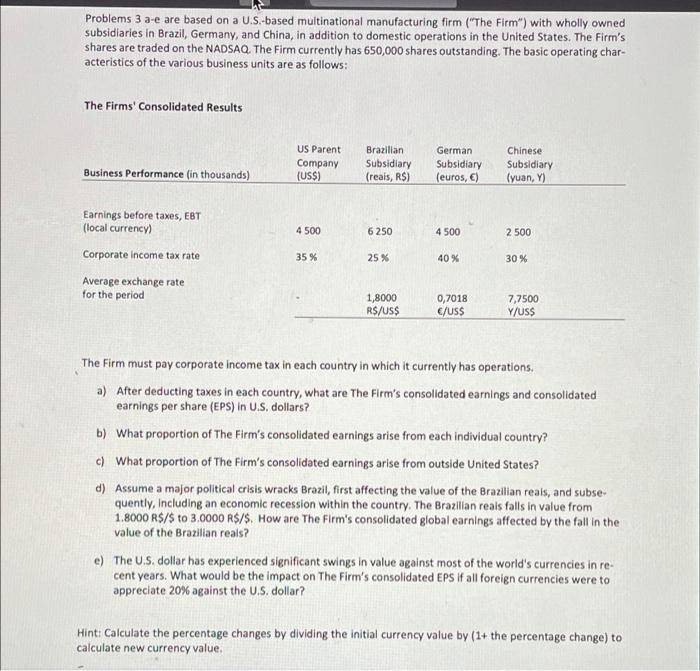

Problems 3 a-e are based on a US-based multinational manufacturing firm ("The Firm) with wholly owned subsidiaries in Brazil, Germany, and China, in addition to domestic operations in the United States. The Firm's shares are traded on the NADSAQ. The Firm currently has 650,000 shares outstanding. The basic operating char- acteristics of the various business units are as follows: The Firms' Consolidated Results US Parent Company (USS) Business Performance in thousands) Brazilian Subsidiary (reais, RS) German Subsidiary (euros, ) Chinese Subsidiary (yuan, Y) 4 500 6250 4 500 2 500 Earnings before taxes, EBT (local currency) Corporate Income tax rate Average exchange rate for the period 35 % 25 % 40% 30% 1,8000 RS/US$ 0,7018 E/US$ 7,7500 Y/USS The Firm must pay corporate income tax in each country in which it currently has operations. a) After deducting taxes in each country, what are The Firm's consolidated earnings and consolidated earnings per share (EPS) in U.S. dollars? b) What proportion of The Firm's consolidated earnings arise from each individual country? c) What proportion of The Firm's consolidated earnings arise from outside United States? d) Assume a major political crisis wracks Brazil, first affecting the value of the Brazilian reals, and subse- quently, including an economic recession within the country. The Brazilian reals falls in value from 1.8000 RS/S to 3.0000 R$/S. How are The Firm's consolidated global earnings affected by the fall in the value of the Brazilian reals? c) The U.S. dollar has experienced significant swings in value against most of the world's currencies in re- cent years. What would be the impact on The Firm's consolidated EPS If all foreign currencies were to appreciate 20% against the U.S. dollar? Hint: Calculate the percentage changes by dividing the initial currency value by (1+ the percentage change) to calculate new currency value, Problems 3 a-e are based on a US-based multinational manufacturing firm ("The Firm) with wholly owned subsidiaries in Brazil, Germany, and China, in addition to domestic operations in the United States. The Firm's shares are traded on the NADSAQ. The Firm currently has 650,000 shares outstanding. The basic operating char- acteristics of the various business units are as follows: The Firms' Consolidated Results US Parent Company (USS) Business Performance in thousands) Brazilian Subsidiary (reais, RS) German Subsidiary (euros, ) Chinese Subsidiary (yuan, Y) 4 500 6250 4 500 2 500 Earnings before taxes, EBT (local currency) Corporate Income tax rate Average exchange rate for the period 35 % 25 % 40% 30% 1,8000 RS/US$ 0,7018 E/US$ 7,7500 Y/USS The Firm must pay corporate income tax in each country in which it currently has operations. a) After deducting taxes in each country, what are The Firm's consolidated earnings and consolidated earnings per share (EPS) in U.S. dollars? b) What proportion of The Firm's consolidated earnings arise from each individual country? c) What proportion of The Firm's consolidated earnings arise from outside United States? d) Assume a major political crisis wracks Brazil, first affecting the value of the Brazilian reals, and subse- quently, including an economic recession within the country. The Brazilian reals falls in value from 1.8000 RS/S to 3.0000 R$/S. How are The Firm's consolidated global earnings affected by the fall in the value of the Brazilian reals? c) The U.S. dollar has experienced significant swings in value against most of the world's currencies in re- cent years. What would be the impact on The Firm's consolidated EPS If all foreign currencies were to appreciate 20% against the U.S. dollar? Hint: Calculate the percentage changes by dividing the initial currency value by (1+ the percentage change) to calculate new currency value