Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Progressive Hospital is considering the purchase of a new Sidewinder scanner, which costs S3,000,000. The new scanner provides a 360-degree internal feature view of the

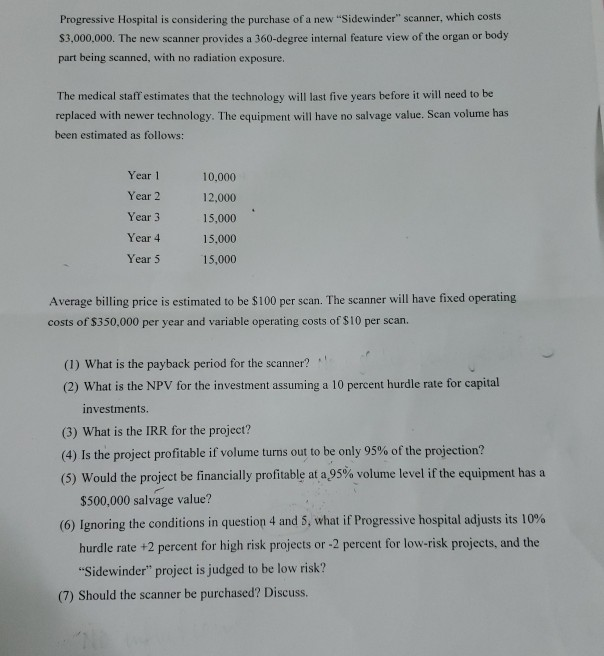

Progressive Hospital is considering the purchase of a new "Sidewinder" scanner, which costs S3,000,000. The new scanner provides a 360-degree internal feature view of the organ or body part being scanned, with no radiation exposure The medical staff estimates that the technology will last five years before it will need to be replaced with newer technology. The equipment will have no salvage value. Scan volume has been estimated as follows: Year 1 Year 2 Year 3 Year 4 Year 5 10,000 12,000 15,000 15,000 15,000 Average billing price is estimated to be $100 per scan. The scanner will have fixed operating costs of $350,000 per year and variable operating costs of S10 per scan. (1) What is the payback period for the scanner? (2) What is the NPV for the investment assuming a 10 percent hurdle rate for capital investments. (3) What is the IRR for the project? (4) Is the project profitable if volume turns out to be only 95% of the projection? (5) Would the project be financially profitable at a95% volume level if the equipment has a $500,000 salvage value? (6) Ignoring the conditions in question 4 and 5, what if Progressive hospital adjusts its 10% hurdle rate +2 percent for high risk projects or -2 percent for low-risk projects, and the Sidewinder" project is judged to be low risk? (7) Should the scanner be purchased? Discuss

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started