Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PROBLEMS - USE THE LINED PAPER TO DO YOUR CALCULAT CLEAR TRAIL OF YOUR WORK. TRY Mi Casa Corporation wishes to prepare a ER TO

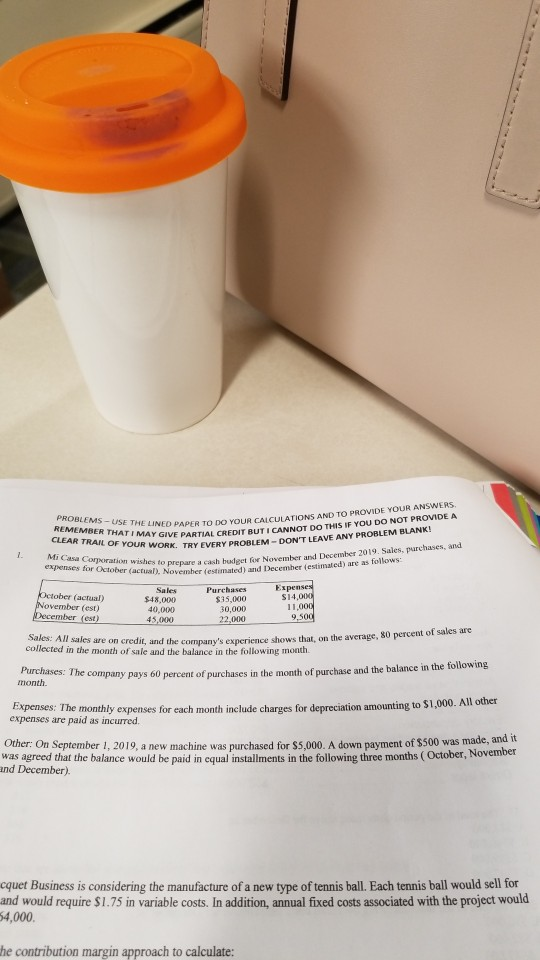

PROBLEMS - USE THE LINED PAPER TO DO YOUR CALCULAT CLEAR TRAIL OF YOUR WORK. TRY Mi Casa Corporation wishes to prepare a ER TO DO YOUR CALCULATIONS AND TO PROVIDE YOUR ANSWERS GIVE PARTIAL CREDIT BUT I CANNOT DO THIS IF YOU DO NOT PROVIDE A OF YOUR WORK. TRY EVERY PROBLEM-DON'T LEAVE ANY PROBLEM BLANK! to prepare a cash budget for November and December 2019. Sales, purchases, and penses for October actual). November (estimated) and December (estimated) are as follows Sales Purchases Expenses October (actual) $48.000 $15.00 $14,000 November (est) 40.000 30,000 11.000 December (est) 45.000 22.000 9.500 Sales: All sales are on credit and the company's e sacs are on credit, and the company's experience shows that on the average, 80 percent of sales de collected in the month of sale and the balance in the following month Purchases: The company pays 60 percent of purch month. company pays 60 percent of purchases in the month of purchase and the balance in the following o to $1.000. All other Expenses: The monthly expenses for each month include charges for depreciation amounting to $1,000. ANO expenses are paid as incurred. Other: On September 1, 2019, a new machine was nurchased for $5.000. A down payment of $500 was made, and was agreed that the balance would be paid in equal installments in the following three months (October, Novem and December) cquet Business is considering the manufacture of a new type of tennis ball. Each tennis ball would sell for and would require $1.75 in variable costs. In addition, annual fixed costs associated with the project would 54,000 the contribution margin approach to calculate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started