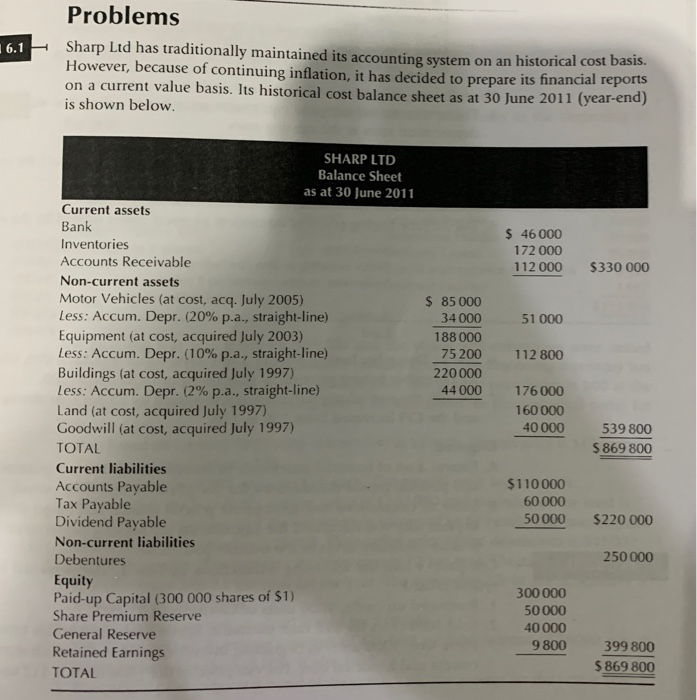

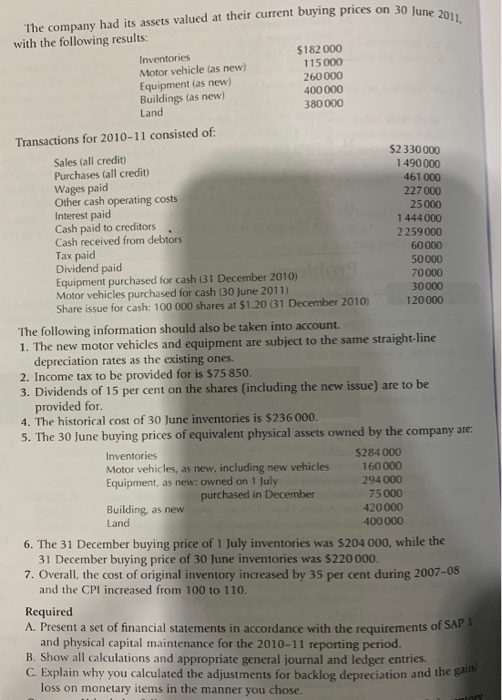

Problems 16.1 Sharp Ltd has traditionally maintained its accounting system on an historical cost basis. However, because of continuing inflation, it has decided to prepare its financial reports on a current value basis. Its historical cost balance sheet as at 30 June 2011 (year-end) is shown below. $ 46 000 172 000 112 000 $330 000 51 000 $ 85000 34000 188 000 75200 220000 44 000 112 800 SHARP LTD Balance Sheet as at 30 June 2011 Current assets Bank Inventories Accounts Receivable Non-current assets Motor Vehicles (at cost, acq. July 2005) Less: Accum. Depr. (20% p.a., straight-line) Equipment (at cost, acquired July 2003) Less: Accum. Depr. (10% p.a., straight-line) Buildings (at cost, acquired July 1997) Less: Accum. Depr. (2% p.a., straight-line) Land (at cost, acquired July 1997) Goodwill (at cost, acquired July 1997) TOTAL Current liabilities Accounts Payable Tax Payable Dividend Payable Non-current liabilities Debentures Equity Paid-up Capital (300 000 shares of $1) Share Premium Reserve General Reserve Retained Earnings TOTAL 176 000 160 000 40 000 539 800 $ 869 800 $110 000 60 000 50 000 $220 000 250 000 300 000 50 000 40 000 9800 399 800 $ 869 800 on 30 June 2011, The company had its assets valued at their current buying prices on 30 June with the following results: Inventories $182 000 Motor vehicle as new) 115000 Equipment (as new) 260 000 Buildings (as new) 400000 Land 380000 Transactions for 2010-11 consisted of: $2 330 000 Sales (all credit) 1 490 000 Purchases (all credit) 461 000 Wages paid 227000 Other cash operating costs 25000 Interest paid 1444000 Cash paid to creditors 2259 000 Cash received from debtors 60000 Tax paid 50000 Dividend paid 70000 Equipment purchased for cash (31 December 2010) 30 000 Motor vehicles purchased for cash (30 June 2011) 120000 Share issue for cash: 100 000 shares at $1.20 31 December 2010) The following information should also be taken into account. 1. The new motor vehicles and equipment are subject to the same straight-line depreciation rates as the existing ones. 2. Income tax to be provided for is $75 850. 3. Dividends of 15 per cent on the shares (including the new issue) are to be provided for 4. The historical cost of 30 June inventories is $236 000. 5. The 30 June buying prices of equivalent physical assets owned by the company are: Inventories $284 000 Motor vehicles, as new, including new vehicles 160 000 Equipment, as new: owned on 1 July 294 000 purchased in December 75 000 Building, as new 420000 Land 400 000 6. The 31 December buying price of 1 July inventories was $204 000, while the 31 December buying price of 30 June inventories was $220 000 7. Overall, the cost of original inventory increased by 35 per cent during 2007-08 and the CPI increased from 100 to 110. Required A. Present a set of financial statements in accordance with the requirements of SA and physical capital maintenance for the 2010-11 reporting period. B. Show all calculations and appropriate general journal and ledger entries C. Explain why you calculated the adjustments for backlog depreciation and the loss on monetary items in the manner you chose. Problems 16.1 Sharp Ltd has traditionally maintained its accounting system on an historical cost basis. However, because of continuing inflation, it has decided to prepare its financial reports on a current value basis. Its historical cost balance sheet as at 30 June 2011 (year-end) is shown below. $ 46 000 172 000 112 000 $330 000 51 000 $ 85000 34000 188 000 75200 220000 44 000 112 800 SHARP LTD Balance Sheet as at 30 June 2011 Current assets Bank Inventories Accounts Receivable Non-current assets Motor Vehicles (at cost, acq. July 2005) Less: Accum. Depr. (20% p.a., straight-line) Equipment (at cost, acquired July 2003) Less: Accum. Depr. (10% p.a., straight-line) Buildings (at cost, acquired July 1997) Less: Accum. Depr. (2% p.a., straight-line) Land (at cost, acquired July 1997) Goodwill (at cost, acquired July 1997) TOTAL Current liabilities Accounts Payable Tax Payable Dividend Payable Non-current liabilities Debentures Equity Paid-up Capital (300 000 shares of $1) Share Premium Reserve General Reserve Retained Earnings TOTAL 176 000 160 000 40 000 539 800 $ 869 800 $110 000 60 000 50 000 $220 000 250 000 300 000 50 000 40 000 9800 399 800 $ 869 800 on 30 June 2011, The company had its assets valued at their current buying prices on 30 June with the following results: Inventories $182 000 Motor vehicle as new) 115000 Equipment (as new) 260 000 Buildings (as new) 400000 Land 380000 Transactions for 2010-11 consisted of: $2 330 000 Sales (all credit) 1 490 000 Purchases (all credit) 461 000 Wages paid 227000 Other cash operating costs 25000 Interest paid 1444000 Cash paid to creditors 2259 000 Cash received from debtors 60000 Tax paid 50000 Dividend paid 70000 Equipment purchased for cash (31 December 2010) 30 000 Motor vehicles purchased for cash (30 June 2011) 120000 Share issue for cash: 100 000 shares at $1.20 31 December 2010) The following information should also be taken into account. 1. The new motor vehicles and equipment are subject to the same straight-line depreciation rates as the existing ones. 2. Income tax to be provided for is $75 850. 3. Dividends of 15 per cent on the shares (including the new issue) are to be provided for 4. The historical cost of 30 June inventories is $236 000. 5. The 30 June buying prices of equivalent physical assets owned by the company are: Inventories $284 000 Motor vehicles, as new, including new vehicles 160 000 Equipment, as new: owned on 1 July 294 000 purchased in December 75 000 Building, as new 420000 Land 400 000 6. The 31 December buying price of 1 July inventories was $204 000, while the 31 December buying price of 30 June inventories was $220 000 7. Overall, the cost of original inventory increased by 35 per cent during 2007-08 and the CPI increased from 100 to 110. Required A. Present a set of financial statements in accordance with the requirements of SA and physical capital maintenance for the 2010-11 reporting period. B. Show all calculations and appropriate general journal and ledger entries C. Explain why you calculated the adjustments for backlog depreciation and the loss on monetary items in the manner you chose