Problems 27&28

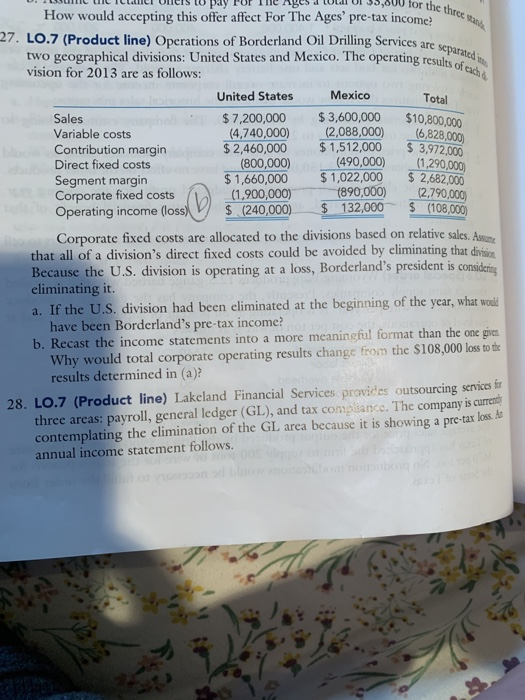

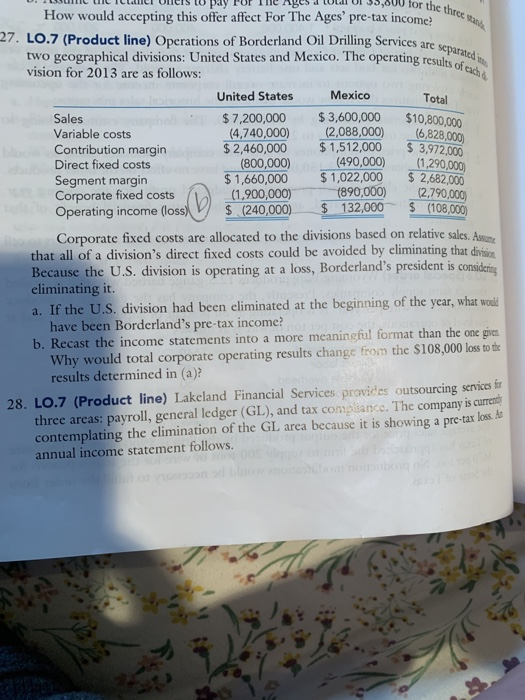

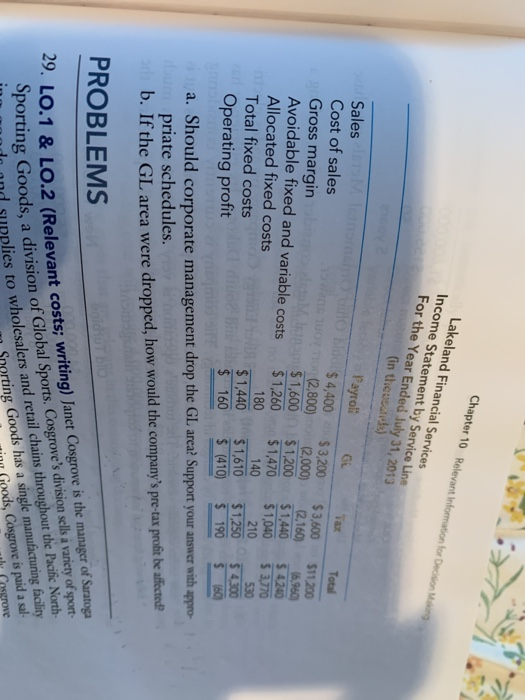

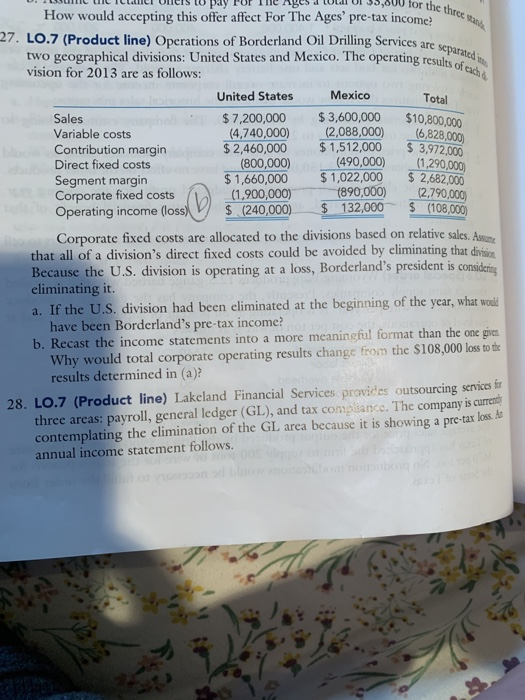

r the three sans How would accepting this offer affect For The Ages' pre-tax income? fe 27. LO.7 (Product line) Operations of Borderland Oil Drilling Services are separ two geographical divisions: United States and Mexico. The operating results of each & vision for 2013 are as follows: Mexico United States Total $3,600,000 (2,088,000) Sales Variable costs Contribution margin Direct fixed costs Segment margin Corporate fixed costs Operating income (loss) V $ 7,200,000 $10,800,000 (6,828,000) 4,740,000) (800,000) (1,900,000) $2,460,000 $1,512,000 3,972,000 (490,000) (1,290,000 $1,660,000 1,022,000 $2,682,000 (890,000)(2,790,000 132,000(108- -$ $ (240,000) Corporate fixed costs are allocated to the divisions based on relative sales, Ausn that all of a division's direct fixed costs could be avoided by eliminating that drvin Because the U.S. division is operating at a loss, Borderland's president is considrin a. If the U.S. division had been eliminated at the beginning of the year, what woud b. Recast the income statements into a more meaningful format than the one give eliminating it have been Borderland's pre-tax income Why would total corporate operating results change from the $108,000 lossto te results determined in (a)? 28. LO.7 (Product line) Lakeland Financial Services provides outsourcing services fir three areas: payroll, general ledger (GL), and tax compiance. The company is current contemplating the elimination of the GL area because it is showing a pre-tax los. annual income statement follows. Lakeland Financial Services Income Statement by Service Line For the Year Ended July 31, 2013 in thevesiek) Payroli $ 4,400 $3,200 $3,600 $11.200 (2,800) (2,000)(2,160 (6,960 $1,600 $1,200 $1,440 $4240 Sales Cost of sales Gross margin Avoidable fixed and variable costs Allocated fixed costs Total fixed costs Operating profit Tax Total $1,260$1,470 $1,040 $370 180 $1,440 $1,610 $1,250 4300 160 (410 19060 140 210 a. Should corporate management drop the GL area? Support your answer with appro priate schedules. If the GL area were dropped, how would the company's pre-tax profit be affectea 29. Lo.1 & LO.2 (Relevant costs; writing) Janet Cosgrove is the manager of Sezteg nd retail chains throughout the Pacific North PROBLEMS of Saratoga sport- oporting Goods, a division of Global Sports. Cosgrove's dinision sels vaniey f pr wholcsalers n Coods has a single manufcturing faciliry 29. LO.1 is paid a sal- Snorting de and su l and supplies to