Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problems 15.1 Shao Electronics has total assets of $550 million and stockholder's equity of $330 million. It has total debt of $220 million. ROA is

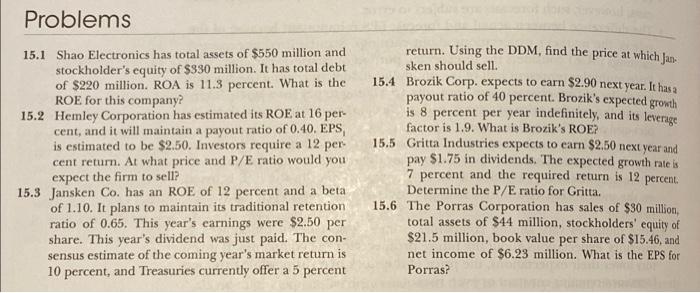

Problems 15.1 Shao Electronics has total assets of $550 million and stockholder's equity of $330 million. It has total debt of $220 million. ROA is 11.3 percent. What is the ROE for this company? 15.2 Hemley Corporation has estimated its ROE at 16 per- cent, and it will maintain a payout ratio of 0.40. EPS, is estimated to be $2.50. Investors require a 12 per cent return. At what price and P/E ratio would you expect the firm to sell? 15.3 Jansken Co. has an ROE of 12 percent and a beta of 1.10. It plans to maintain its traditional retention ratio of 0.65. This year's earnings were $2.50 per share. This year's dividend was just paid. The con- sensus estimate of the coming year's market return is 10 percent, and Treasuries currently offer a 5 percent return. Using the DDM, find the price at which Jan- sken should sell. 15.4 Brozik Corp. expects to earn $2.90 next year. It has a payout ratio of 40 percent. Brozik's expected growth is 8 percent per year indefinitely, and its leverage factor is 1.9. What is Brozik's ROE? 15,5 Gritta Industries expects to earn $2.50 next year and pay $1.75 in dividends. The expected growth rate is 7 percent and the required return is 12 percent. Determine the P/E ratio for Gritta. 15.6 The Porras Corporation has sales of $30 million, total assets of $44 million, stockholders' equity of $21.5 million, book value per share of $15.46, and net income of $6.23 million. What is the EPS for Porras

Problems 15.1 Shao Electronics has total assets of $550 million and stockholder's equity of $330 million. It has total debt of $220 million. ROA is 11.3 percent. What is the ROE for this company? 15.2 Hemley Corporation has estimated its ROE at 16 per- cent, and it will maintain a payout ratio of 0.40. EPS, is estimated to be $2.50. Investors require a 12 per cent return. At what price and P/E ratio would you expect the firm to sell? 15.3 Jansken Co. has an ROE of 12 percent and a beta of 1.10. It plans to maintain its traditional retention ratio of 0.65. This year's earnings were $2.50 per share. This year's dividend was just paid. The con- sensus estimate of the coming year's market return is 10 percent, and Treasuries currently offer a 5 percent return. Using the DDM, find the price at which Jan- sken should sell. 15.4 Brozik Corp. expects to earn $2.90 next year. It has a payout ratio of 40 percent. Brozik's expected growth is 8 percent per year indefinitely, and its leverage factor is 1.9. What is Brozik's ROE? 15,5 Gritta Industries expects to earn $2.50 next year and pay $1.75 in dividends. The expected growth rate is 7 percent and the required return is 12 percent. Determine the P/E ratio for Gritta. 15.6 The Porras Corporation has sales of $30 million, total assets of $44 million, stockholders' equity of $21.5 million, book value per share of $15.46, and net income of $6.23 million. What is the EPS for Porras

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started