Answered step by step

Verified Expert Solution

Question

1 Approved Answer

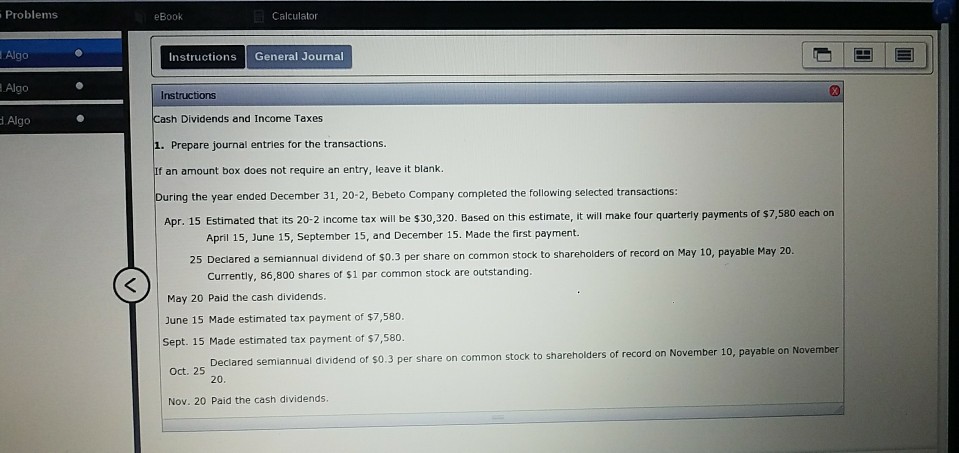

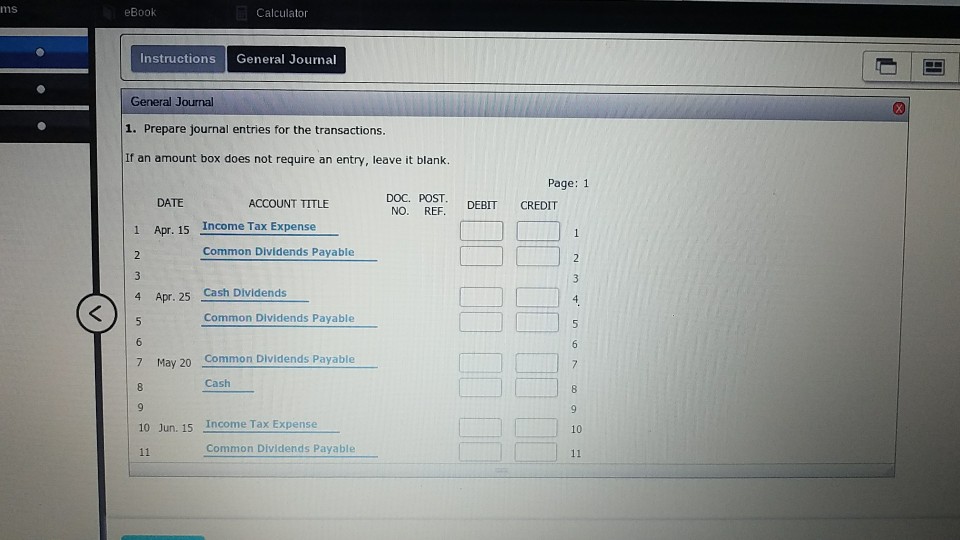

Problems eBook Calculator Algo Algo Algo Instructions General Journal Instructions Dividends and Income Taxes 1. Prepare journal entries for the transactions. f an amount box

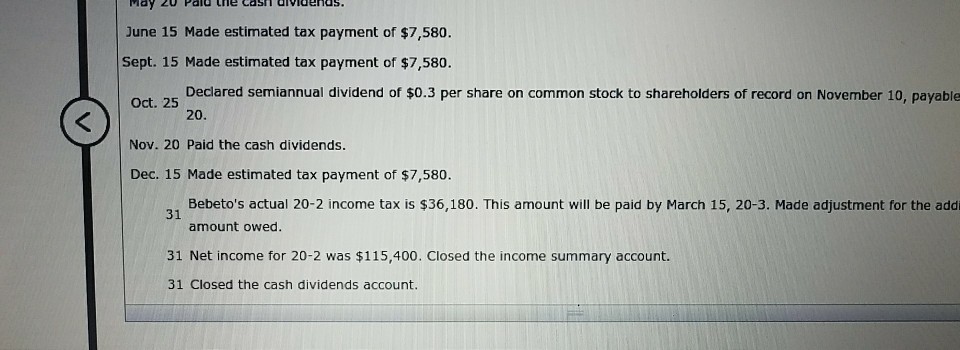

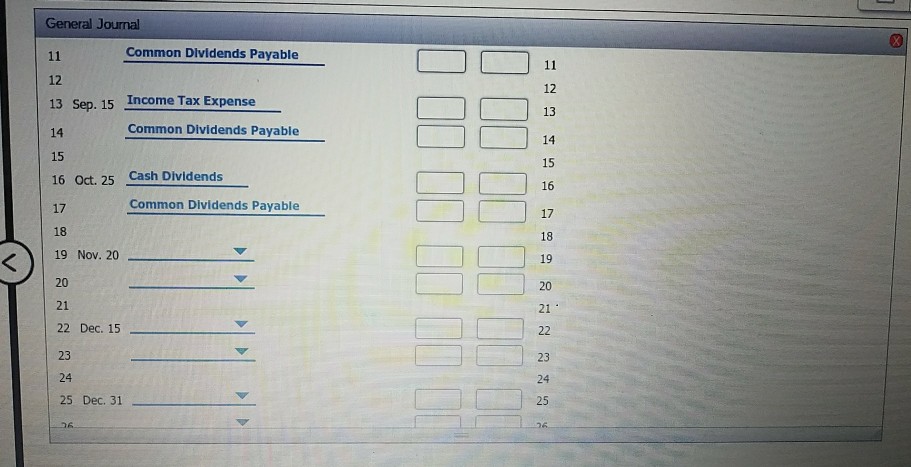

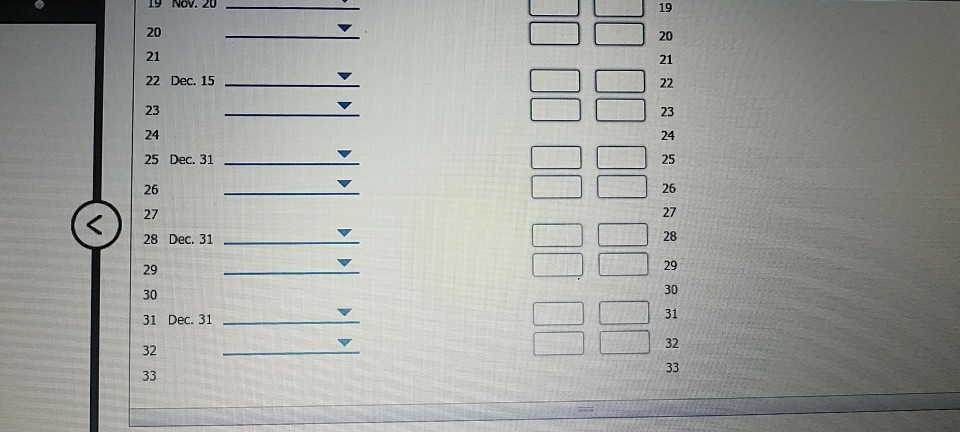

Problems eBook Calculator Algo Algo Algo Instructions General Journal Instructions Dividends and Income Taxes 1. Prepare journal entries for the transactions. f an amount box does not require an entry, leave it blank During the year ended December 31, 20-2, Bebeto Company completed the following selected transactions: Apr. 15 Estimated that its 20-2 income tax will be $30,320. Based on this estimate, it will make four quarterly payments of $7,580 each on April 15, June 15, September 15, and December 15. Made the first payment. 25 Deciared a semiannual dividend of $0.3 per share on common stock to shareholders of record on May 10, payable May 20 Currently, 86,800 shares of $i par common stock are outstanding. May 20 Paid the cash dividends. June 15 Made estimated tax payment of $7,580 Sept. 15 Made estimated tax payment of $7,580 Oct. 25 Declared semiannual dividend of so.3 per share on common stock to shareholders of record on November 10, payable on November 20 Nov. 20 Paid the cash dividends

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started