Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problems 8.2B and 8.3B are based on the following data: Sea Travel sells motor boats. One of Sea Travel's most popular models is the Wing.

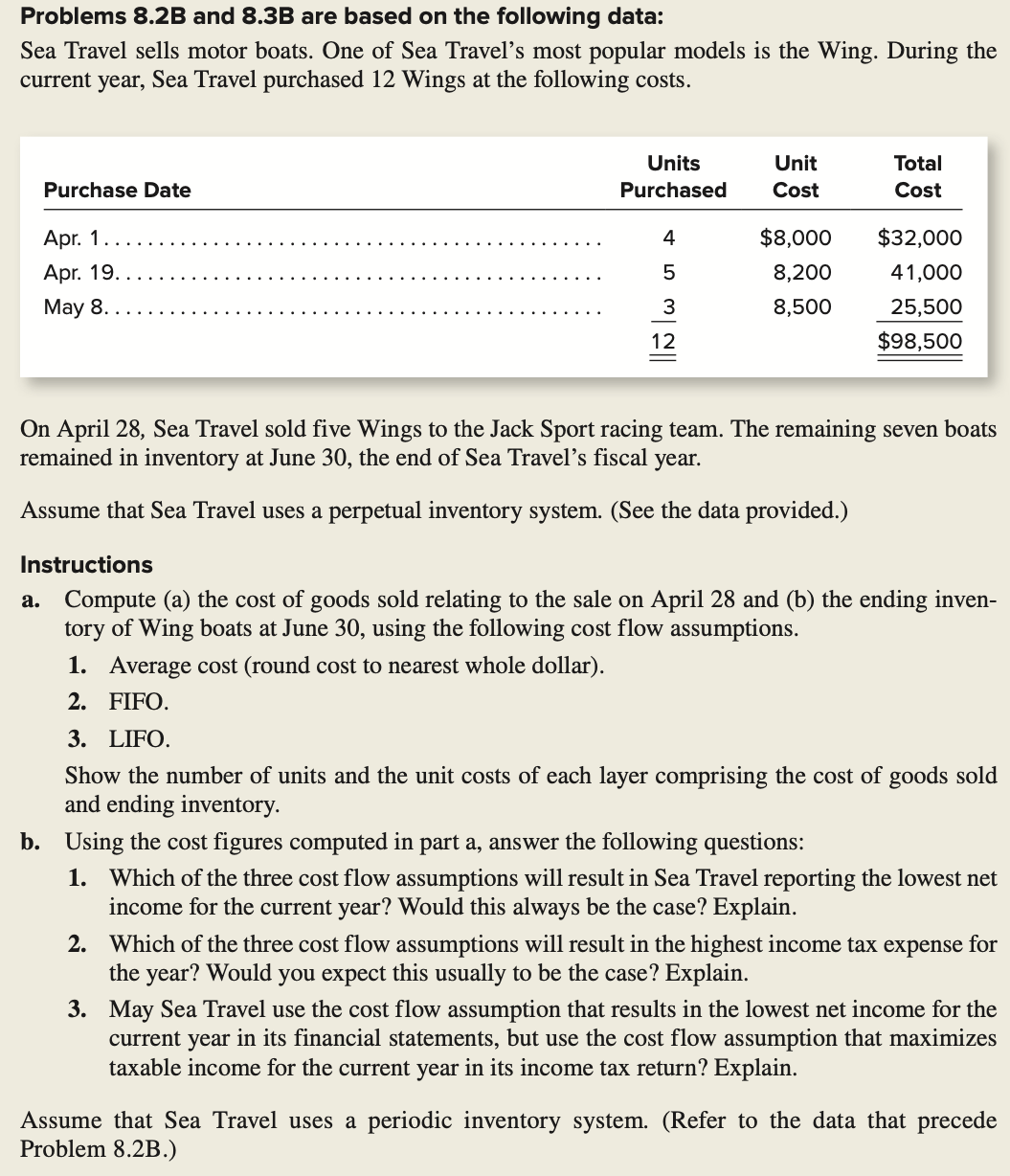

Problems 8.2B and 8.3B are based on the following data: Sea Travel sells motor boats. One of Sea Travel's most popular models is the Wing. During the current year, Sea Travel purchased 12 Wings at the following costs. On April 28, Sea Travel sold five Wings to the Jack Sport racing team. The remaining seven boats remained in inventory at June 30, the end of Sea Travel's fiscal year. Assume that Sea Travel uses a perpetual inventory system. (See the data provided.) Instructions a. Compute (a) the cost of goods sold relating to the sale on April 28 and (b) the ending inventory of Wing boats at June 30 , using the following cost flow assumptions. 1. Average cost (round cost to nearest whole dollar). 2. FIFO. 3. LIFO. Show the number of units and the unit costs of each layer comprising the cost of goods sold and ending inventory. b. Using the cost figures computed in part a, answer the following questions: 1. Which of the three cost flow assumptions will result in Sea Travel reporting the lowest net income for the current year? Would this always be the case? Explain. 2. Which of the three cost flow assumptions will result in the highest income tax expense for the year? Would you expect this usually to be the case? Explain. 3. May Sea Travel use the cost flow assumption that results in the lowest net income for the current year in its financial statements, but use the cost flow assumption that maximizes taxable income for the current year in its income tax return? Explain. Assume that Sea Travel uses a periodic inventory system. (Refer to the data that precede Problem 8.2B.)

Problems 8.2B and 8.3B are based on the following data: Sea Travel sells motor boats. One of Sea Travel's most popular models is the Wing. During the current year, Sea Travel purchased 12 Wings at the following costs. On April 28, Sea Travel sold five Wings to the Jack Sport racing team. The remaining seven boats remained in inventory at June 30, the end of Sea Travel's fiscal year. Assume that Sea Travel uses a perpetual inventory system. (See the data provided.) Instructions a. Compute (a) the cost of goods sold relating to the sale on April 28 and (b) the ending inventory of Wing boats at June 30 , using the following cost flow assumptions. 1. Average cost (round cost to nearest whole dollar). 2. FIFO. 3. LIFO. Show the number of units and the unit costs of each layer comprising the cost of goods sold and ending inventory. b. Using the cost figures computed in part a, answer the following questions: 1. Which of the three cost flow assumptions will result in Sea Travel reporting the lowest net income for the current year? Would this always be the case? Explain. 2. Which of the three cost flow assumptions will result in the highest income tax expense for the year? Would you expect this usually to be the case? Explain. 3. May Sea Travel use the cost flow assumption that results in the lowest net income for the current year in its financial statements, but use the cost flow assumption that maximizes taxable income for the current year in its income tax return? Explain. Assume that Sea Travel uses a periodic inventory system. (Refer to the data that precede Problem 8.2B.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started