Question

Problems 1-4 are for reference. Please Solve 5,6,7 1) You believe you will need $125,000 annually to live comfortably while retired. You plan on retiring

Problems 1-4 are for reference. Please Solve 5,6,7

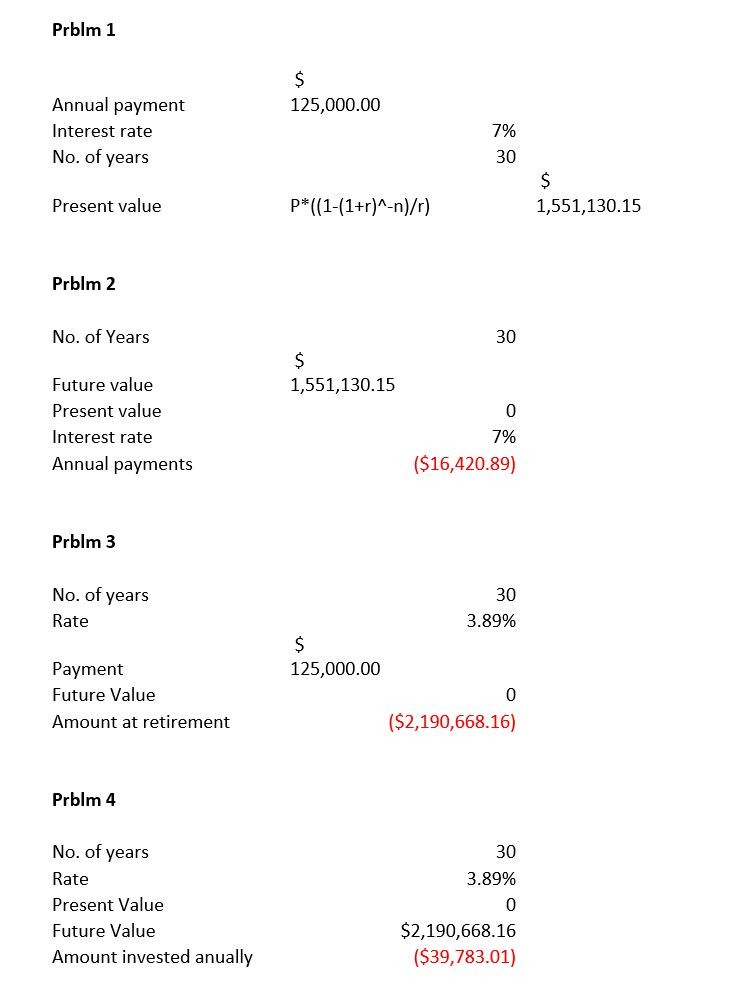

1) You believe you will need $125,000 annually to live comfortably while retired. You plan on retiring when you are 65 and will begin withdrawing funds from your retirement account on your 66th birthday. If you expect to need 30 years of retirement income how much money will you need at retirement (when you are 65) to meet this goal assuming the fair interest rate is 7%?

2) If today is your 35th birthday, and you decide, starting next year and on every birthday up to and including your 65th birthday (30 years total), you will invest the same amount. How much must you invest annually to meet the retirement savings goal you have set in #1 above? Again the fair interest rate is 7% annually.

3) You realize that in the analysis above you forgot to include the impact of inflation. Recalculate the answer to # 1 assuming inflation is 3% per year (the real rate is 3.89%) and the $125,000 annually is stated in real dollars instead of nominal dollars.

4) Given your new answer above in real dollars, calculate the amount you must invest annually in real dollars to meet your retirement goal. Again assume 7% is the fair nominal rate and inflation is 3% per year (the real rate is 3.89%).

Solve:

5) The annual payments you calculated in the previous problem are in real dollars. Since your first annual investment will be made next year, what is the nominal (actual) amount you need to invest next year to account for inflation?

6) Based on the real dollar value you calculated in #3 above, how much will you need in your retirement account in nominal dollars when you retire at age 65?

7) Based on the $125,000 real dollar annual required withdrawals from your retirement account, what amount will you withdraw from your retirement account, in nominal dollars, on your 66th birthday, the first year of retirement?, What is the amount in nominal dollars will you withdraw from your retirement account on your 85th birthday?

Prblm 1 125,000.00 Annual payment Interest rate No. of years 7% 30 Present value P*((1-(1+r)^-n)/r) 1,551,130.15 Prblm 2 No. of Years 30 1,551,130.15 Future value Present value Interest rate Annual payments 7% ($16,420.89) Prblm 3 30 No. of years Rate 3.89% 125,000.00 Payment Future Value Amount at retirement ($2,190,668.16) Prblm 4 30 3.89% No. of years Rate Present Value Future Value Amount invested anually $2,190,668.16 ($39,783.01)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started