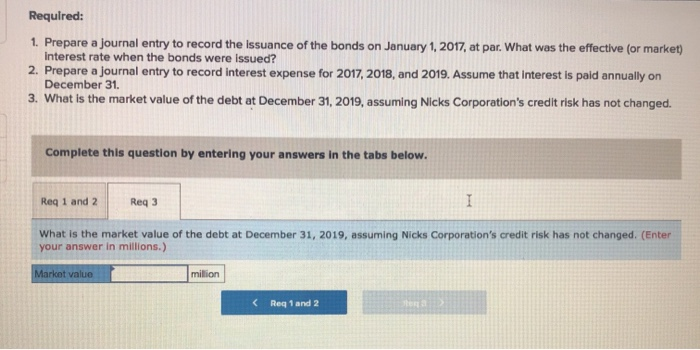

Problems 11-16 Recording floating-rate debt (LO 11-3) On January 1, 2017, Nicks Corporation issued $250 million of floating-rate debt. The debt carries a contractual interest rate of "LIBOR plus 5.5%," which is reset annually on January 1 of each year. The LIBOR rates on January 1, 2017, 2018, and 2019, were 6.5%, 7.0%, and 5.5%, respectively. Required: 1. Prepare a journal entry to record the issuance of the bonds on January 1, 2017, at par. What was the effective (or market) interest rate when the bonds were issued? 2. Prepare a journal entry to record interest expense for 2017, 2018, and 2019. Assume that interest is paid annually on December 31. 3. What is the market value of the debt at December 31, 2019, assuming Nicks Corporation's credit risk has not changed. Complete this question by entering your answers in the tabs below. Req 1 and 2 Req3 1. Prepare a journal entry to record the issuance of the bonds on January 1, 2017, at par. What was the effective (or market) interest rate when the bonds were issued? 2. Prepare a journal entry to record interest expense for 2017, 2018, and 2019. Assume that interest is paid annually on December 31 (If no entry is required for a particular transaction, select "No journal entry required in the first account field.) Show less Journal entry worksheet 1 2 3 4 Prepare the entry for the issuance of bonds. Note: Enter debits before credits. Transaction General Journal Debit Credit TL Record entry Clear entry View general journal Required: 1. Prepare a journal entry to record the issuance of the bonds on January 1, 2017, at par. What was the effective (or market) Interest rate when the bonds were issued? 2. Prepare a journal entry to record interest expense for 2017, 2018, and 2019. Assume that interest is paid annually on December 31. 3. What is the market value of the debt at December 31, 2019, assuming Nicks Corporation's credit risk has not changed. Complete this question by entering your answers in the tabs below. Req 1 and 2 Req3 What is the market value of the debt at December 31, 2019, assuming Nicks Corporation's credit risk has not changed. (Enter your answer in millions.) Market value million 1 Req 1 and 2