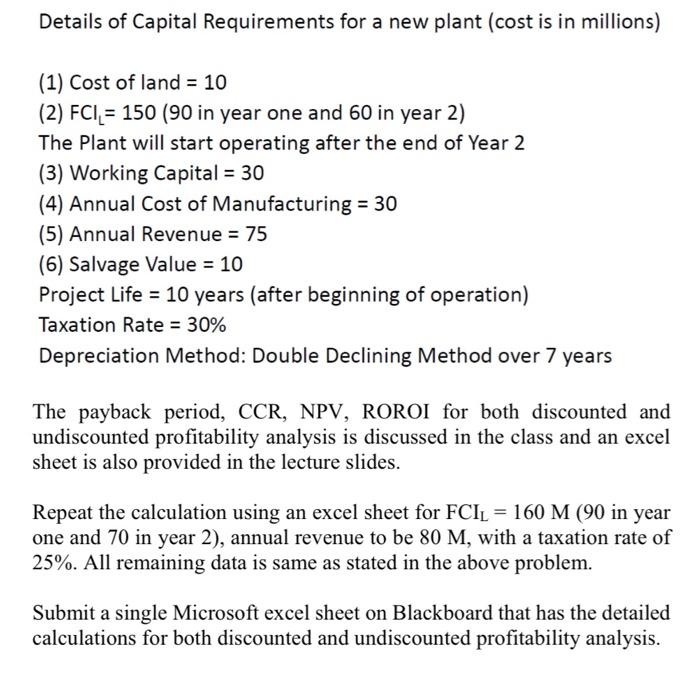

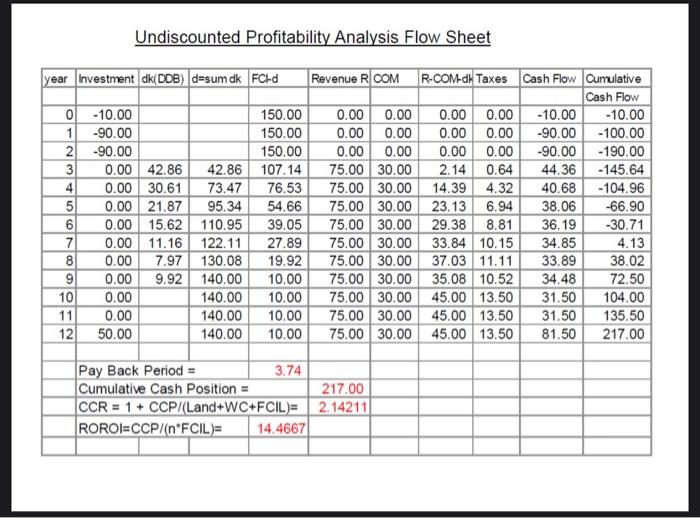

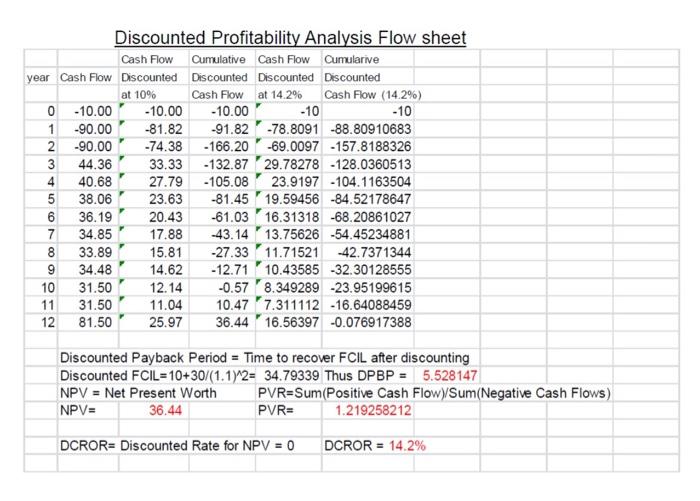

Details of Capital Requirements for a new plant (cost is in millions) (1) Cost of land =10 (2) FClL=150 (90 in year one and 60 in year 2) The Plant will start operating after the end of Year 2 (3) Working Capital =30 (4) Annual Cost of Manufacturing =30 (5) Annual Revenue =75 (6) Salvage Value =10 Project Life =10 years (after beginning of operation) Taxation Rate =30% Depreciation Method: Double Declining Method over 7 years The payback period, CCR, NPV, ROROI for both discounted and undiscounted profitability analysis is discussed in the class and an excel sheet is also provided in the lecture slides. Repeat the calculation using an excel sheet for FCIL=160M(90 in year one and 70 in year 2), annual revenue to be 80M, with a taxation rate of 25%. All remaining data is same as stated in the above problem. Submit a single Microsoft excel sheet on Blackboard that has the detailed calculations for both discounted and undiscounted profitability analysis. Undiscounted Profitability Analysis Flow Sheet Discounted Profitability Analysis Flow sheet Discounted Payback Period = Time to recover FClL after discounting Discounted FCL=10+30/(1.1)2=34.79339 Thus DPBP =5.528147 NPV = Net Present Worth PVR = Sum(Positive Cash Flow)/Sum(Negative Cash Flows) \begin{tabular}{lll|l} NPV= & 36.44 & PVR =1.219258212 \end{tabular} DCROR= Discounted Rate for NPV=0DCROR=14.2% Details of Capital Requirements for a new plant (cost is in millions) (1) Cost of land =10 (2) FClL=150 (90 in year one and 60 in year 2) The Plant will start operating after the end of Year 2 (3) Working Capital =30 (4) Annual Cost of Manufacturing =30 (5) Annual Revenue =75 (6) Salvage Value =10 Project Life =10 years (after beginning of operation) Taxation Rate =30% Depreciation Method: Double Declining Method over 7 years The payback period, CCR, NPV, ROROI for both discounted and undiscounted profitability analysis is discussed in the class and an excel sheet is also provided in the lecture slides. Repeat the calculation using an excel sheet for FCIL=160M(90 in year one and 70 in year 2), annual revenue to be 80M, with a taxation rate of 25%. All remaining data is same as stated in the above problem. Submit a single Microsoft excel sheet on Blackboard that has the detailed calculations for both discounted and undiscounted profitability analysis. Undiscounted Profitability Analysis Flow Sheet Discounted Profitability Analysis Flow sheet Discounted Payback Period = Time to recover FClL after discounting Discounted FCL=10+30/(1.1)2=34.79339 Thus DPBP =5.528147 NPV = Net Present Worth PVR = Sum(Positive Cash Flow)/Sum(Negative Cash Flows) \begin{tabular}{lll|l} NPV= & 36.44 & PVR =1.219258212 \end{tabular} DCROR= Discounted Rate for NPV=0DCROR=14.2%