Question

Use the graph below to complete the answer. Please don't give me the same answer please. I have been getting the same answer. Question: Write

Use the graph below to complete the answer.

Please don't give me the same answer please. I have been getting the same answer.

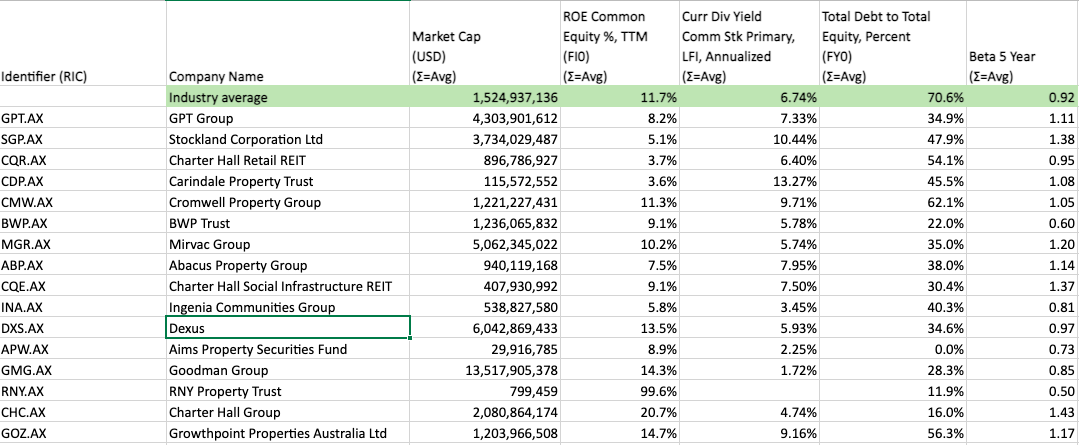

Question: Write Investment essentials/ risks / financial ratio analysis for your company (Dexus) also analyse Dexus

Addresses the pros and cons of making an investment in the company. The analysis includes a thorough review of the cash flow, liquidity, capital structure or financial leverage of the business. Each ratio given below provides additional insight into the financial health of the company, and you will analyse how much these ratios changed over time.

o Liquidity ratios o Capital structure or financial leverage: Total debt ratio, long-term debt ratio, gearing (debt-to-equity ratio)

o Profitability ratios: Return on equity and return on assets

o Valuation: Calculating Net Tangible Assets (NTA) or Net Asset Value (NAV). REITPricing through premium/discount to NTA

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started