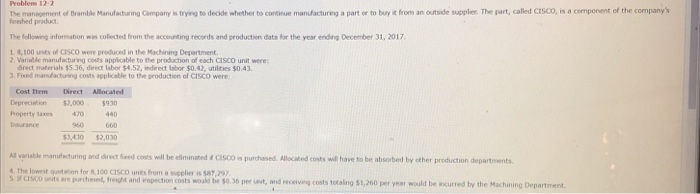

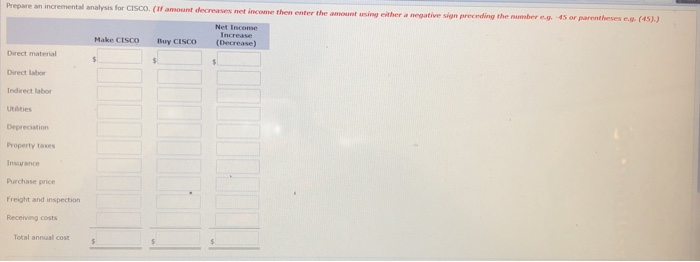

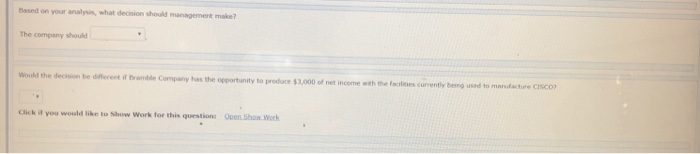

Problenm 12-2 the mansgement of Bramble Manufacthuring Cempany is trying to decide whether to continue manufacturing a part or to buy it from an outside sappliex. The part, called CISCo, is a cemponent of the company's feished prduct The following information was collected from the accounting records and production data for the year ending December 31, 2017 1 8,100 unts of CISCO were produced in the Madhining Department 2 Vaniable manufacturing costs applicable to the prodaction of each CISCO unit were: Grect materials $5.36, direct labor $4.52, indirect labor $0.42, utiliaies $0.43 3. Fxed manactuing costs applicable to the production of CISCO were Cost Item Direct Allocated Depreciation $2,000 Property taxes 470 960 $930 Insurance 660 3,430 $2,030 Al variable manufecturing and rect fxed costs will be eiminated CSCO s purchased Allocated costs wl have to be absorbed by other preduction departments The lowest quotation for 8100 CISCO unts from a sucplier is 587,297 CISCO usts are purche, fresght and npection costs wouls be $0.36 per unst, and eceivieng costs totaling $1,260 per year would be ecurred by the Machining Department Prepare an incremental analysis for CISCO. (If amount decreases net income then enter the amount using either a negative sign preceding t he number e.g. 4s or parentheses e.g. (45).) Net Inco Make CISCO Buy CISCO (Decrease) Direct material Direct labor Indirect labor Utilties Depreciation Property taxes Purchase price freight and inspection Receiving costs Total annual cost Based on your analysis, what decision should management make The company should Would the decision be different if t tramible Company has the opportunity to produce $3,000 of net income with the facoliies curnently being used to marsfacture Cisco uick you would like to Show work for this question; OpenShaiyork Problenm 12-2 the mansgement of Bramble Manufacthuring Cempany is trying to decide whether to continue manufacturing a part or to buy it from an outside sappliex. The part, called CISCo, is a cemponent of the company's feished prduct The following information was collected from the accounting records and production data for the year ending December 31, 2017 1 8,100 unts of CISCO were produced in the Madhining Department 2 Vaniable manufacturing costs applicable to the prodaction of each CISCO unit were: Grect materials $5.36, direct labor $4.52, indirect labor $0.42, utiliaies $0.43 3. Fxed manactuing costs applicable to the production of CISCO were Cost Item Direct Allocated Depreciation $2,000 Property taxes 470 960 $930 Insurance 660 3,430 $2,030 Al variable manufecturing and rect fxed costs will be eiminated CSCO s purchased Allocated costs wl have to be absorbed by other preduction departments The lowest quotation for 8100 CISCO unts from a sucplier is 587,297 CISCO usts are purche, fresght and npection costs wouls be $0.36 per unst, and eceivieng costs totaling $1,260 per year would be ecurred by the Machining Department Prepare an incremental analysis for CISCO. (If amount decreases net income then enter the amount using either a negative sign preceding t he number e.g. 4s or parentheses e.g. (45).) Net Inco Make CISCO Buy CISCO (Decrease) Direct material Direct labor Indirect labor Utilties Depreciation Property taxes Purchase price freight and inspection Receiving costs Total annual cost Based on your analysis, what decision should management make The company should Would the decision be different if t tramible Company has the opportunity to produce $3,000 of net income with the facoliies curnently being used to marsfacture Cisco uick you would like to Show work for this question; OpenShaiyork