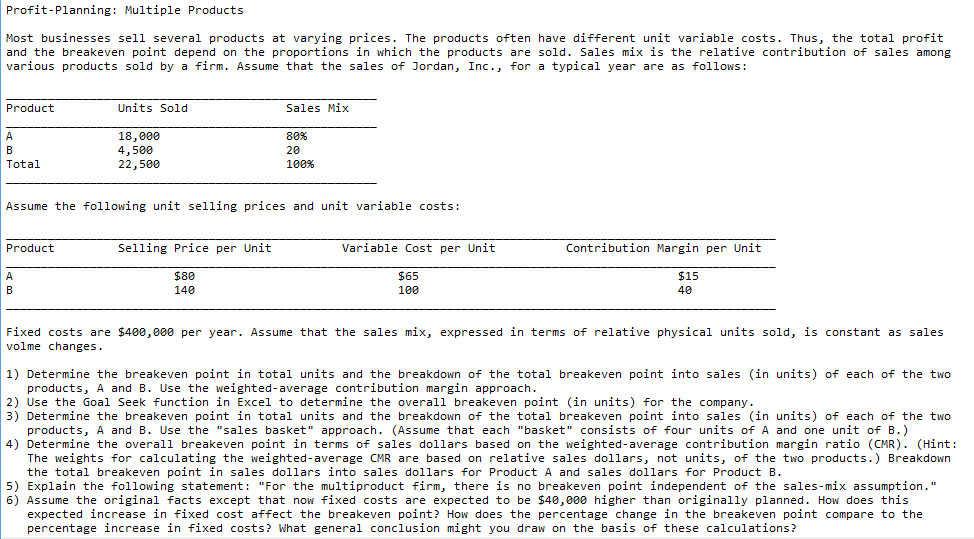

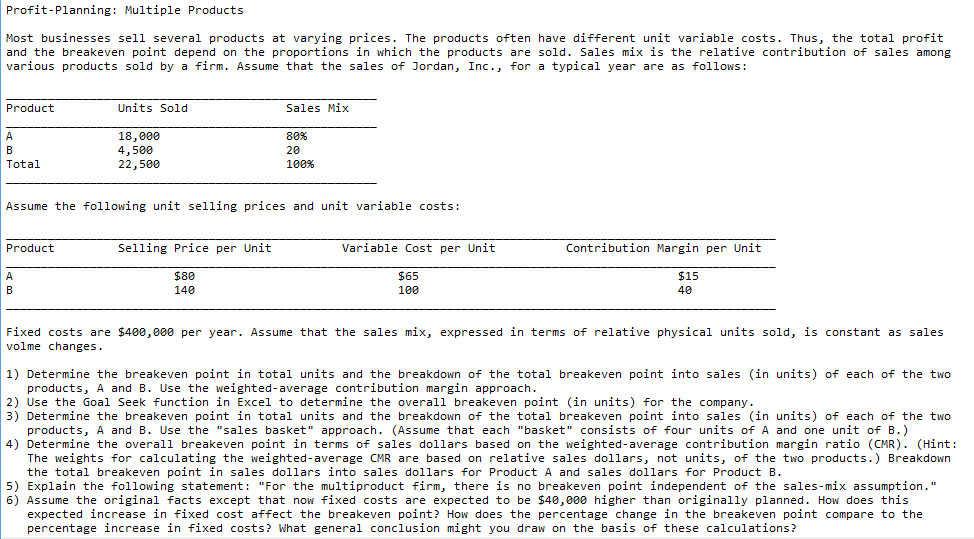

Profit-Planning: Multiple Products Most businesses sell several products at varying prices. The products often have different unit variable costs. Thus, the total profit and the breakeven point depend on the proportions in which the products are sold. Sales mix is the relative contribution of sales among various products sold by a firm. Assume that the sales of Jordan, Inc., for a typical year are as follows: Assume the following unit selling prices and unit variable costs:Fixed costs are $400,000 per year. Assume that the sales mix, expressed in terms of relative physical units sold, is constant as sales volume changes. 1) Determine the breakeven point in total units and the breakdown of the total breakeven point into sales (in units) of each of the two products, A and B. Use the weighted-average contribution margin approach. 2) Use the Goal Seek function in Excel to determine the overall breakeven point (in units) for the company. 3) Determine the breakeven point in total units and the breakdown of the total breakeven point into sales (in units) of each of the two products, A and B. Use the sales basket approach. (Assume that each basket consists of four units of A and one unit of B.) 4) Determine the overall breakeven point in terms of sales dollars based on the weighted-average contribution margin ratio (CMR). (Hint: The weights for calculating the weighted-average OIR are based on relative sales dollars, not units, of the two products.) Breakdown the total breakeven point in sales dollars into sales dollars for Product A and sales dollars for Product B. 5) Explain the following statement: For the multiproduct firm, there is no breakeven point independent of the sales-mix assumption. 6) Assume the original facts except that now fixed costs are expected to be $40,000 higher than originally planned. How does this expected increase in fixed cost affect the breakeven point? How does the percentage change in the breakeven point compare to the percentage increase in fixed costs? What general conclusion might you draw on the basis of these calculations? Profit-Planning: Multiple Products Most businesses sell several products at varying prices. The products often have different unit variable costs. Thus, the total profit and the breakeven point depend on the proportions in which the products are sold. Sales mix is the relative contribution of sales among various products sold by a firm. Assume that the sales of Jordan, Inc., for a typical year are as follows: Assume the following unit selling prices and unit variable costs:Fixed costs are $400,000 per year. Assume that the sales mix, expressed in terms of relative physical units sold, is constant as sales volume changes. 1) Determine the breakeven point in total units and the breakdown of the total breakeven point into sales (in units) of each of the two products, A and B. Use the weighted-average contribution margin approach. 2) Use the Goal Seek function in Excel to determine the overall breakeven point (in units) for the company. 3) Determine the breakeven point in total units and the breakdown of the total breakeven point into sales (in units) of each of the two products, A and B. Use the sales basket approach. (Assume that each basket consists of four units of A and one unit of B.) 4) Determine the overall breakeven point in terms of sales dollars based on the weighted-average contribution margin ratio (CMR). (Hint: The weights for calculating the weighted-average OIR are based on relative sales dollars, not units, of the two products.) Breakdown the total breakeven point in sales dollars into sales dollars for Product A and sales dollars for Product B. 5) Explain the following statement: For the multiproduct firm, there is no breakeven point independent of the sales-mix assumption. 6) Assume the original facts except that now fixed costs are expected to be $40,000 higher than originally planned. How does this expected increase in fixed cost affect the breakeven point? How does the percentage change in the breakeven point compare to the percentage increase in fixed costs? What general conclusion might you draw on the basis of these calculations