Answered step by step

Verified Expert Solution

Question

1 Approved Answer

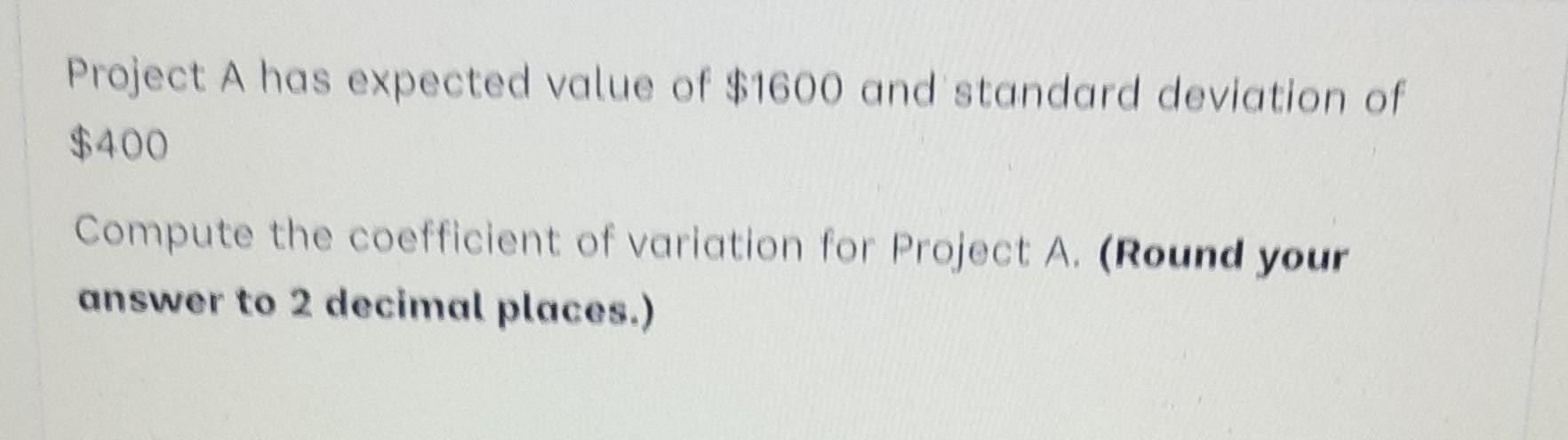

Project A has expected value of $1600 and standard deviation of $400 Compute the coefficient of variation for Project A. (Round your answer to 2

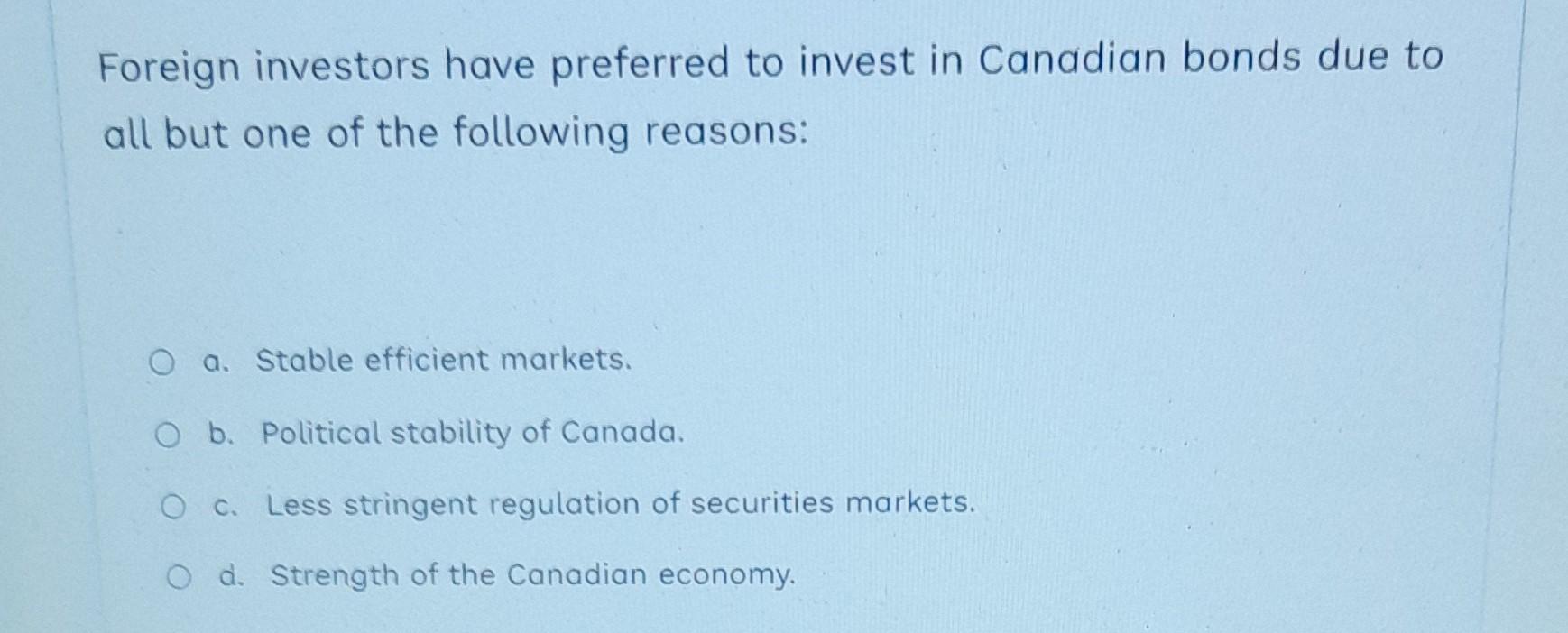

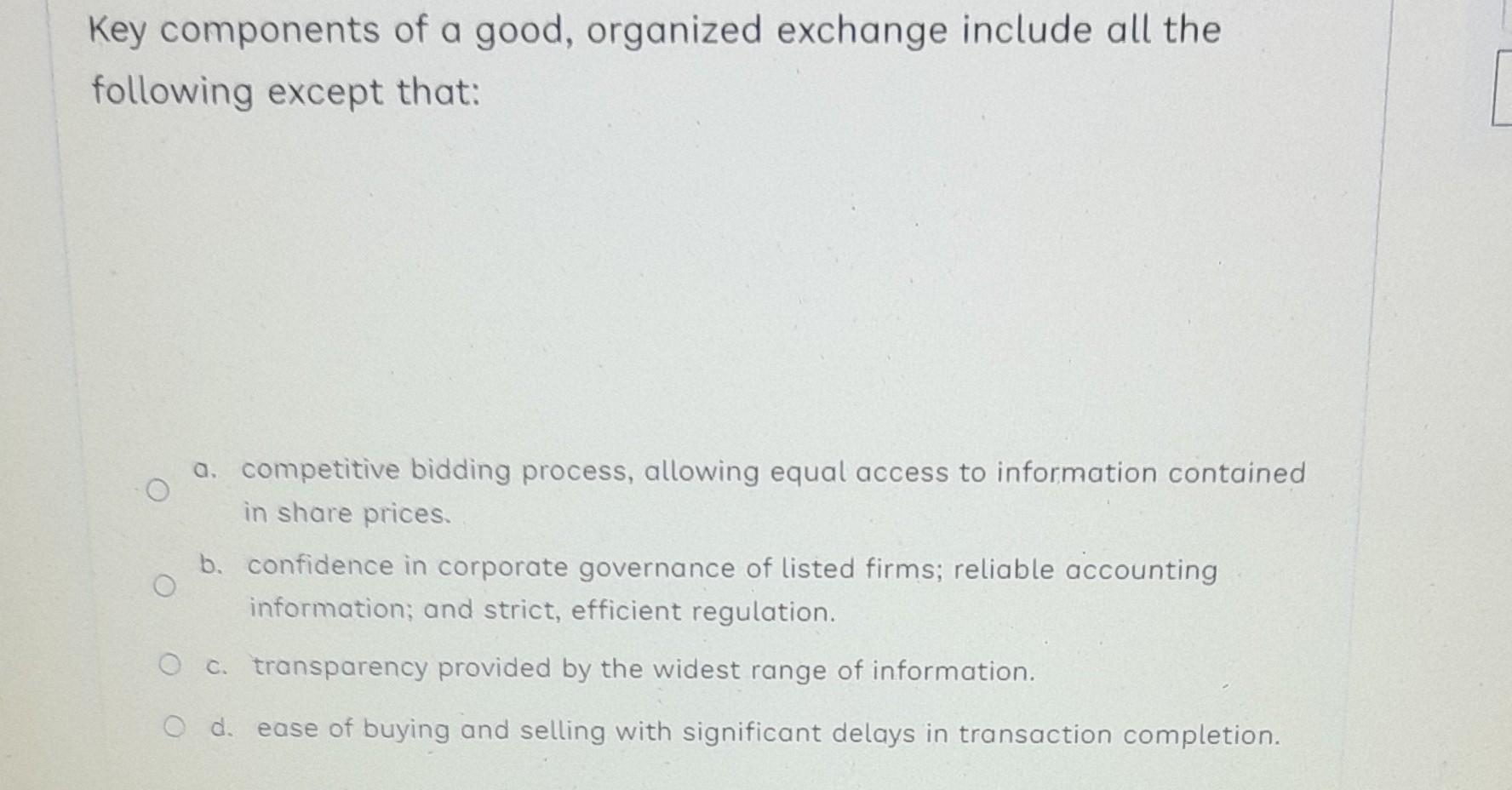

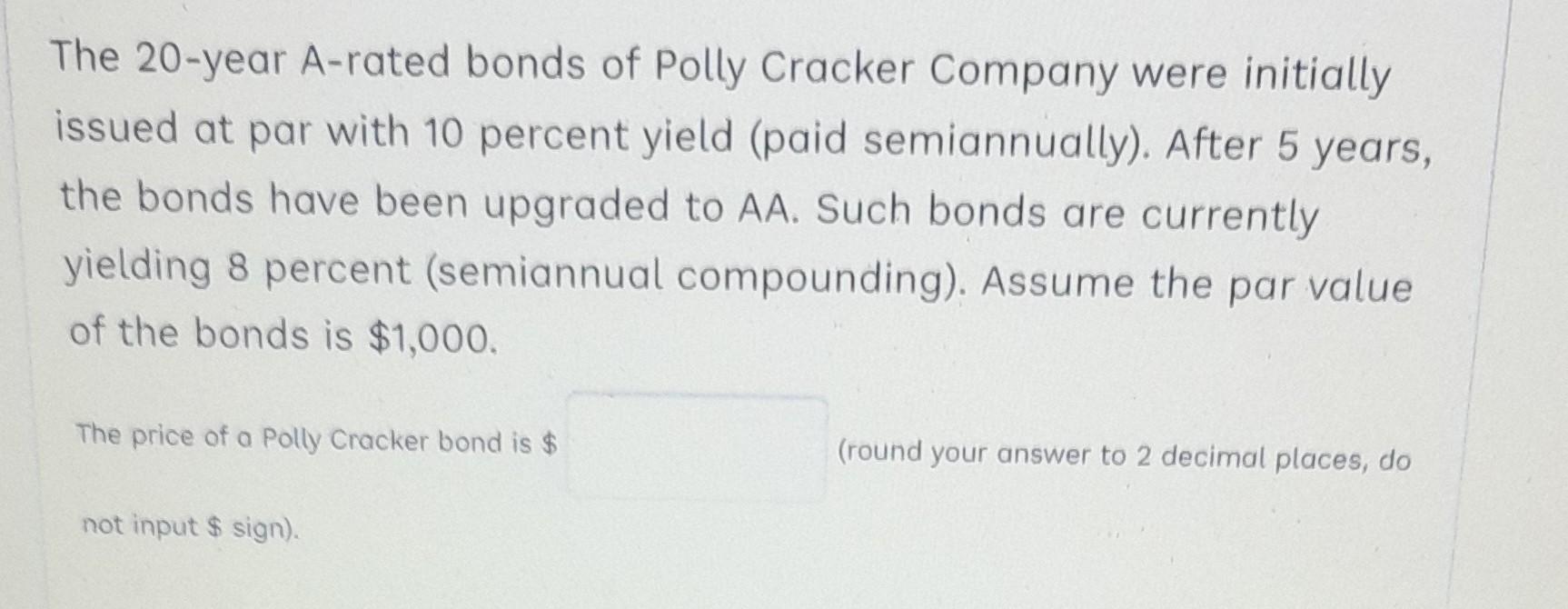

Project A has expected value of $1600 and standard deviation of $400 Compute the coefficient of variation for Project A. (Round your answer to 2 decimal places.) Foreign investors have preferred to invest in Canadian bonds due to all but one of the following reasons: a. Stable efficient markets. b. Political stability of Canada. c. Less stringent regulation of securities markets. d. Strength of the Canadian economy. Key components of a good, organized exchange include all the following except that: a. competitive bidding process, allowing equal access to information contained in share prices. b. confidence in corporate governance of listed firms; reliable accounting information; and strict, efficient regulation. c. transparency provided by the widest range of information. d. ease of buying and selling with significant delays in transaction completion. The 20-year A-rated bonds of Polly Cracker Company were initially issued at par with 10 percent yield (paid semiannually). After 5 years, the bonds have been upgraded to AA. Such bonds are currently yielding 8 percent (semiannual compounding). Assume the par value of the bonds is $1,000. The price of a Polly Cracker bond is $ (round your answer to 2 decimal places, do not input \$sign)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started