Answered step by step

Verified Expert Solution

Question

1 Approved Answer

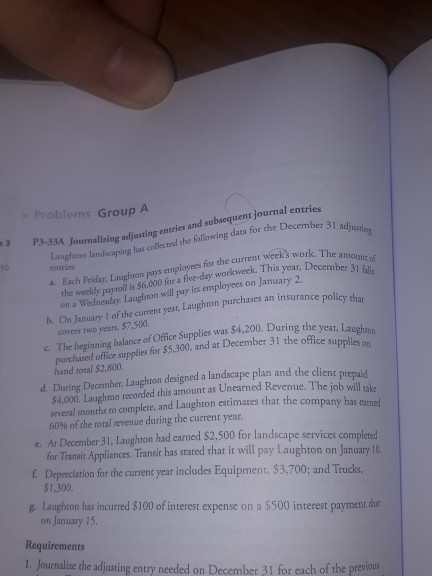

Problems Group A ournalizing adjusting entries and subsequent journal entries ghton landacaping lhas collected the following data for the December a er 31 adjusting loyes

Problems Group A ournalizing adjusting entries and subsequent journal entries ghton landacaping lhas collected the following data for the December a er 31 adjusting loyes for the current weeks work. The amou 50 amounc o fll entries Each Friday, Laughton pays employees the weekly payrol is $6,000 for a five-day workweek. This year, Decentbet o a. nesdy: Laughron will pay its employes on January 2. b. On Jamuary 1 of the corrent yest, L nsurance policy dhre c. The beginning balance of Office Supplies was $4,200. During the year, la punchased office supplies for $5.300. and at December 31 the office supoie d. During December, Laughton designed a landscape plan and the client prenai aughton purchases an i covers rwo years, $7,500 hand total $2,800 $4,000 Laughton recorded this amount as Unearned Revenue. The job will aks several months to complere, and Laughton estimates that the company has earne 60% ofthe total revenue during the current year. e. At December 31, Laughton had earned $2,500 for landscape services completed for Transic Appliances Transic has stated that it will pay Laughton on January 10 E Depreciation for the current year includes Equipment, $3.700; and Trucks $1,300 Laughon has incurred $100 of interest expense on a $500 interest payment do on January 15 Requirements 1. Journalize the adjusting entry needed on December 31 for each of the previous

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started