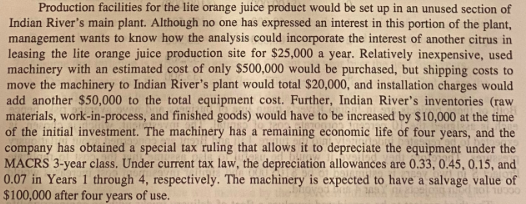

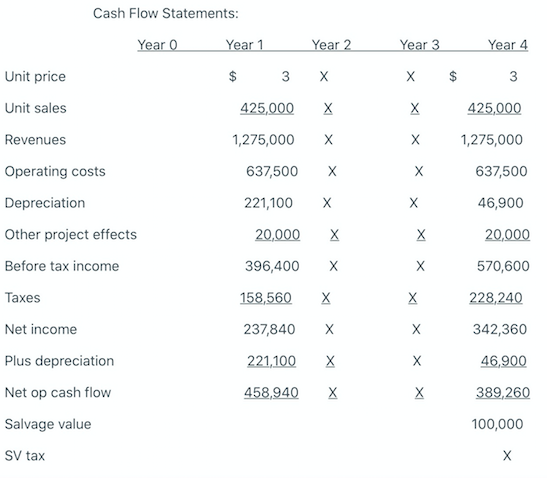

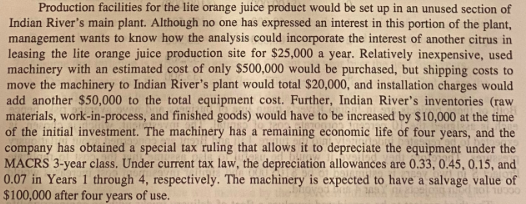

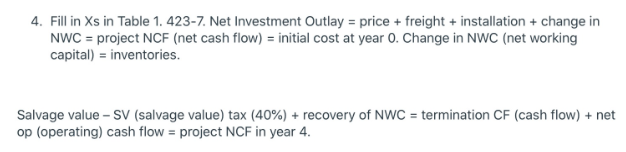

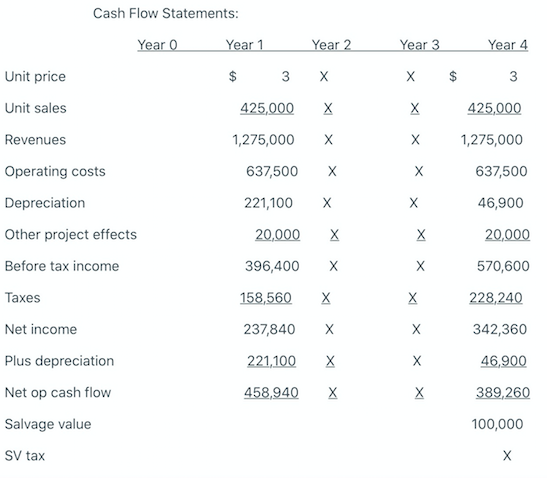

Production facilities for the lite orange juice product would be set up in an unused section of Indian River's main plant. Although no one has expressed an interest in this portion of the plant, management wants to know how the analysis could incorporate the interest of another citrus in leasing the lite orange juice production site for $25,000 a year. Relatively inexpensive, used machinery with an estimated cost of only $500,000 would be purchased, but shipping costs to move the machinery to Indian River's plant would total $20,000, and installation charges would add another $50,000 to the total equipment cost. Further, Indian River's inventories (raw materials, work-in-process, and finished goods) would have to be increased by $10,000 at the time of the initial investment. The machinery has a remaining economic life of four years, and the company has obtained a special tax ruling that allows it to depreciate the equipment under the MACRS 3-year class. Under current tax law, the depreciation allowances are 0.33, 0.45, 0.15, and 0.07 in Years 1 through 4, respectively. The machinery is expected to have a salvage value of $100,000 after four years of use. On page 49 in the casebook, change 500,000 to 600,000. On page 50, change 2 per carton to 3. These revisions will change most of the numbers in Table 1. 4. Fill in Xs in Table 1. 423-7. Net Investment Outlay = price + freight + installation + change in NWC = project NCF (net cash flow) = initial cost at year 0. Change in NWC (net working capital) = inventories. Salvage value - SV (salvage value) tax (40%) + recovery of NWC = termination CF (cash flow) + net op (operating) cash flow = project NCF in year 4. Cash Flow Statements: Year o Year 1 Year 2 Year 3 Year 4 $ 3 X X $ 3 Unit price Unit sales 425,000 X 425,000 Revenues 1,275,000 X 1,275,000 637,500 X X 637,500 221,100 46,900 Operating costs Depreciation Other project effects Before tax income 20.000 X X 20,000 396,400 X 570,600 Taxes 158,560 X 228,240 Net income 237,840 X X 342,360 221,100 X X 46,900 Plus depreciation Net op cash flow 458,940 X X 389,260 Salvage value 100,000 SV tax